According to the report, Russia is gearing up to implement the digital ruble for social benefits and welfare payments to modernize its financial infrastructure. This initiative, spearheaded by the Central Bank of Russia in collaboration with the Federal Treasury and the Ministry of Finance, aims to enhance the efficiency and transparency of government disbursements. The digital ruble, envisioned as the third form of the national currency alongside cash and non-cash rubles, is set to revolutionize the way citizens receive and manage state support.

A New Era for Social Payments

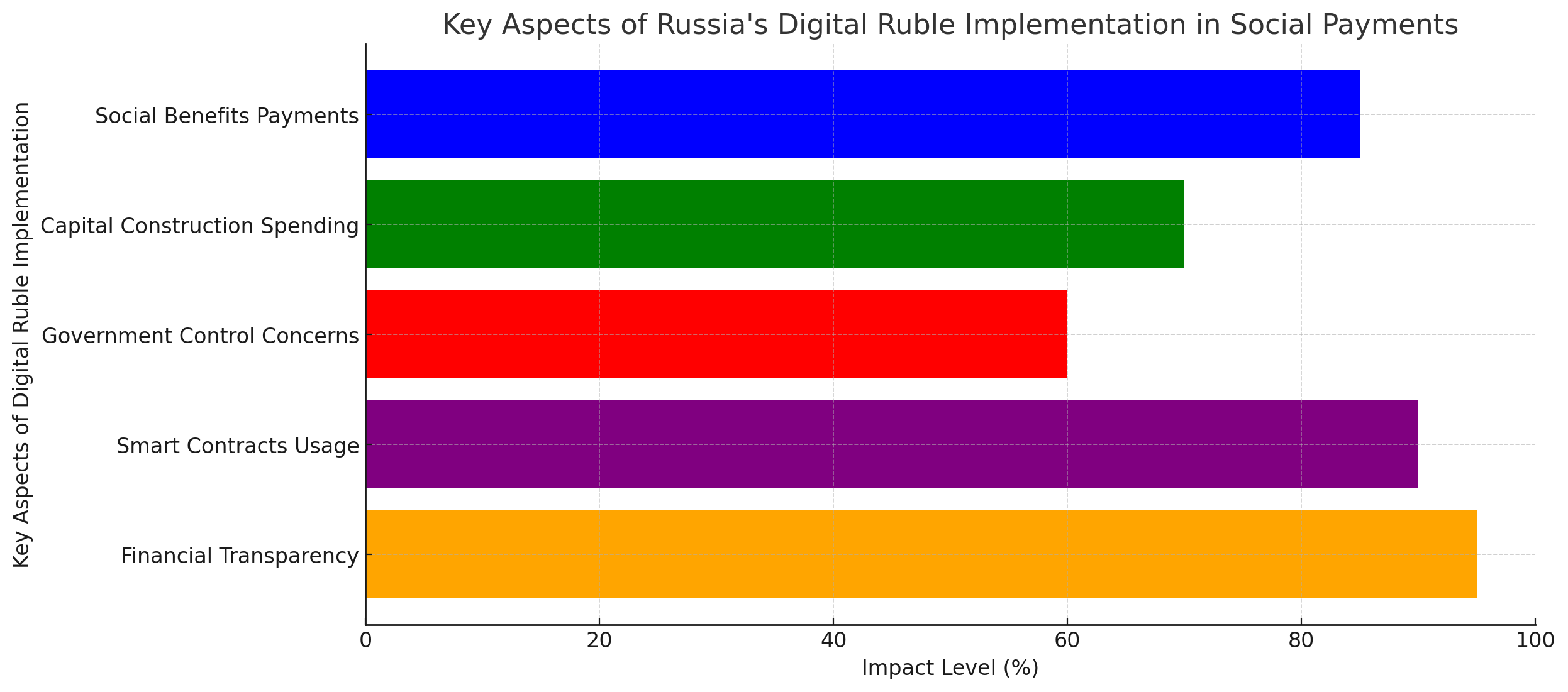

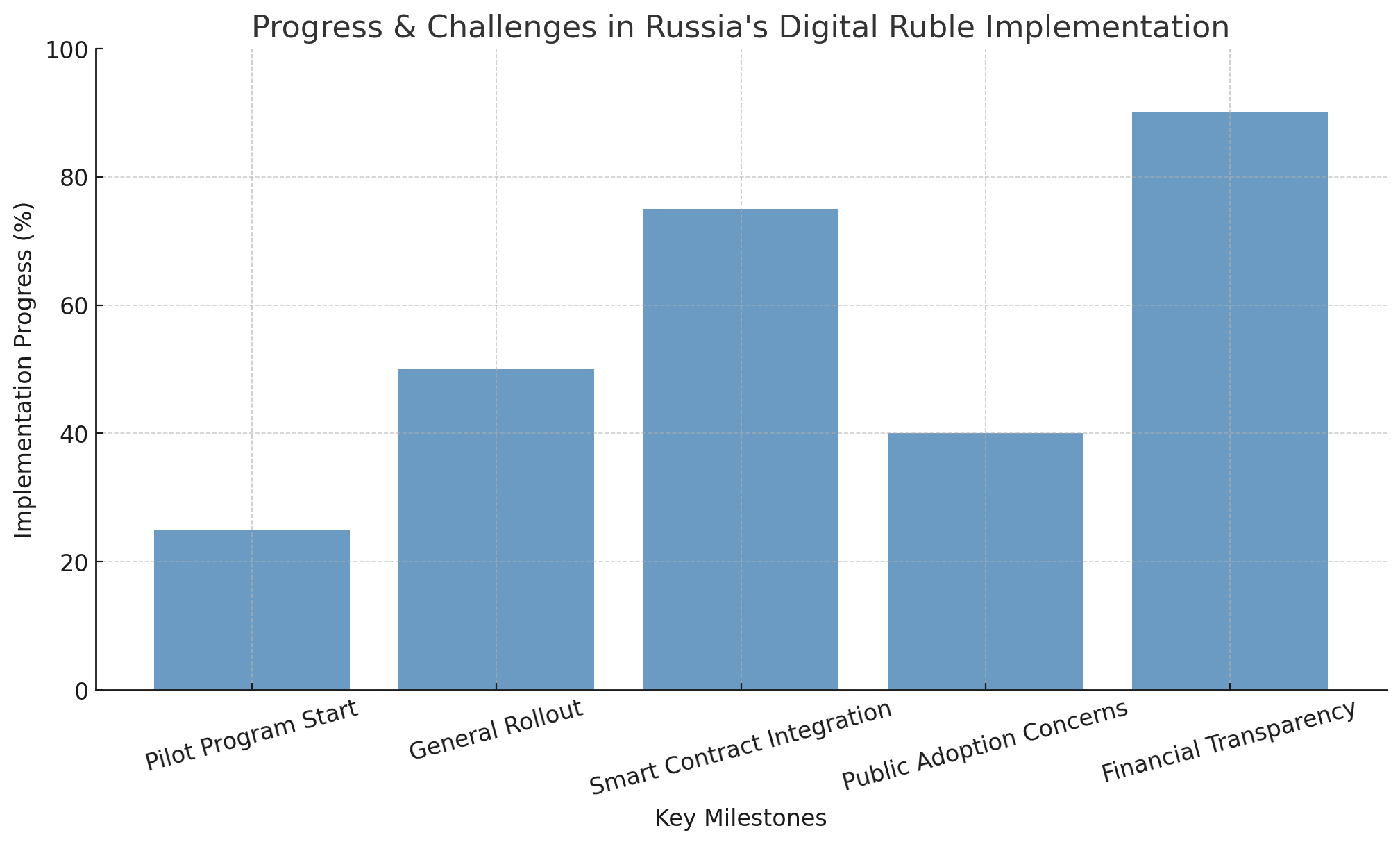

The Russian government has been actively exploring the integration of the digital ruble into its budgetary operations. In late 2024, the Central Bank, the Federal Treasury, and the Ministry of Finance conducted successful tests of the digital ruble in various financial transactions, including the payment of scholarships and fines. Building on these trials, a pilot program is scheduled to commence on August 25, 2025, focusing on distributing social benefits and funding capital construction projects using the digital currency.

Finance Minister Anton Siluanov has emphasized the potential advantages of this digital transition. He stated,

“We are in constant discussions with the Central Bank on the development of the digital ruble. It will be a reliable instrument, especially for cross-border payments. But what is the state’s interest in the digital ruble? [The answer is] traceability. It is important for us to be able to use smart contracts with the digital ruble. That will help with traceability and [ensuring people do not mispend funds]. We are working on this project with the Central Bank.”

Enhancing Transparency and Reducing Fraud

One of the primary motivations behind adopting the digital ruble for social payments is the promise of increased transparency. The currency’s digital nature allows for precise transaction tracking, ensuring that funds are utilized for their intended purposes. This traceability is expected to significantly reduce instances of benefits fraud, a concern that has long plagued traditional disbursement methods.

Moreover, the integration of smart contracts—self-executing agreements with terms directly written into code—can automate and enforce the conditions under which funds are released. This means that welfare payments can be programmed to be spent only on specific goods or services, further ensuring that assistance reaches those who need it most and is used appropriately.

