The crypto world is abuzz with speculation about Bitcoin’s (BTC) next big move. Many analysts and market players are forecasting a major bull run in the near future, and recent analyses offer promising signs for crypto investors. Here’s a look at expert opinions and detailed insights from those closely watching the market.

CryptoCon: A Bitcoin Bull Market is Inevitable

Crypto analysis firm CryptoCon is optimistic about Bitcoin’s future. In a recent statement, the firm highlighted that Bitcoin is currently in a mid-cycle correction and is preparing for a significant price surge. One of the key indicators backing this prediction is the Puell Multiple, which assesses Bitcoin miners’ revenue to predict market movements. According to CryptoCon, this indicator has been observed in September 2012, 2016, and 2020, just before massive bull runs. Despite recent volatility, the firm believes that Bitcoin is gearing up for another major rally.

CryptoCon’s statement was clear:

“A Bitcoin bull market is inevitable. No recession, no bear market, and no doom and gloom. The stages of the Puell Multiple show that we are in the midst of a mid-upper correction, right before the real bull run.”

The firm also pointed out the importance of Bitcoin’s famous halving cycles. According to the Halving Cycles Theory, Bitcoin often experiences significant price increases following a halving. The next halving is set for November 28, 2024, and the firm expects a bull market to begin shortly after, lasting through 2025.

Larry Fink: Bitcoin is an Attractive Diversification Tool

Larry Fink, the founder and CEO of BlackRock, one of the world’s largest asset management firms, has historically been cautious about cryptocurrencies. However, in a recent interview, Fink expressed confidence in Bitcoin. He noted that Bitcoin offers uncorrelated returns, making it a valuable financial tool for portfolio diversification. Fink stated that Bitcoin is particularly appealing to investors concerned about national monetary policies.

Many countries are grappling with high inflation or large budget deficits, leading to a depreciation of their local currencies. In such scenarios, decentralized assets like Bitcoin can offer a solution. Fink emphasized:

“I believe Bitcoin is legitimate,” highlighting the cryptocurrency’s growing role in the financial system. He also pointed out that Bitcoin provides individuals with more financial control, serving as a safety net during times of economic uncertainty.

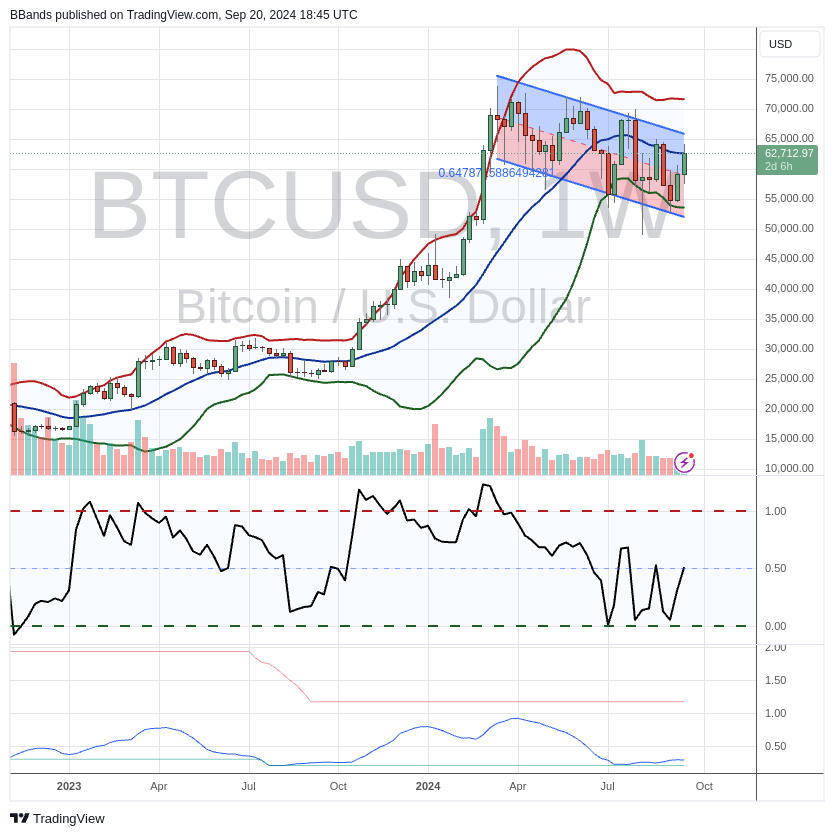

John Bollinger: Technical Analysis Points to an Uptrend

Prominent technical analyst John Bollinger, known for developing the Bollinger Bands technical analysis tool, shared a positive outlook for Bitcoin. He noted that Bitcoin’s weekly chart is forming a W pattern, which is typically a bullish signal. This pattern often indicates that an asset is breaking out of a downtrend and entering an upward trajectory.

Bollinger remarked,

“There’s a nice W pattern forming on the weekly BTC/USD chart. It’s a bullish formation, but I’m waiting for confirmation.”

This suggests that investors should remain cautious until the bull market is fully confirmed. Recently, Bitcoin responded positively to the U.S. Federal Reserve’s 50 basis point rate cut, rising above $63,000. Investors are eager to see if this price movement signals the start of a bull market, with analysts’ optimistic views further fueling these expectations.

As experts like CryptoCon, Larry Fink, and John Bollinger suggest, Bitcoin could be on the brink of another major bull run. With technical indicators and market conditions aligning, the next few months could prove critical for Bitcoin investors. However, as with any volatile market, caution is key.