The Cardano Price Set to Explode Following Successful Bitcoin Bridge Test. The marketplace took notice because BitcoinOS conducted a historic Bitcoin-to-Cardano bridge on May 4, 2025. During early Tuesday trading BitcoinOS technology failed to elevate Cardano (ADA) token prices above $0.65 as the token lost its ability to maintain necessary support levels.

Through X (Twitter) social media BitcoinOS announced a transaction which utilized their new unchained token standard during the milestone event. Sundial Protocol together with ADA Handle supported this initiative.

“The BitcoinOS organization demonstrated the first bridgeless BTC exchange between Bitcoin and Cardano mainnet on May 4, 2025” according to their official statement.

BitcoinOS introduced technology to enable blockchain-to-blockchain transactions autonomously without external third-party platforms which boosts ADA systems’ decentralization in finance.

Bitcoin Bridge Success Raises Long-Term Potential

The Cardano community now celebrates Bitcoin Bridge as a stepping stone toward ADA’s long-term future potential. Secure BTC transfers during the demonstration now allow Cardano price to pursue its goal of operating as a Bitcoin DeFi sidechain.

According to Dan Gambardello, founder of Crypto Capital Venture,

“Cardano is the best positioned bluechip altcoin for a crypto bull market.”

The overall market continues to exhibit volatile movements despite these accomplishments. ADA prices saw their value decrease by more than 10% when the Federal Reserve changed policies and as U.S.-Chinese trade relations worsened in April. The chart reveals that ADA exists beneath both its 21-day and 50-day moving averages, demonstrating a downward momentum.