Pilot Program Details

The upcoming pilot program represents a critical step in assessing the practicality of the digital ruble in real-world scenarios. Set to begin on August 25, 2025, the experiment will involve the Federal Treasury opening a digital ruble account by August 8, followed by the activation of the Treasury on the digital ruble platform by August 22. The pilot will run until the end of September, focusing on the payment of social benefits and capital construction expenses. While the specific types of benefits to be tested have not been disclosed, the outcomes of this pilot will provide valuable insights into the system’s readiness for broader implementation.

Addressing Public Concerns

Despite the anticipated benefits, the introduction of the digital ruble has elicited concerns among the Russian populace. Some citizens fear that digital currency could lead to increased government surveillance of personal finances or even the potential to “disconnect” individuals from the financial system. Addressing these apprehensions, the Central Bank has assured the public that the use of the digital ruble will be entirely voluntary. Governor Elvira Nabiullina emphasized,

“This is an absolutely voluntary use; it is an additional opportunity for people.”

Furthermore, the Central Bank has clarified that individuals will have the freedom to choose whether to receive pensions, salaries, and benefits in cash, traditional bank transfers, or digital rubles. This flexibility accommodates varying comfort levels with digital currencies and ensures a smooth transition for all citizens.

Summing Up

The move towards a digital ruble signifies a broader trend in the global financial landscape, with many countries exploring central bank digital currencies (CBDCs) to modernize payment systems and enhance monetary policy effectiveness. For Russia, the digital ruble offers a pathway to greater financial inclusion, reduced transaction costs, and strengthened economic sovereignty.

As the pilot program unfolds, the insights gained will be instrumental in refining the digital ruble’s framework and addressing any challenges that arise. The government’s commitment to a cautious and transparent rollout underscores its dedication to building public trust and ensuring the digital ruble serves the best interests of all Russians.

Russia’s initiative to integrate the digital ruble into social benefits payments marks a significant milestone in the nation’s financial evolution. By leveraging advanced technologies like smart contracts and ensuring a transparent, voluntary adoption process, the government aims to enhance the efficiency and integrity of welfare disbursements. As the world watches, Russia’s experience with the digital ruble could offer valuable lessons for other nations contemplating the future of digital currencies.

Stay tuned to The BIT Journal and keep an eye on Crypto’s updates.

FAQs

What is the digital ruble?

The digital ruble is a central bank digital currency (CBDC) developed by the Bank of Russia. It serves as a digital form of the national currency, complementing existing cash and non-cash rubles.

When will the digital ruble be widely available?

The Bank of Russia plans to massively implement the digital ruble on July 1, 2025. Initially, its use will be voluntary for individuals but mandatory for major financial institutions.

How will the digital ruble improve social benefits payments?

The digital ruble’s traceability and the use of smart contracts will ensure that welfare payments are used for their intended purposes, reducing fraud and enhancing efficiency in disbursements.

Is the use of the digital ruble mandatory for Russian citizens?

No, the adoption of the digital ruble is entirely voluntary for individuals. Citizens can choose whether to use it or continue with traditional forms of currency.

Glossary of Key Terms

📌 Digital Ruble – Russia’s central bank digital currency (CBDC), issued by the Bank of Russia, designed to complement cash and non-cash rubles.

📌 CBDC (Central Bank Digital Currency) – A digital form of a country’s national currency, issued and regulated by the central bank, offering a government-backed alternative to cash and bank deposits.

📌 Smart Contract – A self-executing contract with terms directly written into code, allowing automated and conditional transactions without intermediaries.

📌 Social Benefits Payments – Government-issued financial aid to citizens, including welfare, pensions, and subsidies, which Russia plans to distribute using the digital ruble.

📌 Federal Treasury of Russia – The Russian government body responsible for managing state funds, including distributing social benefits.

📌 Bank of Russia (Central Bank of Russia) – Russia’s central monetary authority, overseeing financial policy, the national currency, and the implementation of the digital ruble.

📌 Traceability – The ability to track and monitor financial transactions, a key feature of the digital ruble designed to prevent fraud and ensure proper fund usage.

📌 Cryptocurrency vs. CBDC – Unlike decentralized cryptocurrencies (e.g., Bitcoin), a CBDC like the digital ruble is fully controlled and regulated by a central bank.

📌 Pilot Program – A trial phase where new technologies or policies are tested on a limited scale before a full rollout, such as Russia’s digital ruble benefits payment experiment starting in August 2025.

📌 Capital Construction Spending – Government-funded infrastructure projects (e.g., roads, buildings), which Russia plans to finance using the digital ruble as part of its pilot program.