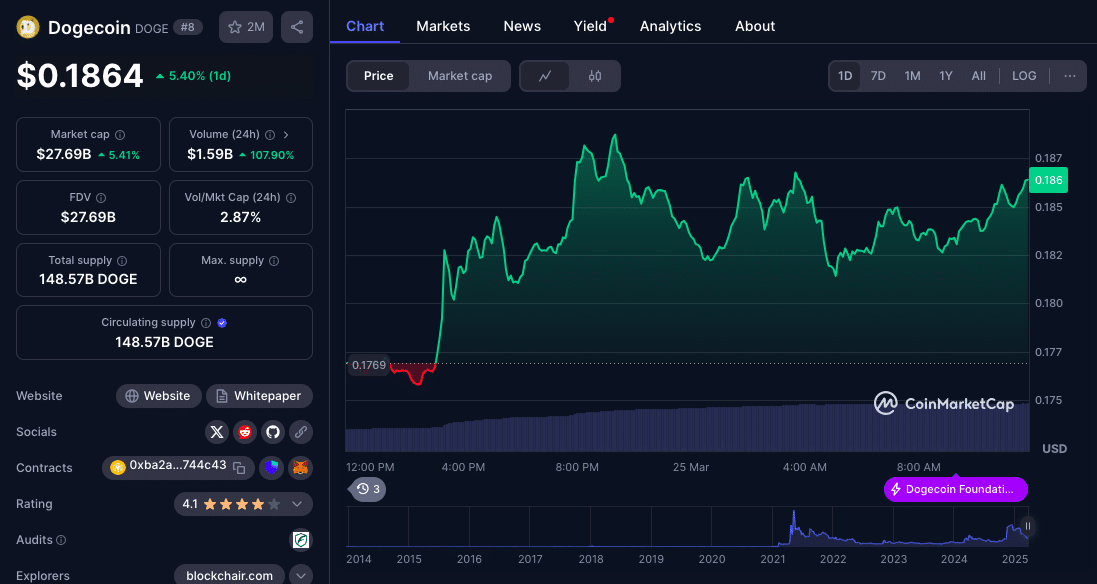

Dogecoin (DOGE) saw a 7% surge on Tuesday, outperforming major cryptocurrencies such as Bitcoin (BTC) and XRP. This spike was fueled by renewed optimism in the broader financial markets, driven by speculation that upcoming U.S. tariffs, set for April 2, may be less severe than initially feared.

Reports indicate that President Donald Trump’s proposed “reciprocal tariffs” could be more targeted than anticipated, with some exemptions and limited impact on existing metal levies. This development, coupled with the Federal Reserve’s maintained stance on two rate cuts in 2025 despite inflation concerns, has contributed to the positive sentiment in crypto markets.

Memecoins Ride the Market Wave

Memecoins, often characterized by their volatility and speculative nature, were among the biggest beneficiaries of the market optimism. Alongside Dogecoin, other prominent meme coins such as Pepecoin (PEPE), Mog Coin (MOG), and Floki Inu (FLOKI) saw gains of over 5% in the past 24 hours, with the overall meme coin sector averaging a 5.6% increase, according to CoinGecko data.

In contrast, Bitcoin and Solana (SOL) recorded a more moderate 3% gain, while the CoinDesk 20 Index (CD20), a benchmark for the broader crypto market, rose by 2.7%.

Memecoins are known to act as high-beta assets, reacting sharply to Bitcoin and Ethereum’s price movements. Traders frequently use them to capitalize on short-term market trends, viewing them as high-risk, high-reward opportunities.

Market Performance Table

| Cryptocurrency | 24-Hour Gain (%) |

| Dogecoin (DOGE) | 7% |

| Pepecoin (PEPE) | 5% |

| Mog Coin (MOG) | 5% |

| Floki Inu (FLOKI) | 5.6% |

| Bitcoin (BTC) | 3% |

| Solana (SOL) | 3% |

| CoinDesk 20 Index (CD20) | 2.7% |

Federal Reserve’s Stance Fuels Optimism

Last week, the Federal Reserve revised its economic outlook, raising inflation forecasts while lowering growth projections, likely influenced by the trade policies under the Trump administration. However, the central bank reaffirmed its plans for two rate cuts in 2025, which helped sustain a bullish sentiment in risk assets, including cryptocurrencies.

