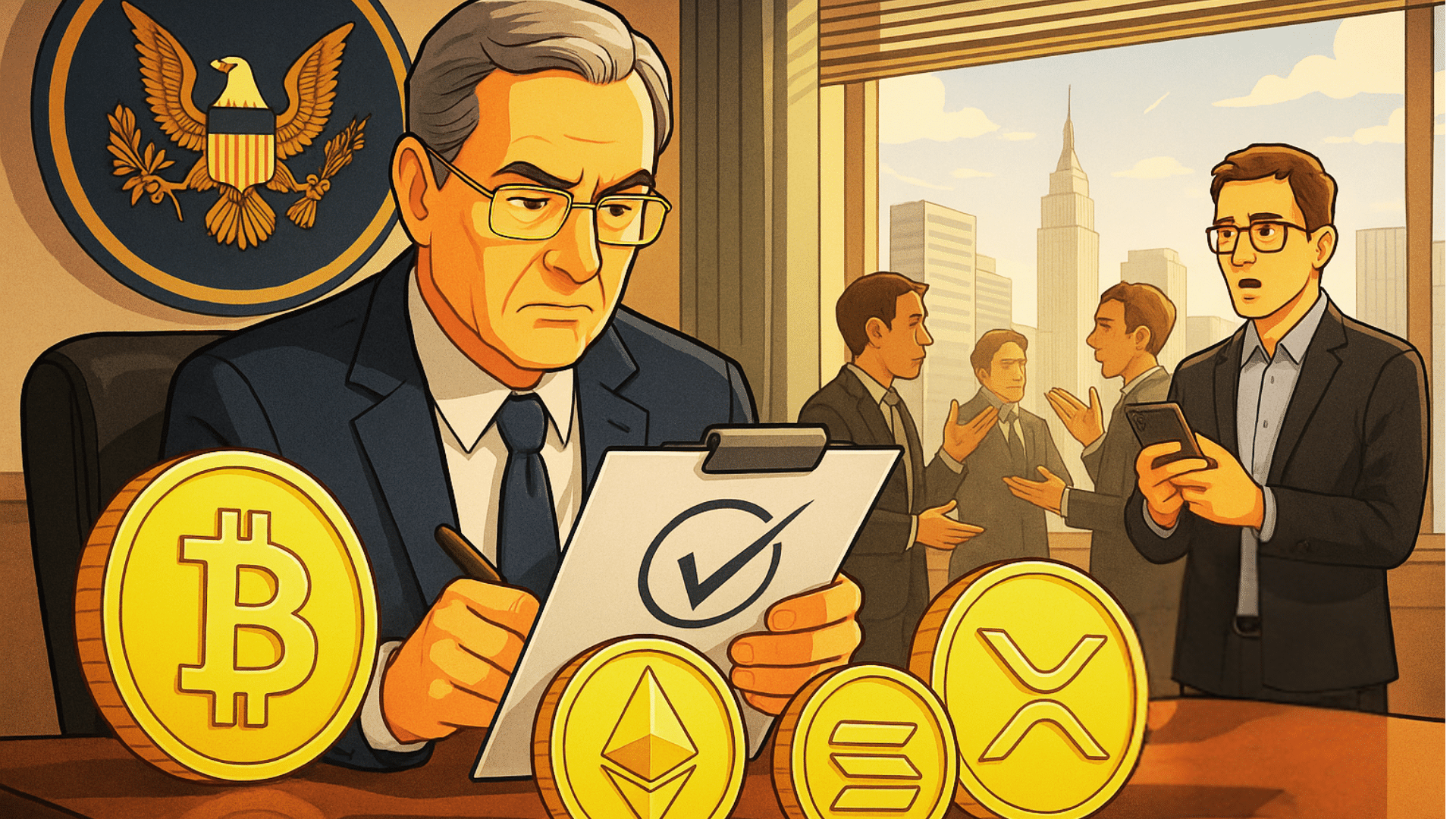

The U.S. Securities and Exchange Commission (SEC) has approved the conversion of Grayscale’s Digital Large Cap Fund into a spot exchange-traded fund (ETF), marking a significant shift in crypto regulation.

