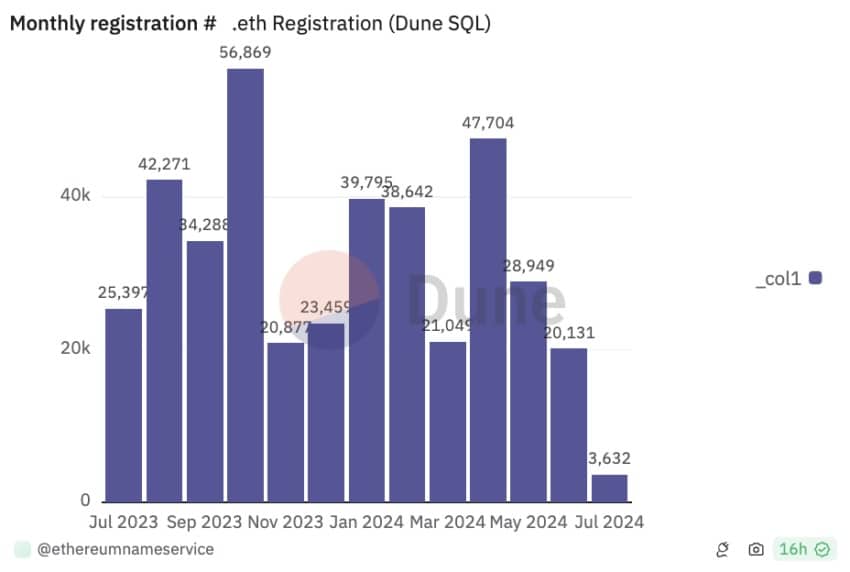

Leading domain name service provider Ethereum Name Service (ENS) witnessed a significant decline in domain registrations during the second quarter of this year. After reaching a peak at the end of April, the monthly registrations on the protocol have shown a noticeable decrease, raising concerns about the future trajectory of this critical component of the Ethereum ecosystem.

Ethereum Name Service Saw a Dip in .eth Name Registrations

The Ethereum Name Service, which facilitates domain name purchases using Ether (ETH), saw a dip in interest despite the lower gas fees accompanying ETH prices’ stagnation. ENS allows users to register .eth domain names, making blockchain addresses more human-readable and user-friendly. With the cost of gas fees falling due to the stagnation of ETH prices, one might have expected an increase in the number of .eth domain registrations. However, this was not the case. Despite the lower transaction costs, interest in this digital asset class remained low amid general market consolidation. This led to a reduction in market participants’ spending on domain name registrations.

On-chain data revealed that the count of .eth names registered in June totalled 20,131, marking a 30% month-over-month (MoM) decline from the 28,949 registrations recorded in May. This also represented a significant 58% decrease from the peak of 47,704 registrations in April. According to reports, this decline indicates a shift in market sentiment, where traders and investors are becoming more cautious amidst broader market conditions.

Primary ENS Name Registrations Hit Year-to-Date Low

Primary ENS name registrations, which are unique, human-readable names used to identify specific Ethereum addresses, also fell to a year-to-date low by the end of June. A primary ENS name allows decentralized applications (dApps) to find and display a user’s ENS name when connected to their Ethereum account, making interactions more seamless and intuitive. According to reports, the number of primary ENS names registered in June was 14,401, representing a 39% MoM decline and a 55% decrease from the 31,982 primary names registered at the beginning of the year. This significant drop underscores the current challenges faced by ENS in maintaining its growth trajectory.

Decline in Open Interest Signals Bearish Sentiment

Additionally, the open interest in ENS derivatives, which reached an all-time high of $153 million on July 1, has since declined significantly. According to reports, the open interest plummeted by 48% within seven days, standing at $80.12 million at press time. Open interest refers to the total number of outstanding derivative contracts that have not been settled. A decline in open interest often signals that traders are closing their positions without opening new ones, indicating reduced activity in the asset’s derivatives market. This decline in open interest is seen as a bearish signal and has often been accompanied by a decline in the token’s value.

Price Impact and Market Sentiment

The decrease in open interest has coincided with a 25% decline in the price of ENS in the last week. At press time, the Ethereum Name Service’s Relative Strength Index (RSI) is below its 50-neutral spot at 47.93, suggesting that selling pressure outweighs buying activity. If this trend continues, the price of ENS may fall further to $23.26. The RSI is a momentum oscillator that measures the speed and change of price movements, with values below 50 indicating that the market is in a bearish phase.

Potential for a Rebound

Despite the current bearish sentiment, there is potential for a rebound if buying activity resurges. If market participants regain confidence and start purchasing ENS tokens, the bearish projection could be invalidated, and the price of ENS might recover towards $25.68. The future of the Ethereum Name Service depends on various factors, including market conditions, investor sentiment, and broader cryptocurrency trends.

ENS and the Broader Crypto Market

The Ethereum Name Service is a critical component of the Ethereum ecosystem, providing a user-friendly way to manage blockchain addresses. Its performance is often seen as a barometer of interest in decentralized web services and blockchain technology. The decline in ENS registrations and market activity reflects broader trends in the cryptocurrency market, where investors are becoming more cautious amid regulatory uncertainties and market consolidation.

Industry experts have weighed in on the recent decline in ENS registrations. According to reports, some analysts believe that the decline is temporary and that the long-term prospects for ENS remain strong. As the market stabilizes and regulatory clarity improves, we expect to see renewed interest in ENS and other blockchain-based services.

Conclusion

The recent downturn in Ethereum Name Service (ENS) registrations and the subsequent decline in market interest and price highlight the volatile nature of the cryptocurrency market. As the market consolidates, the performance of ENS will likely continue to fluctuate, influenced by broader economic trends and the evolving landscape of digital assets. While the current trend is bearish, the potential for a rebound remains, contingent on market conditions and investor sentiment. For more detailed insights and updates on the Ethereum Name Service (ENS), stay informed with The BIT Journal about the latest developments in the cryptocurrency market.