The Pi Network is back in the news, but not for the reasons its early supporters anticipated. As July progresses, the price of PI has showed symptoms of weakness, falling further despite increased inflows to controlled exchanges (CEXs) and a big token unlock. This shift in momentum, along with deteriorating technical indications and lower trading volume, has raised worries among traders and long-term investors alike.

According to Crypto Times, Pi Network price is holding at $0.46 after a sudden 1.7% drop, resulting in persistent lower lows on the charts. With firm resistance above $0.5155 and a relative strength index (RSI) of 38.7, the market is providing obvious signs that short-term sentiment is neutral to negative. Meanwhile, MACD analysis shows a static pattern with minimal volatility, suggesting a lack of positive momentum.

Pi Network: Token Unlocks Add Fuel to the Fire

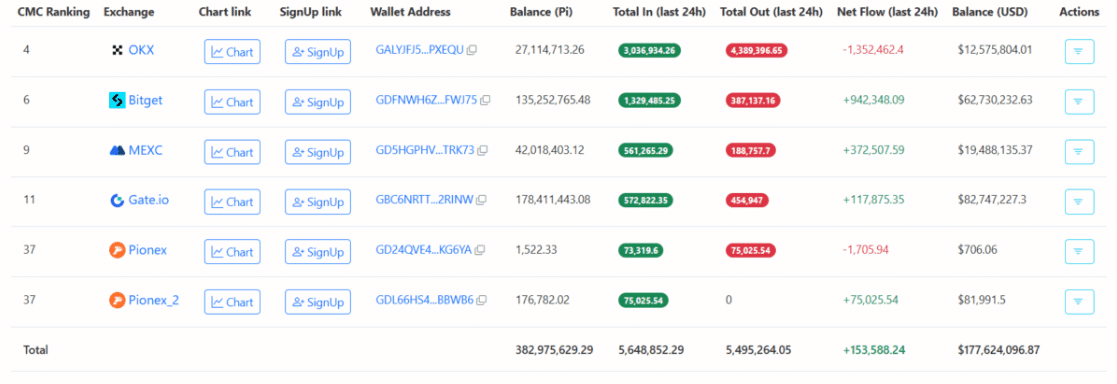

One of the most urgent concerns for the Pi Network is the enormous number of tokens hitting the market. Over 300 million PI tokens were unlocked between July 4 and July 15, accounting for almost 4% of the circulation supply. With such a large volume entering exchanges like Bitget, MEXC, and Gate.io, the potential for sell-side pressure is immense. This adjustment in supply dynamics has a substantial impact on the project’s liquidity and perceived value.

As reported by Crypto.news and AINvest, Pi’s value has fallen by more than 70% in the last two months, owing in part to the July unlock and exacerbated by a lack of communication from the development team. “When supply increases and transparency fades, the market responds with uncertainty,” said a WhaleStats strategist. That uncertainty has translated into genuine market movement, as investors begin to doubt the network’s fitness for open-market participation.

Declining Volume, Rising Reserves

Another major problem is the growing disparity between trade volume and exchange reserves. Pi’s daily volume was more than $5.4 billion in May, but latest figures reveal a significant drop to less than $500 million in July. At the same time, the centralized exchange reserves increased from 263 million to roughly 370 million PI tokens. This mismatch indicates a lack of demand as liquidity is moved into storage rather than circulation.

On-chain analytics platforms like as CryptoRank and BeInCrypto also detect concerning trends in volume momentum indicators. Chaikin Money Flow (CMF) and squeeze momentum indices have turned red, indicating that investors are withdrawing money rather than adding it. “This kind of volume-reserve mismatch rarely ends well for token price,” said an IntoTheBlock expert.

Weak Technicals and Project Silence Compound Market Anxiety

The Pi Network’s technical profile demonstrates recurring flaws. Breakdowns below critical supports around $0.50 and $0.40 pave the way for more drops, with some experts forecasting a drop below $0.25 or perhaps $0.10 if volume does not return. Meanwhile, the project’s leadership has been fairly mute, particularly on KYC delays and progress toward open mainnet capabilities. That silence is becoming an issue for investors looking for comfort during this uncertain period.

Adding to the uncertainty is a lack of updates on utility development or business relationships, both of which may assist in absorbing the enormous token inflow. Without such catalysts, the route to recovery is unclear.

Summary

The Pi Network will face a key test in July 2025. With almost 300 million tokens freed, increased centralized exchange inflows, deteriorating technical signs, and decreased trading volume, market sentiment is severely pessimistic. While the project’s strong community and long-term ambition remain promising, its short-term prospects are obscured by structural and strategic challenges. Unless there is a demonstrable improvement in leadership transparency and investor trust, Pi may struggle to restore its previous price strength.

FAQs

Why is Pi Network’s price falling in July 2025?

A combination of large token unlocks, rising exchange inflows, and weakening technical signals has contributed to downward price pressure.

What are centralized exchange inflows and why do they matter?

These refer to the movement of tokens into exchanges. Rising inflows can indicate that holders are preparing to sell, which may drive prices lower.

How much Pi was unlocked in July?

Over 300 million PI tokens were unlocked between July 4 and 15, increasing circulating supply and contributing to sell-side pressure.

Is the Pi Network project still active?

While technically ongoing, the lack of consistent updates, delays in KYC rollout, and silence from the development team have raised concerns.

Glossary of Key Terms

Token Unlock: A scheduled release of previously locked tokens into circulation, often affecting market supply and price.

Centralized Exchange (CEX): Platforms like Binance or Gate.io where users can buy and sell crypto assets. Inflows to CEXs often indicate selling pressure.

Relative Strength Index (RSI): A momentum indicator used in technical analysis that measures the speed and change of price movements.

MACD> The Moving Average Convergence Divergence indicator, used to track momentum and trend direction in assets.

Chaikin Money Flow (CMF): A volume-weighted average that measures the accumulation and distribution of an asset.