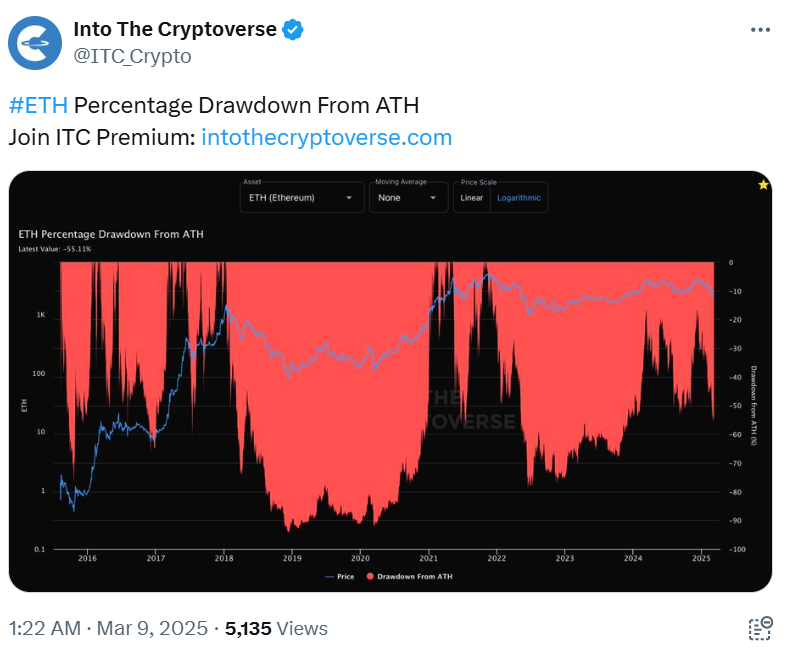

Ethereum (ETH) has long been one of the leading cryptocurrencies, known for its ability to recover from sharp market declines. ETH has consistently demonstrated resilience despite extreme volatility, emerging stronger after each downturn. As of March 10, 2025, ETH is trading at $2,135, reflecting 46.30% drawdown from its peak.

This price level follows a series of major corrections, most notably the 80% drop in 2022 triggered by the FTX collapse. However, ETH has shown a remarkable ability to bounce back, supported by key developments such as the 2024 Dencun upgrade and the approval of Ethereum ETFs.

Key Developments

Significant fluctuations have often marked ETH market performance. In 2022, the market experienced a steep decline following the FTX scandal, pushing ETH’s value down by as much as 80%. Despite this setback, Ethereum has recovered considerably and seems to have found a stable price level. Analysts have highlighted that ETH’s recovery is partly due to the Dencun upgrade, which enhanced scalability and transaction speeds. Additionally, the approval of Ethereum ETFs has allowed institutional investors to participate more easily, contributing to the asset’s recovery and growth.

Ethereum Market Overview

Ethereum’s price history shows a series of deep corrections followed by substantial recoveries. 2018 ETH experienced a 70% drop; in 2021, it saw a 60% decline. Each time, the cryptocurrency rebounded, showcasing its market strength. The combination of the Dencun upgrade, favourable market sentiment, and institutional support through ETFs has helped ETH stabilize. ETH’s historical resilience is often tied to market cycles where bullish recoveries follow deep corrections.

ETH’s Price Performance and Recovery

Ethereum’s price has shown remarkable resilience despite significant market corrections. After dropping sharply in 2022, ETH has stabilized at $2,100, with a 46.33% drop from its previous highs. This reflects a consistent pattern in ETH’s price history: steep corrections followed by recoveries. Ethereum’s performance in 2025 suggests it could surpass its all-time highs if the market continues favouring the asset.

The Role of the Dencun Upgrade

The Dencun upgrade, implemented in 2024, was critical in ETH recovery. This upgrade improved Ethereum’s scalability, allowing it to handle more transactions per second. Dencun helped restore investor confidence in ETH’s long-term potential by addressing some of the network’s scalability challenges. As a result, ETH has seen a gradual price increase, reflecting the market’s positive response to these improvements.

Institutional Support through Ethereum ETFs

The approval of Ethereum ETFs in 2024 gave institutional investors a new vehicle to gain exposure to ETH. This move further solidified the cryptocurrency’s place in the broader financial landscape. ETFs allow traditional investors to access ETH without buying and managing the cryptocurrency directly. This development has contributed to the growing institutional interest in ETH, further boosting its price stability.

