Nearly 45% of investment fraud cases in Ireland are associated with cryptocurrencies. The national police of the country stated that 44% of all the investment fraud cases during January 2020 to August 2024 are related to Bitcoin and other cryptocurrencies, as stated in the Irish Independent.

A majority of these incidents involved individuals who pretended to be investment managers, took money from victims through website impersonation and through internet and social media advertisements. Scammers have managed to steal over €75 million (around $83 million) from more than 1,117 victims during this period, with €13.5 million taken so far this year. In 2023 highest losses incurred with €28 million being stolen, and this is more than the combined total of both 2021 and 2022.

Exemplary Case of Deceptive Crypto Investment

A crypto related temporal event was mentioned in the report where a victim came across an advertisement on the social media platform investing into a mobile app based trading platform. After signing up, the scammers contacted the victim and used social engineering tactics to persuade him to transfer €45,000 (approximately $50,000). Afterward, the scammers wrote to the victim informing him that his investments earned him over €727,000 (around $808,620), they claimed the funds were locked in USDC stablecoin within an Ethereum-based Atomic Wallet. However, when the victim tried to take out the money, he was informed that he had to pay an additional $40,000 as “dirty tax” to get his money back.

A “dirty tax” denotes a common con in which the scammer instructs the victim to pay a certain fee or tax in order to receive the promised amount of money or profits. This strategy is often seen in investment scams which was recently illustrated as the Washington State Department of Financial Institutions issued a warning in July. The scammers lure their victims to unprofitable, risky, or fake crypto trading platforms where one is locked out when they attempt to withdraw their earnings but only required to pay extra cash to unblock.

Expert Warning on Targeted Scams

Michael Cryan, Detective Superintendent of the Garda National Economic Crime Bureau, cautioned that scammers typically target “ordinary, decent people” and advised vigilance when transferring money internationally. “The fraudsters engaged in fraudulent investment schemes often sound convincing and claim to possess insider knowledge, but they are seasoned criminals following a well-rehearsed script,” he stated.

There have been increased cases of people being defrauded globally through get rich quick schemes involving cryptocurrencies investment. One of the recent measures was taken by the Australian Securities & Investments Commission, which has recently severed access to 615 websites associated with crypto investment scams. Before that, Australia’s competition regulator sought legal action against Meta, Facebook after the Platform experienced a sharp rise of fake ads promoting crypto scams.

Over one million customers warned of the dangers of Investment Fraud

This week, Bank of Ireland has contacted over one million personal and business customers about investment fraud scams. This warning comes after a study showed that more people in Ireland are falling victim to scams with a staggering 94% of the population reporting to have received a fraudulent message, phone call, text or email in the past one year.

There is a marked increase in various investment fraud, putting up a 77% increase across the country in 2023. More and more people are getting caught every day, some of whom lose all their monetary wealth. The Garda National Economic Crime Bureau has stated that reports made to Gardaí in relation to fake SMS messages have increased by more than 30% in 2023.

Scammers reliably create fake websites and brochures mimicking actual investment businesses to fool their targets. These fake websites of shares, bonds, and cryptocurrencies look professional and the persons there posing as ‘advisors’ can seem convincing at times. Bank of Ireland has advised customers on signs of investment scam and means to counter scams on their accounts.

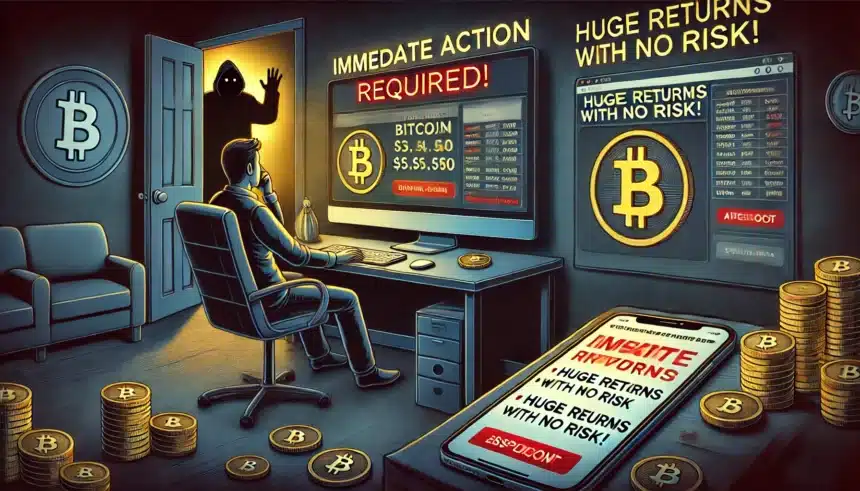

Five Red Flags of Investment Fraud

- Follow-up calls: You receive a call after clicking on an ad for an investment product on social media or in a sponsored search result.

- Big/fast returns: They promise quick and profitable returns with little or no risk.

- Pressure: They insist you must act quickly to seize an “opportunity of a lifetime.”

- Urgency: They urge you to make an immediate payment to secure the deal.

- Secrecy: They instruct you not to discuss the “investment” with family, friends, or your bank, and may ask you to sign a “non-disclosure agreement” (NDA).

Bank of Ireland’s fraud teams are active 24/7, intercepting or preventing most fraud attempts. In cases where fraud is successful, every effort is made by the fraud team to recover funds for customers.