The Grayscale ETF approval not only provides institutional exposure to Bitcoin and Ethereum but also opens the doors for Solana, XRP, and Cardano to enter regulated spot trading. This move is widely regarded as a critical step toward broader crypto adoption and regulatory normalization in the United States.

Regulatory Context and Significance

For years, crypto products like XRP and ADA have faced legal uncertainty in the U.S., limiting their accessibility on institutional platforms. The Grayscale ETF approval now allows Solana, XRP, and Cardano to trade as part of a regulated fund on NYSE Arca, without being individually declared non-securities. While the SEC has not made a definitive ruling on the status of these tokens, this ETF approval represents a de facto validation of their legitimacy in institutional markets.

Legal experts argue that this step is comparable to how Bitcoin ETFs were approved despite early hesitance. It sets a precedent and may reduce barriers for other altcoins like Avalanche or Polygon, whose ETF applications are also under review.

Grayscale ETF approval: A Multi-Asset Exposure Revolution

The ETF, which tracks the CoinDesk Large Cap Select Index (CD5), includes five of the most liquid digital assets by market cap: Bitcoin, Ethereum, Solana, XRP, and Cardano. This diversified basket allows asset managers and investors to gain regulated exposure to a broader slice of the crypto market in one vehicle.

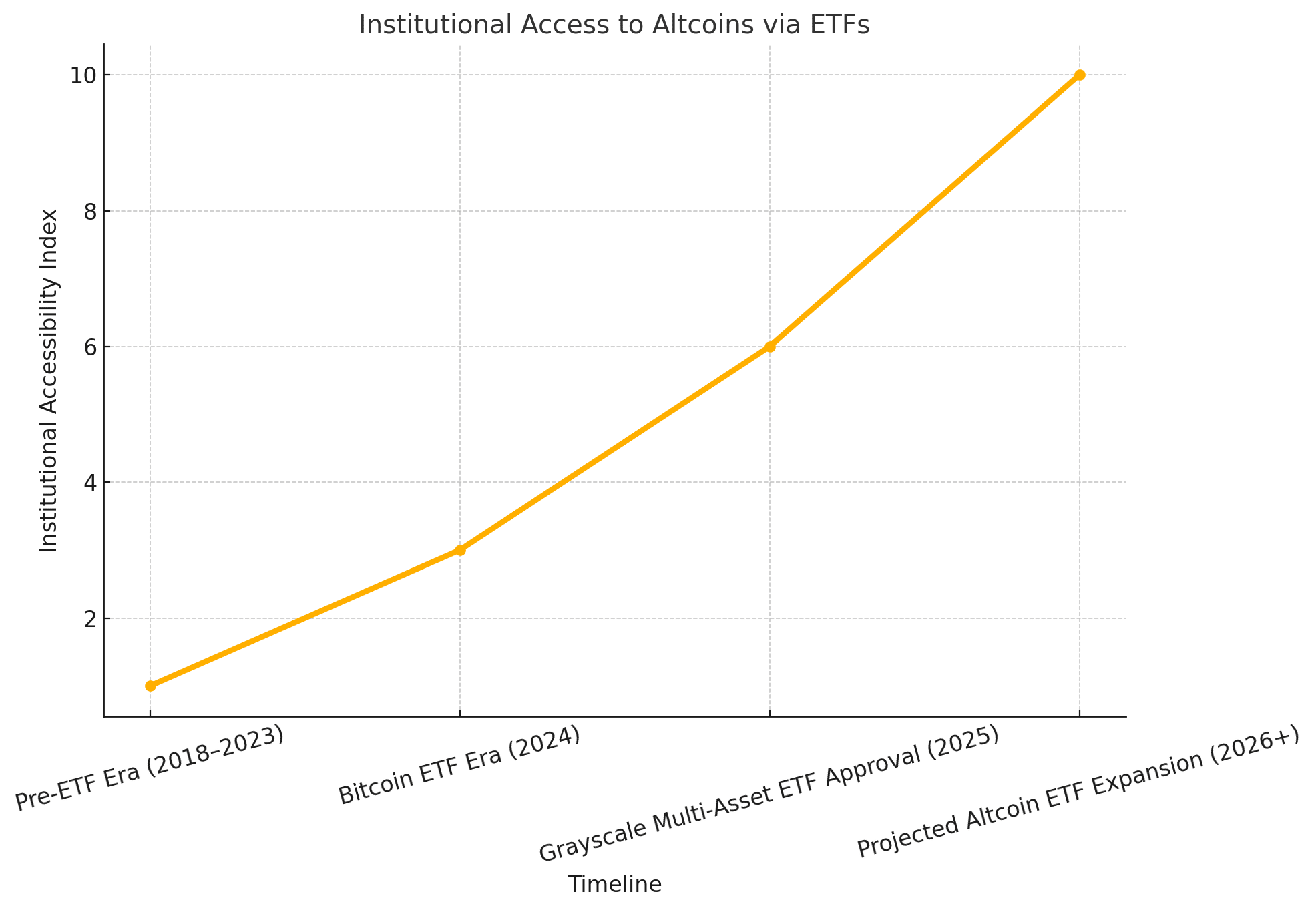

For institutional investors previously limited to Bitcoin and Ethereum, this approval marks a paradigm shift. Financial advisors can now offer exposure to multiple altcoins under a single, compliant umbrella, which significantly enhances portfolio construction strategies.

Industry and Expert Reactions

The approval has drawn praise from crypto industry leaders and analysts alike. Andy Baehr, Managing Director at CoinDesk Indices, called the move “a gateway moment that allows institutions to access the five most important digital assets in a single wrapper.”

Katie Talati, Head of Research at digital asset manager Arca, said:

“This Grayscale ETF approval signals that the SEC is willing to tolerate regulated exposure to non-Bitcoin, non-Ethereum tokens in specific contexts. That has deep implications for the future of token classification.”

Asset managers like VanEck and Invesco have also taken notice, with existing Solana-only ETF filings likely to see accelerated consideration. Experts believe that the Grayscale ETF serves as a blueprint for upcoming multi-token and single-asset products, pushing the U.S. ETF market into its next growth phase.

