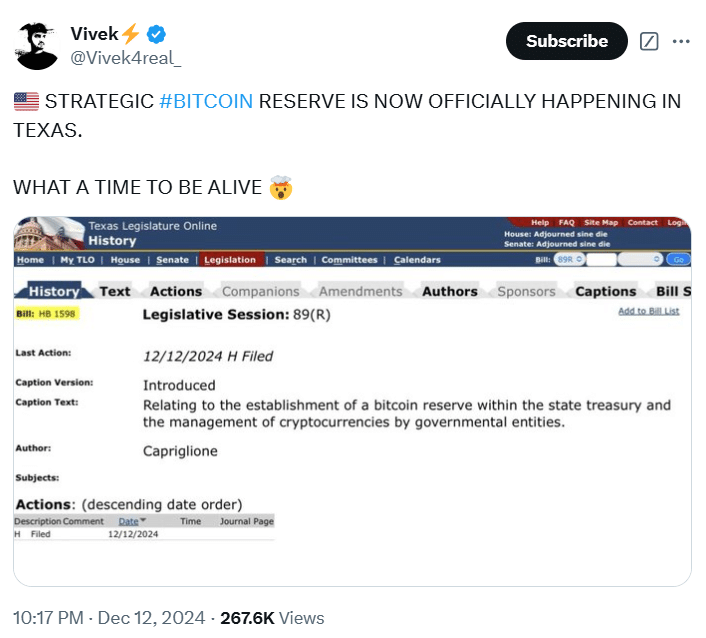

Bitcoin is slowly but surely being accepted in the United States on the individual and institutional levels, and state-level legislative initiatives are pointing towards a new era of cryptocurrency regulation. Data reveals that one in every five Americans now owns BTC, pointing to a rising faith in the digital currency. Consequently, state governments across the nation are gradually stepping up efforts towards the formation of Bitcoin reserves, a move that Ohio, Texas, and Pennsylvania are spearheading.

The state bills are to fight inflation and establish financial reserves through BTC. For instance, Texas has proposed a bill that permits its citizens to make payments of taxes and donations in Bitcoin. The state intends to hold and accumulate BTC for at least five years without trading it in. Texas suggests that Bitcoin is able to prevent the depreciation of the US dollar. Therefore, with the acquisition of the BTC, Texas wants to provide a shield against future inflations and depreciation of regular currency.

Ohio’s Bitcoin Reserve Proposal

Ohio’s proposal is somewhat like the Texas proposal, but the primary emphasis is on the use of Bitcoin as a store of value. The Ohio Bitcoin Reserve Act provides that the state treasury may invest in Bitcoin as an additional form of asset. The bill does not state how much BTC would be bought, but it does raise the potential that Bitcoin could help Ohio pay down its large debt. The latest reports indicate that Ohio’s debt as of 2022 was $72.16 billion. The state’s entry into BTC could be a solution to this problem, although the bill is not yet complete and may be ready only by 2025.

The state of Pennsylvania is also seeking the use of BTC in order to combat inflation. A bill was presented sometime in November 2024 where the state is requested to allocate between 5 and 10% of the General Funds to BTC purchases. This could definitely be close to $1 billion in cryptocurrency investments. The state wants to use the BTC to shield its money from the devaluation caused by inflation. Nevertheless, this bill is still at an initial stage and has to go through a bill-making process to be enacted into law.

The initiative for the creation of a Bitcoin reserve is also being championed at the federal level. In July of 2024, Wyoming Senator Cynthia Lummis presented the Boosting Innovation, Technology, and Competitiveness through Optimized Investment Nationwide (BITCOIN) Act. This bill suggests that the US government should buy one million BTC out of the total 21 million and store them in a distributed network of vaults controlled by the US Treasury. According to Lummis, BTC, as with gold, can be used as an additional reserve asset on the country’s balance sheet. She said this would assist in reducing the nation’s national debt and safeguard against inflation.

Bitcoin’s Impact on Dollar

Lummis’s recommendation has attracted much controversy. Opponents of the idea of buying bitcoins claim that this will only lead to the weakening of the US dollar. Nic Carter, a known critic of crypto, opined that such a move would mean the beginning of the end of the dollar-dominated monetary system. This, he warns, could reduce the dollar’s dominance. Nevertheless, Lummis continues to be a proponent of BTC and thinks that her proposal will be approved.

However, the journey to a national Bitcoin reserve is not a certainty. The effectiveness of state-level strategies remains a matter of conjecture as well. Research has it that, of every five bills introduced at the state level only two will be passed into law. It could even be even lower in Texas, Ohio and Pennsylvania. Even if these state bills do not pass, these new proposals will most likely reappear in the future.

The main problems are still present in the process of their realization. According to the proposed bill, Texas might have problems with collecting taxes that were paid in the form of BTC. People have questions about how the taxing authorities will be able to recognize and confirm BTC transactions.

In the same way, Ohio and Pennsylvania have to work out how they will handle Bitcoin reserves. These challenges show that the adoption of cryptocurrency into the government’s system is not an easy task.

Conclusion

As the debate over Bitcoin reserves continues, one thing is clear: The use of Bitcoin in the American financial system is changing soon. As more and more states consider adopting the currency, and as the federal government considers proposals to regulate it, Bitcoin is becoming viewed as something beyond an investment vehicle. It has become a valuable resource, with the ability to help recommend the future of US economic policy.

The BIT Journal is available around the clock, providing you with updated information about the state of the crypto world. Follow us on Twitter and LinkedIn, and join our Telegram channel.

FAQs

Which states are leading Bitcoin reserves?

Texas, Ohio, and Pennsylvania are creating Bitcoin reserves to fight inflation.

How will Texas use Bitcoin?

Texas plans to accept BTC for taxes and donations, holding it for five years.

What is the federal government’s BTC plan?

Senator Lummis proposes a national BTC reserve to reduce debt and inflation.

What challenges do states face with BTC?

States may struggle with tax collection and verifying BTC transactions.