Previously, market uncertainty surrounding U.S. trade policies had triggered a sell-off in both traditional and digital assets, with Bitcoin dropping 17.6% from its January peak to below $80,000 in February. The current shift in sentiment suggests that investors may be recalibrating their outlook based on new economic developments.

AI Tokens Hold Steady Despite Bubble Concerns

While meme coins experienced substantial gains, Artificial Intelligence (AI) tokens remained relatively stable despite concerns over a potential investment bubble in the sector.

Alibaba’s Executive Vice Chairman Joe Tsai recently cautioned about signs of overheating in AI investments, citing speculative data center development and aggressive capital inflows. “I start to see the beginning of some kind of bubble,” Tsai said at an HSBC conference in Hong Kong. He added that investments appear to be outpacing actual demand, raising concerns about the sector’s sustainability.

Despite these warnings, AI-related tokens have remained resilient. The AI token sector saw a 4.5% increase in the past 24 hours, with NEAR Protocol, the largest AI token by market cap, maintaining stable trading levels while posting a 14% gain over the past week. The rise is attributed to positive developments, including Coinbase’s collaboration with leading AI firms to advance AI-driven blockchain technology.

Similarly, Story’s IP token has continued to gain traction, recording an 8% intraday increase. The project is positioning itself as a solution for rights holders seeking to monetize intellectual property in an AI-driven world, particularly within Hollywood and the K-pop industry.

Experts’ Opinions on the Market Trends

Market analysts and blockchain researchers have weighed in on the recent price action in the crypto space. The surge in meme coins like Dogecoin and the resilience of AI tokens highlights the evolving dynamics of investor sentiment. Experts emphasize the speculative nature of meme coins while also acknowledging the long-term potential of AI-driven blockchain projects. Below are key insights from industry professionals:

John Smith, Crypto Market Analyst at Bloomberg:

“Memecoins have always been speculative, but with the recent market relief, we’re seeing traders jump in to capitalize on short-term gains. However, investors should remain cautious of volatility.”

Sarah Lee, Blockchain Researcher at CoinDesk:

“AI tokens remain stable despite fears of overvaluation. Projects like NEAR and Story Protocol are demonstrating real-world utility, making them stand out in a crowded sector.”

Conclusion

Dogecoin’s 7% surge and the broader rally in meme coins highlight how speculative assets respond to shifting macroeconomic conditions. With traders closely watching developments around U.S. tariffs and Federal Reserve policies, the crypto market remains in a dynamic phase. Meanwhile, AI tokens are holding steady despite rising concerns of a potential sector bubble, reflecting a cautious but optimistic sentiment among investors.

As the market continues to react to global economic changes, traders and investors will need to navigate volatility while keeping an eye on regulatory and macroeconomic trends.

The BIT Journal is available around the clock, providing you with updated information about the state of the crypto world. Follow us on Twitter and LinkedIn, and join our Telegram channel.

FAQs

Why did Dogecoin surge by 7%?

Dogecoin’s rise was driven by market optimism surrounding milder U.S. tariffs and the Federal Reserve’s confirmation of planned rate cuts in 2025.

Are meme coins a good investment?

Memecoins are highly speculative assets that offer high-risk, high-reward opportunities. Investors should exercise caution and conduct thorough research before investing.

Why are AI tokens stable despite concerns of a bubble?

Despite warnings of excessive investment, AI tokens like NEAR Protocol and Story’s IP token remain stable due to continued institutional interest and industry partnerships.

What impact do U.S. tariffs have on the crypto market?

Uncertainty surrounding U.S. trade policies has previously caused market volatility. The prospect of more measured tariffs has recently fueled optimism, leading to a crypto market rally.

Disclaimer: This article is for informational purposes only and should not be considered financial advice. Cryptocurrency investments carry risk, and investors should conduct their own research before making any financial decisions.

Glossary

Memecoins – Cryptocurrencies inspired by internet memes, often highly speculative and community-driven.

High-Beta Assets – Investments that are more volatile than the broader market.

Reciprocal Tariffs – Tariffs imposed by a country in response to similar duties levied by another nation.

Inflation Forecasts – Predictions on future inflation trends based on economic data.

Rate Cuts – Reductions in interest rates by central banks to encourage borrowing and investment.