Implications for the Crypto Ecosystem

This development may catalyze a series of structural shifts:

Liquidity Reallocation: Traders may rotate capital into altcoins now considered “ETF-eligible.”

Increased Market Confidence: Regulatory acceptance of a diversified crypto basket can restore confidence among hesitant institutional players.

Momentum for Future Filings: Polygon, Avalanche, and even meme coins may now have a clearer path toward regulated investment vehicles.

Moreover, the ETF’s structure enables real-time creation and redemption of shares, eliminating inefficiencies such as premium/discount volatility common in legacy trusts.

An Overview

The Grayscale ETF approval is more than just another milestone, it marks the emergence of multi-asset crypto investing under U.S. regulation. With Solana, XRP, and Cardano now available in a regulated ETF structure, institutional exposure to a broader digital asset market is no longer speculative—it’s happening now. This breakthrough may lead to a wave of innovation in crypto asset management, making this a defining moment in the maturation of the cryptocurrency industry.

Frequently Asked Questions

Q1: What does the Grayscale ETF approval actually mean?

A: It allows the Digital Large Cap Fund to convert into a spot ETF, enabling institutions to invest in five digital assets, including Solana, XRP, and Cardano, through regulated channels.

Q2: Are Solana, XRP, and Cardano no longer considered securities?

A: The SEC has not formally declared them non-securities. However, the approval implies a willingness to permit their inclusion in regulated financial products.

Q3: Will more ETFs be approved soon?

A: Given this precedent, industry watchers expect additional altcoin and thematic ETFs to be approved in the coming months.

Q4: Does this impact the price of these tokens?

A: While the article does not focus on prices, broader access and regulatory clarity can positively influence market sentiment and institutional inflows.

Glossary of Key Terms

Grayscale ETF Approval: SEC decision allowing Grayscale to convert a digital asset trust into a spot-traded ETF.

Spot ETF: An exchange-traded fund that holds actual crypto assets instead of futures contracts.

Altcoins: Cryptocurrencies other than Bitcoin, such as Ethereum, Solana, and XRP.

CoinDesk CD5 Index: An index tracking five leading cryptocurrencies by market capitalization.

Surveillance-Sharing Agreement (SSA): A regulatory measure ensuring trading transparency and market integrity.