XRP is exhibiting some initial signs of a reversal, but the bearish pressure has not given up control over the price of this currency. The cryptocurrency remains restricted within a larger bearish channel which has made investors careful. While these challenges still exist, there are some clues of a change for the better although the general market outlook is still unclear.

Key Developments in XRP’s Price Action

Over the past 24 hours, the XRP cryptocurrency indeed fell below the $2.25 to $2.30 critical range. However, it has failed to close below this level on a daily basis. Presently, one XRP costs $2.27, with the coin’s price rising by an average of 6.19 % within the last 24 hours.

A jump in the trading volume of XRP to $10.36 million displays an 8.58% rise in its volume. This increase in volume is suggestive of an increase in market activity, however, the Relative Strength Index (RSI) remains below the 50 level at 37 marking it as a sell zone. The coin is down by 18.90% of value in the last 30 days and by 10.94% in the last seven days.

Bearish Divergence Continues to Loom

While it lacks some ground on rebounds, the larger bearish divergence remains in tact. On the long timeframe, it is still bearish, and the cryptocurrency is being affected by this trend even in the longer term. Investors should be careful because additional selling opportunities still prevail on such charts as long as bearish divergence continues to control the market.

A recent bounce may form a temporary bearish reversal pattern but it is not very convincing as to form a confirmation of a bull reversal. It is also important to hat the current market is still dominated by bearish pressure.

XRP Resistance Zones

The price of XRP is in the process of testing major resistance levels at $2.30 – $2.46. Any attempt to trade above these levels could be an indication that a bullish phase has begun in the coin. On the other hand, if these levels were not broken then this would suggest additional downside possibility that the bearish trend is still intact.

These resistance levels are critical to defining XRP’s next move. For the bulls, a move above these levels would be good news, while a failure to regain and hold above these points means continuation of the bearish trend.

Support Levels to Watch at $1.95

The first technical support area for the XRP is at $1.95. If that level is breached to the downside, it would suggest any rebound attempt is just a bear market rally and could entail a deeper pullback. Nevertheless, if the support is maintained, the cryptocurrency could begin the process to move up once again.

The crucial level to watch for in XRP is $1.95, the level below which the price will potentially drop to $1.77. This is a significant level for the traders since it can serve as the last critical support level that might prevent a further decline.

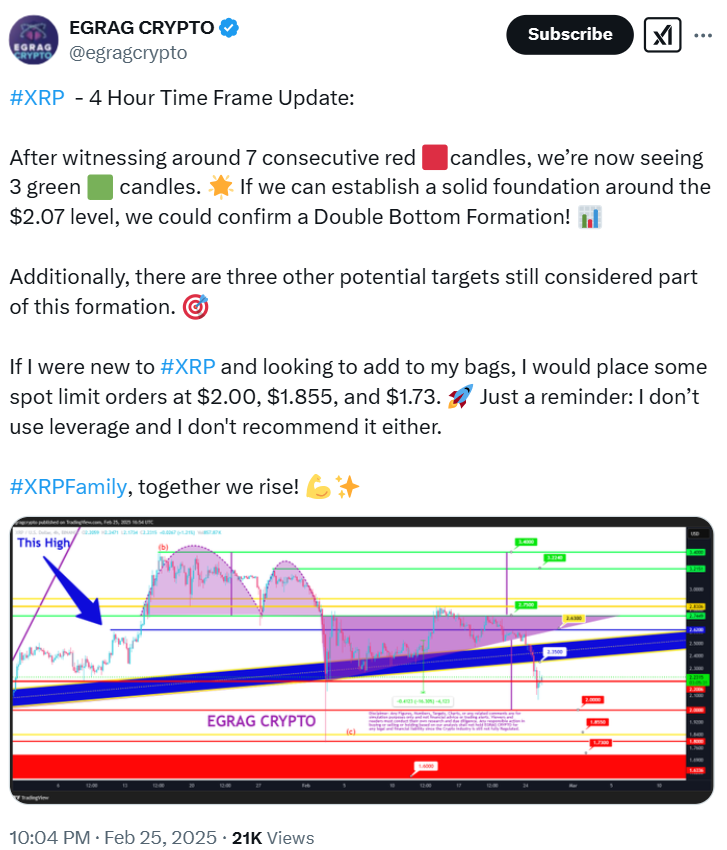

Analyst Insights on Potential Double Bottom Formation

Recently, Analyst Egrag Crypto pointed out that XRP has potential to create a double bottom figure pattern on the chart. After seven red candles, three green candles signify that the trend is likely to change direction at the end of the week, depending on an investor’s entry point. If price can hold above $2.07 this formation may signify the end of this downward move.

Egrag also proposes that new investors place their spot limit orders at $2.00, $1.855 and $1.73 as entry points. It also keeps risks minimal while proposing to abstain from leverage strategies during such a situation.

