Recent movements of Bitcoin by a cryptocurrency wallet connected to the German government have sparked intense speculation and concern within the cryptocurrency community. The wallet, known to be associated with the German government, conducted a series of transactions totalling $52 million in Bitcoin on July 2. These transactions included transfers to prominent exchanges such as Coinbase, Bitstamp, and Kraken, which has prompted speculation among market observers regarding the intentions behind these moves.

Analysing the Impact on Bitcoin’s Price

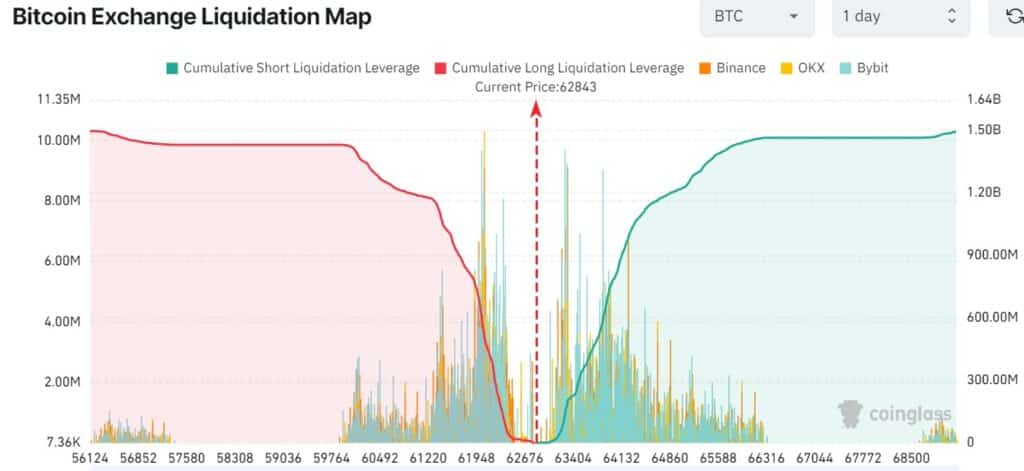

The transfer of 832.7 Bitcoin arrives at a pivotal moment in Bitcoin’s price movement. In the last month, Bitcoin has decreased by 7.3%, briefly stabilizing above $58,450 before recovering to its present levels near $62,000. Analysts warn that sizable sell-offs from entities holding substantial Bitcoin reserves, like the German government, with 43,850 BTC valued at about $2.75 billion, might intensify selling pressure in the market.

This selling pressure has been particularly noticeable recently as Bitcoin strives to stabilize after heightened volatility. Market sentiment remains cautious, with traders closely monitoring movements in large Bitcoin holdings, anticipating their potential impact on market dynamics.

Government Strategy: Selling Pressure on the Horizon?

The repeated transfers to centralized exchanges suggest a strategic intention by the German government to potentially liquidate a portion of its Bitcoin holdings. This strategy first came into the spotlight on June 19 with a massive transfer of 6,500 BTC worth over $425 million. Subsequent transfers, including significant amounts to undisclosed wallets like “139Po,” indicate ongoing divestment plans by the government. These assets were initially seized from operators linked to the now-defunct pirate movie website Movie2k back in February 2024.

Germany’s approach to managing its Bitcoin reserves raises broader questions about its strategy regarding digital assets. While some speculate that these transfers aim to manage financial risk or seize current market conditions, others view them as a potential signal of diminished long-term confidence in Bitcoin as an asset class.

Implications for Crypto Investors and Market Dynamics

As regulatory scrutiny and market volatility continue to shape the cryptocurrency landscape, the actions of major Bitcoin holders, such as governments, carry significant implications. Market participants eagerly await further clarity on the motivations behind Germany’s Bitcoin transfers. The government has not publicly commented on this matter so far, leaving investors to speculate and monitor developments closely. These developments provide crucial insights into potential market movements and investor sentiment surrounding digital assets.

Investors keenly observe how governments’ decisions regarding Bitcoin holdings may influence broader market sentiment and regulatory attitudes towards cryptocurrencies. The transparency and impact of such large-scale transfers underscore the need for clear regulatory frameworks to accommodate the growing presence of digital assets while ensuring market stability and investor protection.

Government Bitcoin Transfers: Regulatory Challenges and Institutional Strategies

The recent German Bitcoin transfers highlight the evolving relationship between governments and cryptocurrencies. Bitcoin continues to navigate through regulatory challenges and market uncertainties, with its resilience and adaptability being tested against shifting institutional strategies and global regulatory frameworks. The ongoing narrative surrounding government-held Bitcoin holdings signifies a pivotal moment for the cryptocurrency community, underscoring the broader implications of institutional involvement in digital asset markets.

Ultimately, the impact of these transfers extends beyond immediate market reactions, shaping perceptions of Bitcoin’s role in institutional portfolios and its resilience in the face of macroeconomic uncertainties. Investors and stakeholders are encouraged to remain vigilant and informed as governments worldwide define their stances on digital assets and their potential impacts on global financial systems.

German Bitcoin Transfer-Final Remarks

As Bitcoin and other cryptocurrencies continue to attract attention and scrutiny from global regulators, the recent Bitcoin transfers by the German government highlight the evolving role of institutional players in digital asset markets. The actions of major stakeholders, including governments, play a crucial role in shaping market sentiment and regulatory frameworks. Bitcoin’s dual nature as both a speculative asset and a potential hedge against inflation and economic uncertainty adds complexity to regulatory discussions. These developments emphasize the pressing need for robust regulatory frameworks that balance fostering innovation with ensuring investor protection and systemic stability. The ongoing management of government-held Bitcoin holdings represents a significant moment in understanding how institutional participation shapes the broader landscape of cryptocurrency markets.