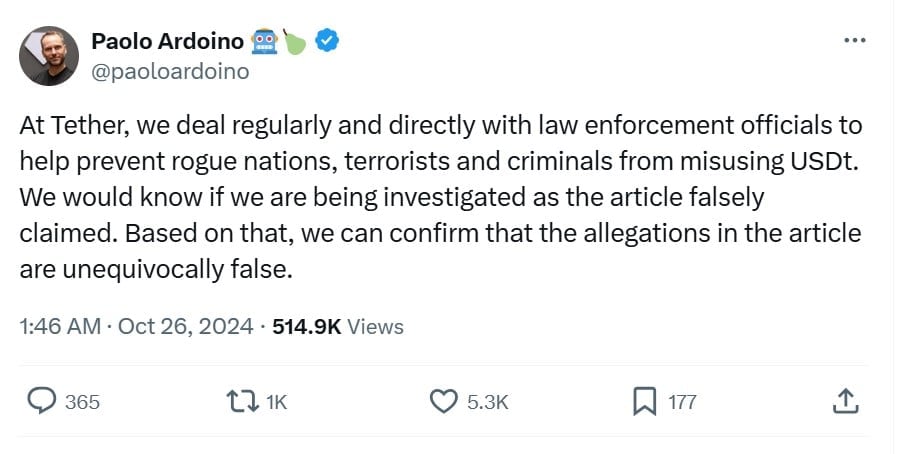

At the Lugano PlanB Forum in Switzerland, Tether’s CEO Paolo Ardoino firmly addressed rumours circling about an alleged investigation into the stablecoin issuer by United States authorities. Addressing reports from The Wall Street Journal asserting that Tether was under DOJ and Treasury analysis due to potential anti-money laundering and sanctions infractions, Ardoino made it unambiguous that these allegations were unfounded.

He accentuated Tether is not being looked into, depicting the media reports as “recycled gossip”. Meanwhile, others at the event questioned whether such regulation of stablecoins would stifle innovation in cryptocurrency, or protect consumers. Ardoino asserted that Tether welcomed reasonable oversight that balanced both.

Tether CEO Sets the Record Straight

Paolo Ardoino addressed rumours that swirled regarding a potential federal investigation into Tether and its stablecoin USDT from the stage as well as online, firmly denying any legitimacy to such claims. The speculation started from a Wall Street Journal article citing unnamed sources suggesting that US authorities may be looking into whether Tether had adhered to anti-money laundering laws or if sanctioned entities had utilized its digital currency. However, Ardoino dismissed the unnamed accusations outright, asserting that Tether has cooperated extensively with enforcement agencies for years and would undoubtedly have been notified if a probe were truly underway.

“As communicated to the WSJ previously, there are absolutely no signs that Tether is under scrutiny. The WSJ article only rehashed outdated rumours,” Ardoino stated resolutely in his speech at the PlanB Forum to squash the unfounded speculation. He went on to elaborate that Tether’s ongoing coordination with international regulators included aiding the recovery of approximately $109 million in illegally obtained assets linked to criminal activities such as cybercrime and sanctions evasion dating back to 2014 through their cooperation.

Tether’s Reserves: Bitcoin, Gold, and Treasuries

In his comprehensive address, Tether’s leader elaborated extensively on the firm’s backup possessions, a subject of great interest amid amplified oversight of dollar-pegged cryptos. According to Ardoino, Tether maintains an impressive stockpile comprising nearly one hundred billion in American Treasury bonds, forty-eight metric tons of precious metal, and over eighty-two thousand Bitcoin valued at approximately five and a half billion based on prevailing marketplace prices. These backup holdings are intended to fully back the circulating supply of USDT, offering transparency while bolstering Tether’s dependability despite regulatory and public concerns.

Tether’s reliance on Bitcoin, gold and United States Treasuries positions it as one of the largest holders of American national debt, buttressing its claim to robust economic wellness. These backup possessions have taken center stage in Tether’s argument for its steadiness and solvency, particularly given the instability in the broader crypto market.

Fighting Misuse of USDT and Compliance Measures

Ardoino expounded upon Tether’s diligent attempts to deter the misuse of USDT in unlawful acts. He pointed to Tether routinely collaborating with agencies such as the U.S. Department of Justice and blockchain analytics companies to detect and freeze funds employed for criminal purposes. These safety measures, including abiding by the Office of Foreign Assets Control and Specially Designated Nationals sanction lists, reflect the company’s proactive stance regarding regulation.

When questioned about the potential use of USDT by sanctioned entities, Ardoino stressed Tether’s internal investigatory mechanisms and noted the company had frozen over $1.3 billion in assets related to fraud and hacking incidents. Such precautions have earned Tether a strong reputation among law enforcement, contrasting with the negative publicity surrounding the most recent rumoured investigation.

Local AI Development Kit: Tether’s Technological Future

While regulatory matters demanded attention, Tether’s chief executive elaborated upon emerging technological feats. At the Lugano gathering, Ardoino unveiled Tether’s localized artificial intelligence development kit, emphasizing seclusion and peer-to-peer attributes. This AI package is representative of Tether’s far-reaching goal of amalgamating pioneering developments into the blockchain sphere, further solidifying its position not solely as a monetary provider but also as a pioneer within the distributed technology community. Privately, Ardoino mused upon spirited expansion into novel coding frontiers and their untapped opportunity for socially-conscious progress.

The Final Thoughts

While Tether CEO Paolo Ardoino vehemently denied the rumours of an investigation, helping to quell some of the intense anxieties plaguing the cryptocurrency community, concerns still lingered. By thoroughly examining Tether’s substantial holdings and chronicling its cooperation with regulating bodies, Ardoino aimed to reiterate the business’s pledge to openness and adherence to protocol. As Tether continues playing a pivotal part in worldwide crypto markets, the leader’s unambiguous position, combined with forthcoming plans for artificial intelligence technologies, implies the corporation stays focused on ensuring dependability as well as pioneering new solutions.

Stay tuned to TheBITJournal and keep an eye on Crypto’s updates. Follow us on Twitter and LinkedIn, and join our Telegram channel to be instantly informed about breaking news!