Ethereum (ETH) investors are on edge as the price falls below key support levels. Analysts point to the MVRV ratio, which has dropped to a critical level, historically signaling major downturns. While some experts warn of a potential 40% decline, others maintain that a $10,000 price target remains feasible in the long run.

Could Ethereum Drop to $2,100?

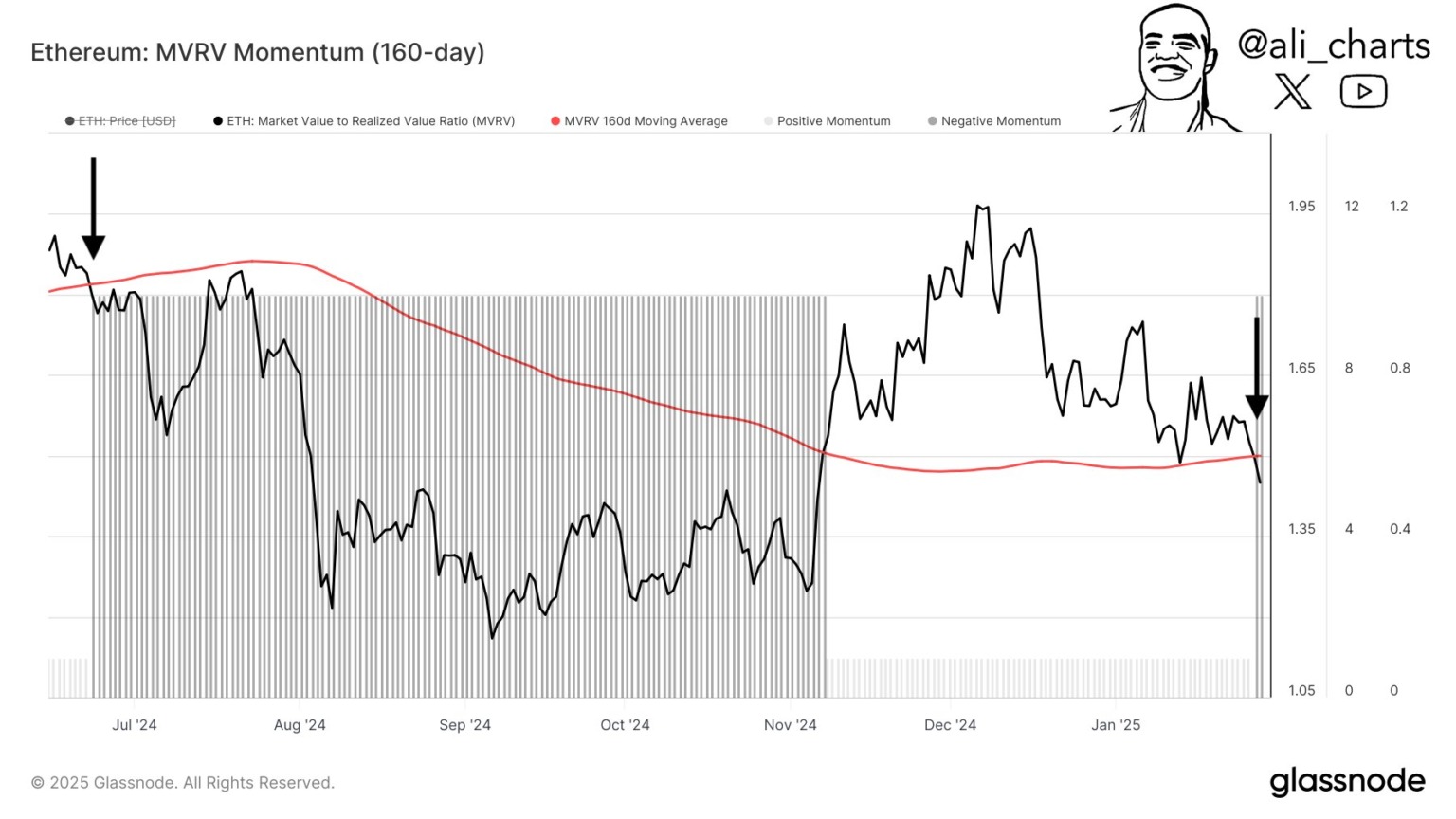

Renowned analyst Ali Martinez highlights that Ethereum’s MVRV ratio has dipped below its 160-day moving average—a pattern that has previously led to significant price corrections. If history repeats itself, ETH could drop to $2,100.

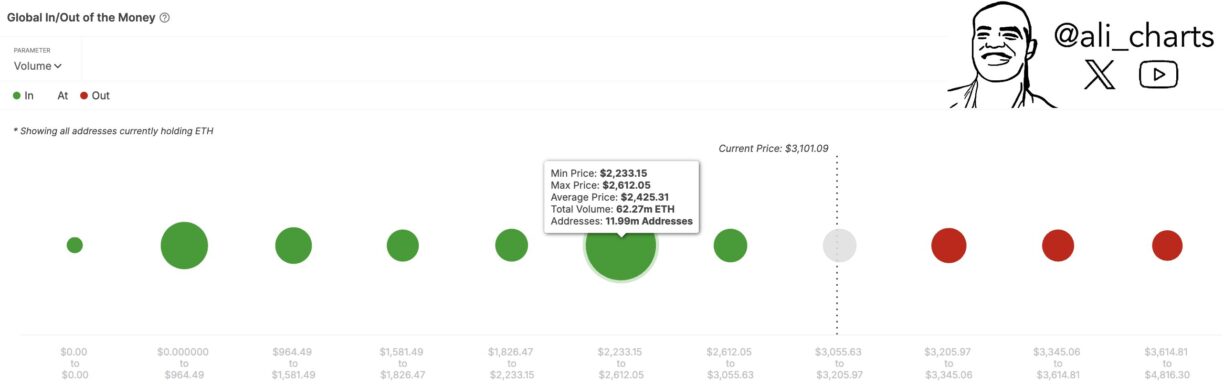

On the other hand, Martinez notes that Ethereum has a strong support zone between $2,230 and $2,610, where nearly 62 million ETH is held across 11.99 million wallets. If this level fails to hold, the market could witness a deeper crash.

Increasing Supply Puts Pressure on Ethereum’s Price

Crypto analyst Benjamin Cowen warns that Ethereum’s supply is increasing, contradicting the deflationary model that many had anticipated. Since July 2023, ETH’s supply has grown by 60,000 coins per month, exerting downward pressure on its price.

Cowen cautions that if Ethereum’s supply approaches pre-Merge levels, it could spell trouble for the market. A sustained increase in supply could make price recovery increasingly difficult, urging investors to adopt a more cautious stance in the short term.

Can Ethereum Reach $10,000?

Despite bearish signals, some analysts remain optimistic about Ethereum’s long-term growth. Analyst Ted Pillows asserts that if ETH surpasses $4,000, a major rally could follow, potentially driving prices toward $9,000 – $10,000 within a few months.

At present, Ethereum is trading at $3,186, with a 24-hour trading volume surging 22% to $24.17 billion. However, some analysts speculate that XRP could eventually overtake ETH if the latter continues to struggle. The $3,000 level remains a crucial threshold for investors—if ETH drops below this level, a slide to $2,100 could be imminent. Conversely, breaking past $4,000 could set the stage for new all-time highs.

Stay tuned to The Bit Journal for more insights on Ethereum, market trends, and the evolving crypto landscape.

- https://twitter.com/Thebitjournal_

- https://www.linkedin.com/company/the-bit-journal/

- https://t.me/thebitjournal

Follow us on Twitter and LinkedIn and join our Telegram channel to get instant updates on breaking news!