XRP Price Predictions for 2025

According to a CoinCodex analysis, the forecasted price target for XRP by the end of the year 2025 is between $2.28 and $4.20. If the prices are $3.01 on average, then it would translate to a possible ROI of 83%. It is significant to note that while the forecast exhibits an upward trend for the cryptocurrency; the projections are relatively moderate.

| Month | Min. Price | Avg. Price | Max. Price | Potential ROI |

|---|---|---|---|---|

| Feb 2025 | $ 2.28 | $ 2.36 | $ 2.49 | 8.22% |

| Mar 2025 | $ 2.46 | $ 3.17 | $ 4.20 | 82.41% |

| Apr 2025 | $ 2.82 | $ 3.60 | $ 3.99 | 73.26% |

| May 2025 | $ 2.52 | $ 2.89 | $ 3.13 | 35.88% |

| Jun 2025 | $ 2.44 | $ 2.57 | $ 2.65 | 15.41% |

| Jul 2025 | $ 2.59 | $ 3.01 | $ 3.47 | 50.94% |

| Aug 2025 | $ 2.98 | $ 3.23 | $ 3.55 | 54.40% |

| Sep 2025 | $ 2.98 | $ 3.18 | $ 3.32 | 44.37% |

| Oct 2025 | $ 3.13 | $ 3.26 | $ 3.44 | 49.73% |

| Nov 2025 | $ 2.81 | $ 2.92 | $ 3.09 | 34.13% |

| Dec 2025 | $ 2.86 | $ 2.92 | $ 2.97 | 29.31% |

XRP Price Predictions for 2028

XRP is expected to be $2.72 in 2028, which is up 18.82 % of the current price. It is forecasted to sell at a minimum mid-year at a price that could vary from $2.29 to a maximum of $5.30 in December and potentially return an impressive 131% of investment.

| Month | Min. Price | Avg. Price | Max. Price | Potential ROI |

|---|---|---|---|---|

| Jan 2028 | $ 2.40 | $ 2.48 | $ 2.57 | 12.13% |

| Feb 2028 | $ 2.40 | $ 2.45 | $ 2.53 | 10.07% |

| Mar 2028 | $ 2.53 | $ 2.58 | $ 2.66 | 15.86% |

| Apr 2028 | $ 2.39 | $ 2.46 | $ 2.56 | 11.42% |

| May 2028 | $ 2.40 | $ 2.43 | $ 2.45 | 6.79% |

| Jun 2028 | $ 2.36 | $ 2.39 | $ 2.43 | 6.05% |

| Jul 2028 | $ 2.29 | $ 2.45 | $ 2.59 | 12.87% |

| Aug 2028 | $ 2.38 | $ 2.50 | $ 2.55 | 11.24% |

| Sep 2028 | $ 2.44 | $ 2.50 | $ 2.58 | 12.44% |

| Oct 2028 | $ 2.41 | $ 2.44 | $ 2.52 | 9.84% |

| Nov 2028 | $ 2.40 | $ 3.10 | $ 4.38 | 90.87% |

| Dec 2028 | $ 4.56 | $ 4.92 | $ 5.30 | 131.02% |

XRP Price Predictions for 2030

For the year 2030, the price of XRP may range from $4.54 to $5.59. This would actually mean that there is a potential for return on investment (ROI) of about 144 percent. However, the long-term picture for XRP still appears bright given the current market conditions.

| Month | Min. Price | Avg. Price | Max. Price | Potential ROI |

|---|---|---|---|---|

| Jan 2030 | $ 5.08 | $ 5.28 | $ 5.53 | 140.73% |

| Feb 2030 | $ 5.09 | $ 5.39 | $ 5.59 | 143.43% |

| Mar 2030 | $ 5.32 | $ 5.45 | $ 5.59 | 143.59% |

| Apr 2030 | $ 5.08 | $ 5.32 | $ 5.52 | 140.21% |

| May 2030 | $ 4.68 | $ 4.81 | $ 5.12 | 123.09% |

| Jun 2030 | $ 4.54 | $ 4.61 | $ 4.71 | 105.09% |

| Jul 2030 | $ 4.55 | $ 4.61 | $ 4.68 | 103.83% |

| Aug 2030 | $ 4.57 | $ 4.63 | $ 4.67 | 103.48% |

| Sep 2030 | $ 4.57 | $ 4.70 | $ 4.89 | 112.91% |

| Oct 2030 | $ 4.80 | $ 4.85 | $ 4.93 | 114.90% |

| Nov 2030 | $ 4.61 | $ 4.70 | $ 4.88 | 112.62% |

| Dec 2030 | $ 4.59 | $ 4.64 | $ 4.69 | 104.33% |

Conclusion

However, overall the bearish divergence has emerged as a major concern for XRP, even though it has been witnessing some sort of a trend reversal lately. Businessmen and investors will be to manage key support and resistance effectively especially the $2.30-$2.46 resistance level. Thus, XRP can attempt to rise above the given levels, entering a new upward cycle, but for now, the market remains rather cautious.

The BIT Journal is available around the clock, providing you with updated information about the state of the crypto world. Follow us on Twitter and LinkedIn, and join our Telegram channel.

Frequently Asked Questions

1- What signs suggest XRP might be reversing its trend?

The price action of XRP is still bearish and there are initial signs of a reversal.

2- What is XRP’s key resistance level to watch?

At the moment XRP is testing the resistance between $2.30 – 2.46, a breakout above could be a bullish signal for the cryptocurrency.

3- What happens if XRP falls below $1.95?

If XRP falls below $1.95, it may be seen as a threat of more downside risk to deeper corrections.

4- What are XRP’s long-term price predictions?

By 2025, XRP is forecasted to attain a value of $2.28 to $4.20, with the upper potential in 2030.

Appendix: Glossary of Key Terms

Bearish Divergence: This is a case when the price rises while other technical indicators such RSI declines thus indicating that the price may fall.

Relative strength index (RSI): An oscillator that helps in determining if an asset price is overbought or oversold given the speed of price changes within a period.

Resistance Level: Any level at which there is a tendency for selling pressure to curb an upward price movement in the price limit.

Support Level: A price level at which the buying interest is usually able to hamper any further drop in the price.

Bear Market Rally: An indication of an upward movement within a well-defined bear market environment.

References

Coinpedia – coinpedia.com

CoinCodex – coincodex.com

TradingView – tradingview.com