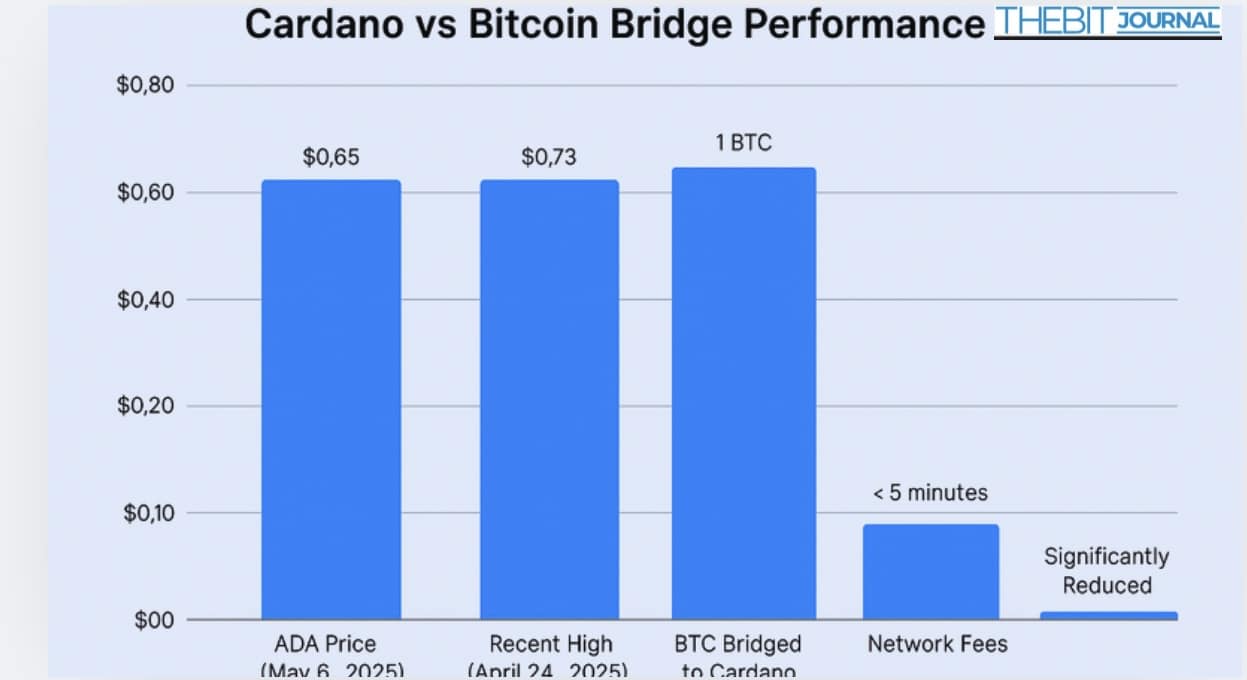

Key Metrics – Cardano vs Bitcoin Bridge Performance

| Metric | Value | Source |

| ADA Price (May 6, 2025) | $0.65 | CoinMarketCap |

| Recent High | $0.73 (April 24, 2025) | CoinMarketCap |

| BTC Bridged to Cardano | 1 BTC | BitcoinOS |

| Time Taken for Round Transfer | < 5 minutes | BitcoinOS |

| Network Fees | Significantly Reduced | BitcoinOS |

Cardano Price Faces Macro Hurdles Despite Innovation

Cardano Price Faces Macro Hurdles Despite Innovation

Although Cardano Price Set to Explode Following Successful Bitcoin Bridge Test, The future of Cardano priceremains uncertain because of its growing market recognition. Market tension could intensify as the Federal Open Market Committee (FOMC) prepares to issue its policy statement on Wednesday.

The crypto markets experienced initial growth after Trump’s trade policy changes produced speculation about trade war reduction.

Conflicting economic indicators, such as the steep rise in the US Treasury yield curve, point toward a potential recession, while investors continue to have an overall uncertain sentiment.

Easing of monetary policies in the market typically fosters altcoin price appreciation. A lack of easing policies signals a less-than-ideal situation for dramatic altcoin price increases during the current quarter.

Cardano Price Technical Outlook: More Downside Ahead?

ADA currently trades at $0.65 below its April peak of $0.72. An absence of momentum reversal according to technical analysts could force Cardano price towards $0.50 resistance levels.

Market data shows Cardano price has dropped below both its 21-day and its 50-day moving averages. The technological breakthrough with BitcoinOS coexists with short-term price bearishness that emerges in the market data.

The market price of altcoins including ADA and their relatives tend to move in step with Bitcoin’s strength and improved economic indicators.

Accumulation Opportunity or Wait-and-See?

Numerous analysts agree that present market conditions present a favorable moment for buying ADA units at discounted prices. Launched from research-based blockchain methods Cardano price creates operating networks based on secure blockchain principles that can expand safely.

The Ouroboros proof-of-stake consensus secured by the project remains its distinctive feature against Ethereum and Solana and their respective consensus protocols. The Midnight protocol represents an upcoming development that seeks to integrate millions of users into the ecosystem by incorporating privacy-centric applications.

Bitcoin integrated DeFi applications will determine the long-term growth of the world yet users need to demonstrate patience throughout this program’s development stage.

Conclusion: Short-Term Challenges, Long-Term Promise

The question Cardano Price Set to Explode Following Successful Bitcoin Bridge Test? remains complex. BitcoinOS bridge platform links developer resources through a platform which tracks investor activities and real-time economic factors.

ADA shows signs of short-term bearish trends since major banks enforce restrictive monetary policies in a state of market pessimism. At this time kinetic investors can begin developing their long-term position holdings in blockchain platforms which show greatest growth potential.

FAQs

What is the BitcoinOS bridge test?

May 4, 2025 marked the start of unchained Bitcoin-transfers between Bitcoin and Cardano price through an unchained token standard which became the first bridgeless transference.

Why is the ADA price not rising despite the news?

Recent economic indicators, combined with rate increases and trade wars, have surpassed technical improvement advantages within this brief timeframe.

Is Cardano a good long-term investment?

Gambardello identifies the combination of Academic foundations built by Cardano and scalability components that establish growth sustainability for Cardano.

Glossary

BitcoinOS: A bridging protocol enabling BTC transfers across blockchains.

Ouroboros: Cardano’s proof-of-stake protocol known for energy efficiency and security.

DeFi: Decentralised Finance, blockchain-based alternatives to traditional financial services.

FOMC: Federal Open Market Committee, which sets interest rates in the US.

Yield Curve: A graph showing interest rates across maturity dates; used to gauge economic outlook.

References

- BitcoinOS Official Announcement on X

- Dan Gambardello Tweet

- Cardano Blockchain Overview – IOHK

- US Treasury Yield Curve Data – FRED

‘Follow us on Twitter and LinkedIn and join our Telegram channel to be instantly informed about breaking news!