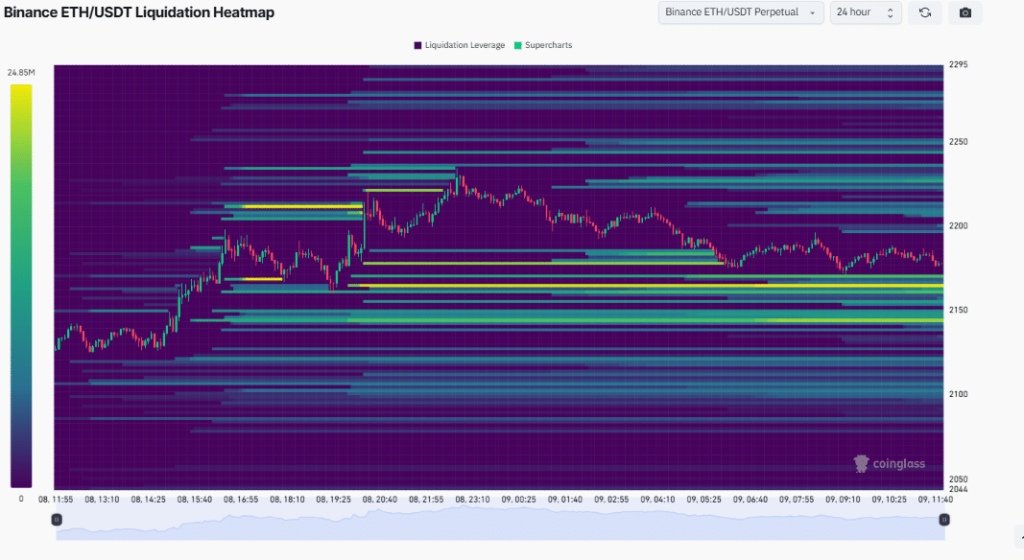

Whale Activity and Market Movements

Ethereum’s price is also influenced by whale activity, where large investors accumulate significant amounts of ETH during price dips. These investors often play a crucial role in stabilizing ETH’s price and helping it recover from market downturns. Whale accumulation during dips has been a key factor in Ethereum’s ability to weather market turbulence, and market analysts closely watch their actions.

While ETH shows strong potential, it is not immune to regulatory challenges. Governments and financial authorities worldwide are still grappling with how to regulate cryptocurrencies. Any unfavorable regulatory action could lead to market turbulence and potentially lower ETH’s price. Analysts caution that regulatory crackdowns or adverse market conditions could lead to price declines of up to 40% to 50%. However, ETH’s past performance indicates that it has the strength to bounce back from such setbacks.

Trading Volume and Investor Sentiment

Trading volume trends also shape Ethereum’s market activity. A significant rise in trading volume often signals increased investor interest. From February 13 to March 6, 2025, trading volume surged from 50k to 450k. This spike in volume coincided with ETH’s stabilization, suggesting growing investor confidence. High trading volumes often indicate strong market participation, which can increase ETH’s price.

Long-Term Price Forecast and Potential ATH

Looking ahead, Ethereum’s potential to reach new all-time highs (ATH) remains strong. Analysts predict ETH could surge to $3,000-$4,164 by the end of 2025, provided market conditions remain favorable. Factors such as institutional interest, continued whale activity, and ETH’s technological upgrades are expected to contribute to this growth. However, the risk of regulatory intervention or market manipulation could impact this forecast.

Conclusion

Ethereum’s resilience through multiple market cycles has proven its strength as a top cryptocurrency. Despite experiencing sharp declines, it has consistently recovered, supported by key developments such as the Dencun upgrade and Ethereum ETFs. The future of ETH looks promising, with analysts predicting potential price surges to new all-time highs. However, regulatory risks and market volatility remain significant challenges.

The BIT Journal is available around the clock, providing you with updated information about the state of the crypto world. Follow us on Twitter and LinkedIn, and join our Telegram channel.

Frequently Asked Questions (FAQ)

1- How was Ethereum affected by the 2022 FTX collapse?

The 2022 FTX collapse caused Ethereum’s price to drop by 80%, but it has since recovered and stabilized.

2- How did the Dencun upgrade affect Ethereum?

The Dencun upgrade significantly improved Ethereum’s scalability and transaction speed, contributing to its market recovery and boosting investor confidence.

3- Could Ethereum reach $4,000?

Analysts predict Ethereum could reach $3,000-$4,164 by the end of 2025, depending on market conditions and continued institutional interest.

4- How do Ethereum ETFs impact the market?

The approval of Ethereum ETFs in 2024 allowed institutional investors to access ETH more easily, supporting price stability and fostering broader market participation.

Appendix: Glossary of Key Terms

ETH: The cryptocurrency used on the Ethereum network, enabling transactions, smart contracts, and decentralized applications.

Dencun Upgrade: A 2024 improvement to the ETH network, enhancing scalability and transaction efficiency.

ETFs (Exchange-Traded Funds): Investment vehicles that allow institutional and retail investors to invest in ETH without directly holding the cryptocurrency.

Whale Activity: Large-scale investors or entities that hold significant amounts of ETH, influencing market trends and price movements.

Market Correction: A decline in the price of an asset, typically by 10% or more, from its most recent peak.

Liquidity: The ease with which an asset, such as ETH, can be bought or sold in the market without significantly affecting its price.

Bullish Sentiment: Investor optimism that typically drives prices higher, often fueled by positive news, upgrades, or increased demand.

References

AMB Crypto – ambcrypto.com

CoinMarketCap – coinmarketcap

CoinDesk – coindesk.com

TradingView – tradingview.com

CoinGlass – coinglass.com