According to a report by Nikkei on March 30, 2025, Japan’s Financial Services Agency ( FSA), the country’s regulatory body, is leaning towards tighter regulation on cryptocurrencies. To do so, the agency is considering classifying digital assets as financial products. The report further says that it is also planning to submit the legislative proposal by the start of 2026 to the parliament.

Many analysts consider that the new law will turn crypto investments into more like traditional financial assets and will add more rules to prevent fraud, insider trading, and market manipulation. This change showed that Japan is growing and accepting Cryptocurrencies as a valid part of its financial system while ensuring better investor protection and clearer regulations.

Japanese Legislative Reforms

The legislative proposal have change the Financial Instruments and Exchange Act (FIEA). Currently this act is regulating the nation’s stock markets, bonds, and other financial products.

These changes will help to make clearer rules for digital assets and ensure that they follow similar rules as traditional financial markets. One of the important modifications is the introduction of insider trading restrictions. This restriction will stop people from using secret information for financial gains in crypto trading.

Currently, there are no clear rules for Japan’s crypto market. This consequently raised concern about its price, manipulation, and unfair practices. The new rules will work with the existing financial regulations and will increase the security and transparency of the crypto industry in the nation.

Expected Potential Impact

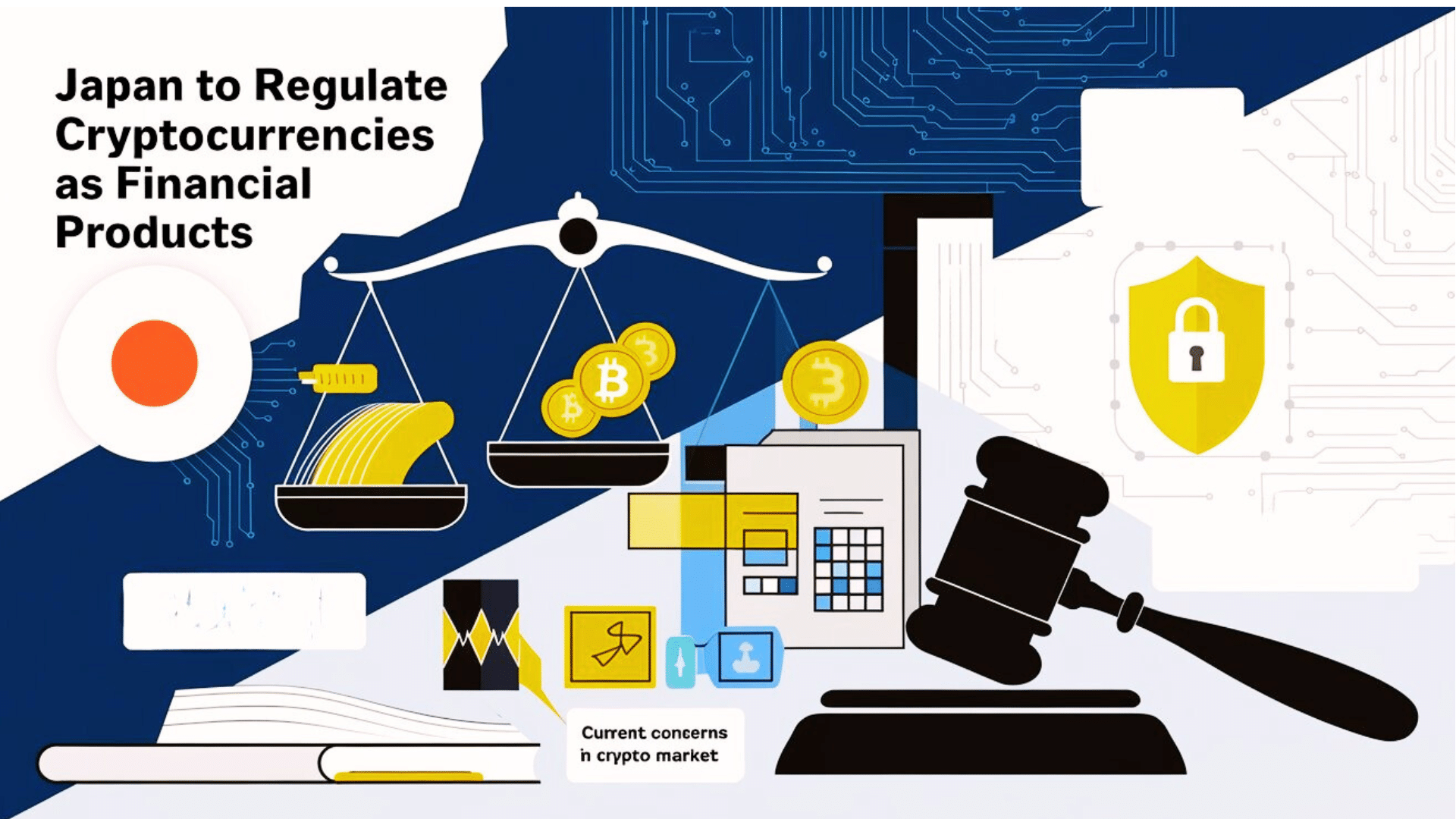

Japan, the first country to accept Bitcoin for payment in 2017. It became one of the major economies to accept Bitcoin as a legal form of payment. Since then, it has also earned a top position as one of the leading players in the adoption of Cryptocurrency.

However, with the growth of the crypto market, fraud, hacking, and regulatory gaps have also been growing, which has led the government to strengthen its rules.

Currently, crypto investment in the nation is taxed at around 55%, which is much higher than the capital gains tax, which is 20%, for stocks and ETFs.

Experts suggest that Cryptocurrencies might be more appealing to big Investors if they are classified as traditional financial products and if the taxes are lowered.

According to Tiger Research Senior analyst Jay Jo, combining Cryptocurrency taxation with traditional financial instruments might attract more institutional investors, which would lead to a more stable market and increase confidence in crypto investments.

Japan’s Strategic Approach to Crypto Regulation

Japan is trying to make these Regulatory changes to be a global leader in digital finance. Last year, the nation’s lawmakers urged for making a National Bitcoin Reserve, which shows that government interest in crypto is increasing.

Additionally, the Japanese Bitcoin Treasury firm Metaplanet has already acquired around 3,350 BTC and is planning to buy even more; this shows the increasing trust of institutions in digital assets.

Though this new classification will make regulations stricter, the Japanese government is still focusing on supporting crypto innovation and making sure that these rules don’t slow down the growth of the industry. The country is trying to balance the protection of investors with technological progress.

Conclusion

Japan is planning to regulate Cryptocurrencies with financial products, by adding insider trading rules and by lowering taxes to attract more investors. The country is trying these changes to make the crypto industry safer and more organized. Experts believe that this approach might set an example for other countries to follow.

FAQs

1. Who is working on new crypto laws?

Financial Services Agency of Japan is working on proposal to introduce new crypto laws

2. What changes is the agency making?

It is considering classifying crypto as a financial product.

3. When will the agency submit the legislative proposal?

The proposal will be submitted by 2026.

4. What analysts think about crypto taxes

Analysts think crypto taxes may be lowered to attract investors.

5. How will the new law help crypto investors?

It will bring clearer rules and better security.

Glossary

FIEA- A Japanese law that regulates financial markets

Metaplanet- A Japanese company holding lots of Bitcoin.

Financial Services Agency (FSA)- Financial regulatory body

Insider Trading – Using secret information to trade illegally.

Bitcoin Reserve – Bitcoins held by a government.