Ethereum’s ETFs have pulled in more than $5 billion in institutional investments. While Bitcoin ETFs still lead the market, many are curious if ETH can catch up or even eclipse BTC’s dominance in the coming years.

A Steady Climb in ETF Inflows

Starting in November 2024, growing interest from asset managers and funds led to a surge in Ether ETF investments. Since then, total inflows have exceeded $5 billion, reflecting strong investor confidence in its core strengths.

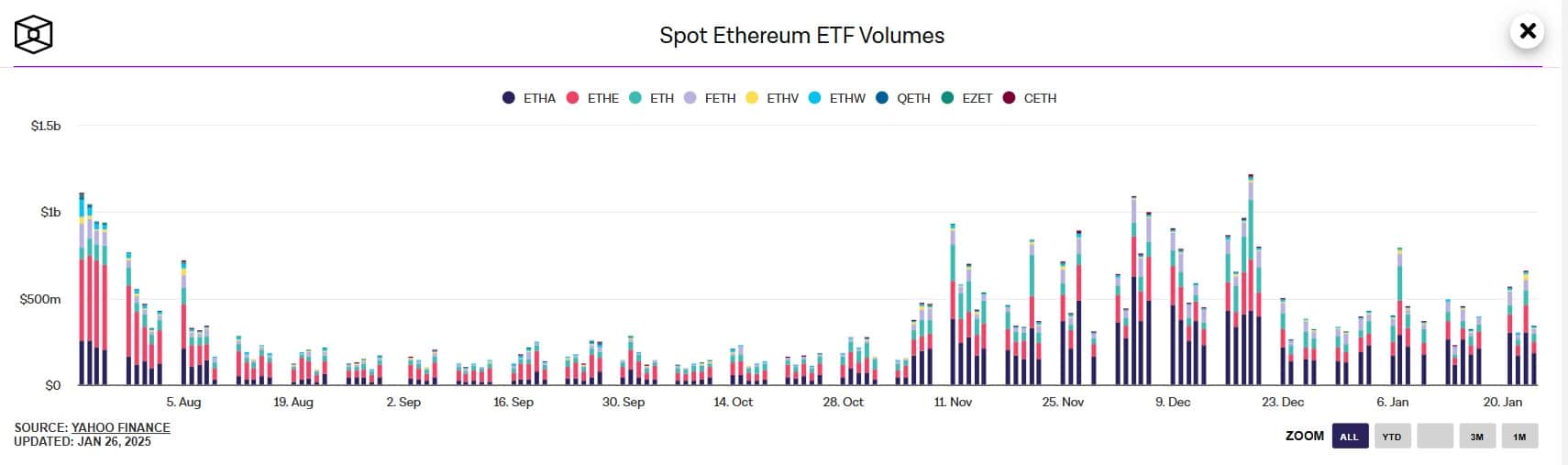

Notably, daily trading volumes for Ether ETFs have surged in tandem with overall inflows. In December, multiple days saw transactions surpass $1 billion, a testament to the sheer scale of institutional involvement. ETFs like ETHE and ETHW have emerged as top picks among professional investors seeking exposure to ETH’s wide-ranging use cases.

Why Institutions Are Embracing Ethereum?

A major reason institutions find Ethereum appealing is the successful Shanghai upgrade. This update lets users withdraw staked ETH without causing network problems, making it a more reliable long-term investment. Institutional staking also surged post-upgrade, with more large-scale investors opting to lock in their ETH for additional rewards.

Scalability is another driving force. With layer-2 solutions like Arbitrum and Optimism, ETH’s platform is evolving to handle higher transaction volumes at lower costs—a core requirement for widespread adoption. This scalability reduces network congestion and appeals to businesses and financial institutions looking to streamline operations on the blockchain.

Moreover, real-world asset tokenization is increasingly finding a home on this cryptocurrency. High-profile examples—like JPMorgan’s $20 million tokenized bond—demonstrate how the network can serve as a backbone for traditional financial instruments, thereby attracting institutions intrigued by cutting-edge financial products.

