Metaplanet is once again making waves in the crypto market with its aggressive Bitcoin acquisitions, sparking renewed interest among investors. As the company’s BTC holdings reach 6 billion Japanese Yen, many are wondering if this is a signal for Bitcoin’s next all-time high.

Metaplanet’s Growing Bitcoin Portfolio

As reported by The Bit Journal, Metaplanet, often referred to as the “MicroStrategy of Asia,” continues to expand its Bitcoin investments. In its latest move, the company purchased 108.78 BTC, equivalent to 1 billion Japanese Yen. This brings their total Bitcoin investments to a significant level, strengthening their position in the crypto space. Since May 2024, Metaplanet has been consistently acquiring Bitcoin, reflecting its long-term commitment to crypto assets.

Strategic Bitcoin Acquisitions and Options Trading

Last week, Metaplanet made another strategic play, acquiring $1.4 million worth of Bitcoin through options trading. The company sold 223 fully collateralized USD options contracts, earning 23.97 BTC in premiums. These gains will be reflected in their future financial statements, reinforcing their bullish stance on Bitcoin.

Stock Performance: Metaplanet and MicroStrategy

In parallel with its Bitcoin purchases, Metaplanet’s stock has also seen a rise, trading around 1,045 over the past month. Despite this growth, shares are still 66% below their all-time high reached in May, even after a 544% gain year-to-date.

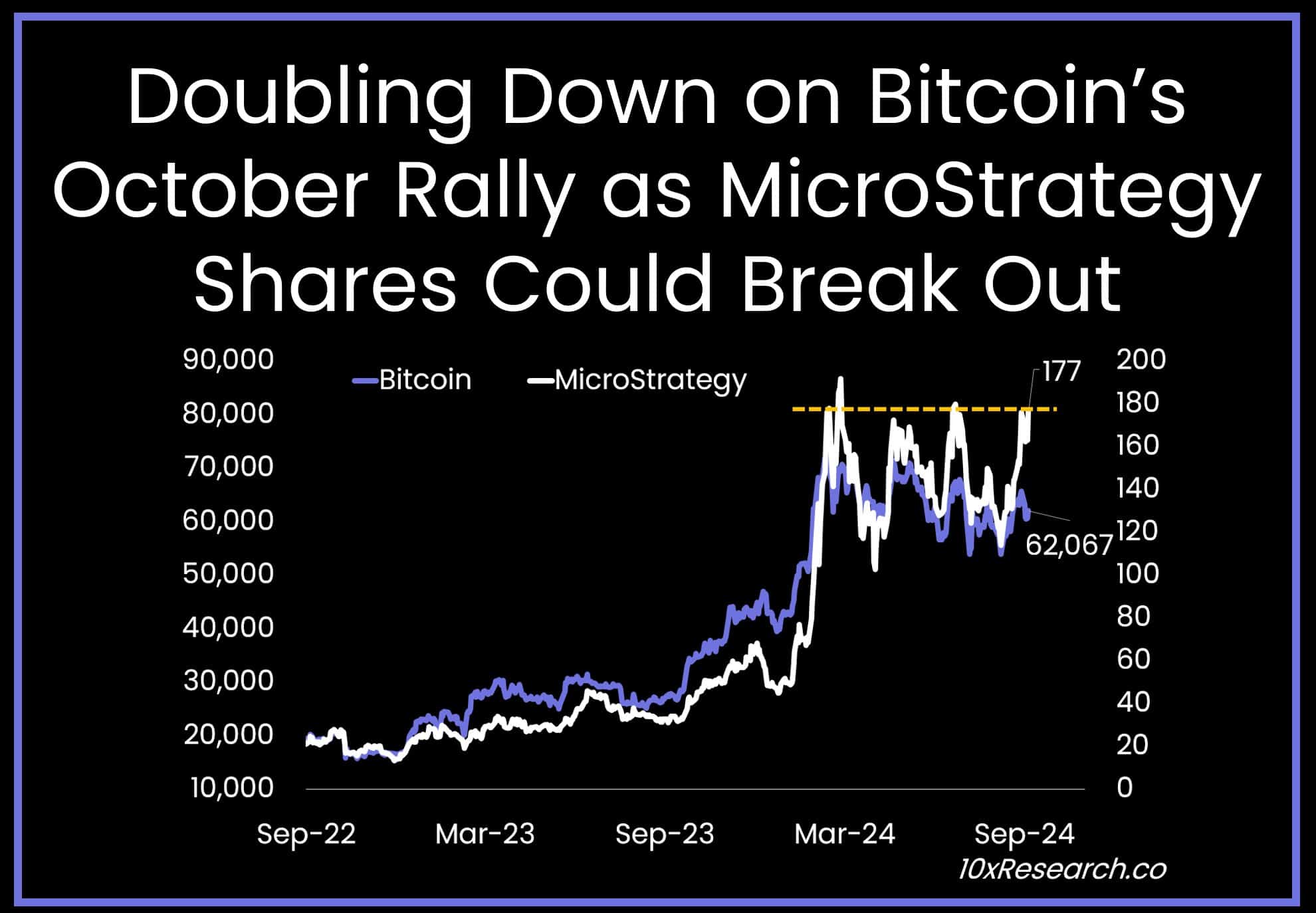

Similarly, MicroStrategy (MSTR) shares have experienced strong performance. Following positive U.S. unemployment data, MSTR shares jumped 8%. The stock has gained 157% since the start of the year, making it a focal point for investors eyeing the crypto market.

Bitcoin Poised for New Heights?

In Monday’s Asian trading session, Bitcoin surged 3% to hit $63,600. Analysts predict a strong rally ahead, supported by Metaplanet’s ongoing BTC purchases and historical data. In October, Bitcoin has historically risen by 31.72%. After rebounding from a low of $59,800 last week, there’s speculation that Bitcoin could hit $77,700 by the end of the month.

BTC typically bottoms 3-4 days into October

From the bottom to the end of October, BTC is up 32% (36% if you exclude Octobers that have a negative return)

We tagged 59.8K on Oct 3 after a sell off

If we return 30% on 59.8K, we will end the month at 77.7K pic.twitter.com/9Wirjz9zuG

— jay (@0xjaypeg) October 6, 2024

According to 10x Research, geopolitical factors are unlikely to disrupt this upward trend. Instead, they could present opportunities for investors looking to capitalize on market volatility. With significant institutional buys and growing positive sentiment, the Bitcoin market is expected to maintain its bullish momentum. Metaplanet’s continuous acquisitions only add to the anticipation, with many analysts forecasting new all-time highs for Bitcoin in the coming months.

- https://twitter.com/Thebitjournal_

- https://www.linkedin.com/company/the-bit-journal/

- https://t.me/thebitjournal

Follow us on Twitter and LinkedIn and join our Telegram channel to be instantly informed about breaking news!