Is ETH’s Versatility Pulling Ahead of Bitcoin’s Stability? A Shifting Dynamic

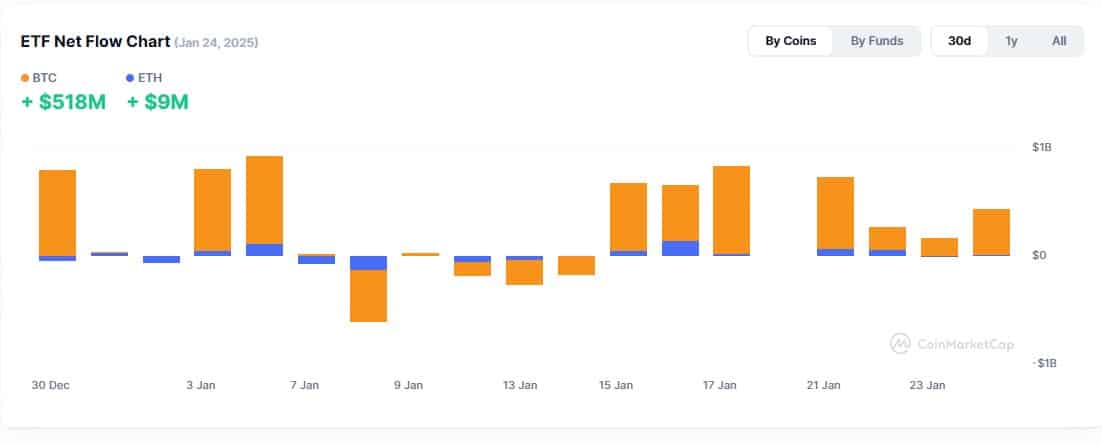

Bitcoin ETFs remain a fixture in institutional portfolios, pulling in over $518 million this month alone. BTC ETFs are approaching $122 billion in total assets, driven by six consecutive days of net inflows. It saw $188.65 million added, with BlackRock’s IBIT and Bitwise’s BITB leading the gains.

BlackRock’s IBIT alone brought in $154.64 million, reaching $60 billion in assets. Despite a $49.94 million outflow from Grayscale’s GBTC, overall sentiment remains positive. Meanwhile, Ether ETFs faced a $14.93 million net outflow but aim to rebound.

Their appeal is often tied to BTC’s status as a digital gold equivalent—relatively straightforward and more established in the public consciousness. Yet, Ethereum’s surge to over $5 billion in recent inflows suggests a dynamic shift. While BTC might still be considered the “safer” choice, ETH’s value proposition lies in its versatility, particularly for decentralized finance (DeFi), staking, and the tokenization of diverse assets.

This diversification angle is gradually resonating with institutional investors who seek store-of-value potential and an ecosystem that can drive broader use cases. In essence, BTC’s singular focus contrasts with ETH’s multi-pronged functionality, giving the latter a compelling edge.

What Lies Ahead?

ETH’s continued expansion into institutional territory reflects a broader strategic move in the crypto world: the pursuit of adaptable platforms with real-world applications. As regulators across the globe clarify their stances on digital assets, its proactive approach to network upgrades and user experience may further strengthen its position.

Still, some challenges could impede ETH’s climb. Ongoing global economic shifts, potential regulatory hurdles, and the network’s pursuit of scalability may influence its performance. Nonetheless, the rivalry between Ethereum and Bitcoin—two giants driving crypto adoption—appears to be fueling a wave of innovation and mainstream acceptance.

Conclusion:

The $5 billion milestone marks a pivotal stage for Ethereum. While BTC’s influence is far from waning, ETH’s versatility and steady growth point to a future where adaptability may define the leading digital asset. Its success depends on strong trading volumes, institutional support, and meeting DeFi needs.

Stay tuned to The BIT Journal and watch Crypto’s updates. Follow us on Twitter and LinkedIn, and join our Telegram channel to be instantly informed about breaking news!

Frequently Asked Questions (FAQs)

1. What milestone has Ethereum ETFs achieved?

They have attracted over $5 billion in institutional investments.

2. How does this compare to Bitcoin ETFs?

Bitcoin ETFs still dominate, with $122 billion in total assets, but Ethereum is steadily closing the gap.

3. Why are institutions investing in ETH?

Due to its successful Shanghai upgrade, scalability improvements and use cases like real-world asset tokenization make it appealing.

4. What role did the Shanghai upgrade play?

It enabled staked ETH withdrawals without network disruptions, boosting ETH’s appeal as a long-term investment.

5. Which ETH ETFs are most popular?

ETFs like ETHE and ETHW have become top choices for institutional investors.