JP Morgan analysts have noted the prominent role of “debasement trade“ in boosting gold and bitcoin prices. However, the surge of gold has been supported by other reasons as it intensely focuses more on inflation, geopolitical tension and trust crisis in standard currencies. Thus, institutional and everyday investors both have grown increasingly to view gold and bitcoin as their choice of safe heaven in these uncertain times.

According to global strategist Nikolaos Panigirtzoglou and his team, while the dollar and bond yields are in part responsible for gold’s upward mobility, these driving forces merely “capture only one side of what is happening.” It is not just the status of as a reserve currency but instead also fueled by geopolitical tensions, fears of inflation and mistrust in fiat.

Analysts said the so-called “debasement trade” included a combination of elements lifting gold, expanding its demand. These include rising geopolitical uncertainty since 2022, long-term inflation fears, concerns for a “debasement of the debt” from high public deficits.

JP Morgan analysts also looked into how institutional investors are behaving, saying:

“To us, this suggests that speculative institutional investors such as hedge funds might see gold and bitcoin as similar assets, i.e. both as beneficiaries of the so-called ‘debasement trade’, but not ethereum.”

JP Morgan Points Out The Implications Involved

Gold prices have soared in the last few months and reached as high as $2700 by the end of September. Part of this uptrend follows the recent decline of the USD and US real bond yields. In comparison, as the dollar fell 4-5%, JP Morgan says this move in gold goes beyond just the negative correlation between bond yields and the USD. The bank proposes that a darkening geopolitical horizon may be exerting even heavier influence.

After all, Bitcoin has long been considered a safe haven against traditional currency risks, and, of course, these conditions are expected to affect the environment by favouring the main cryptocurrencies. JP Morgan analysts who are seeing “sovereign debt debasement” due to the high government deficits in major countries say this is driving investors towards non-fiat currency options.

Bitcoin Price Outlook Amid JP Morgan Forecast

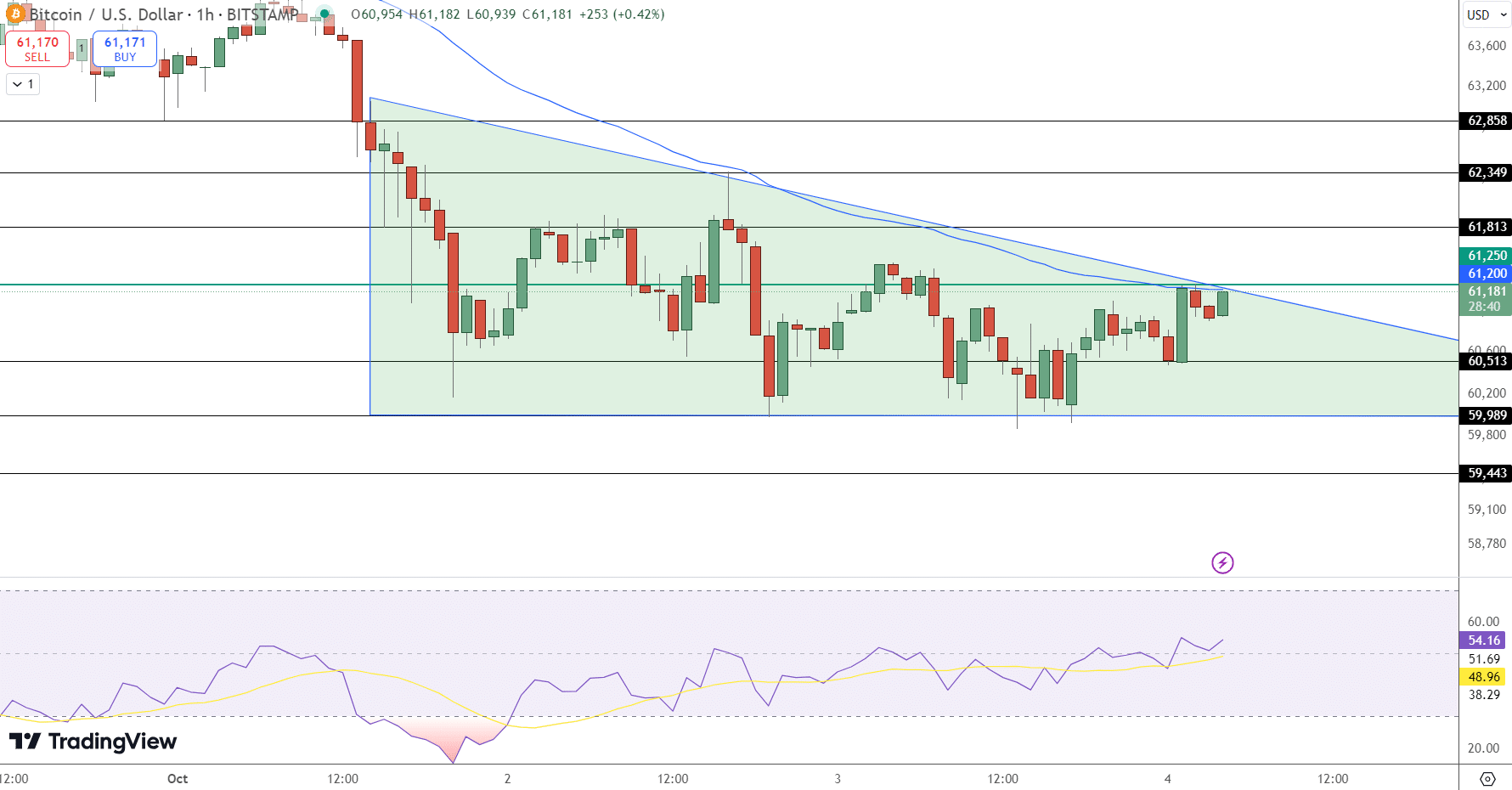

Currently, Bitcoin is trading at a price level of $61,150 and shows an upward trend of 0.70%, taking a pause at a price level of $61,250. The cryptocurrency under review is shaping the Dow pattern which holds an ambiguity bias. The first level of resistance is seen at $61,810 and the latter at $62,350.

There is a possibility of some fresh buying coming in and taking prices higher in case of a movement above $61,250 for bitcoin. To the down side is the immediate support of $60,510 with a stronger support at $60,000. The (50) day EMA stands at 61,200 and provides further support and remains critical for the bullish trend to continue above this level.

That being said, the RSI is currently at 55, which signifies that the trend in the market is so far neutral, but there exists room for further movement that is upward if a breakout occurs.

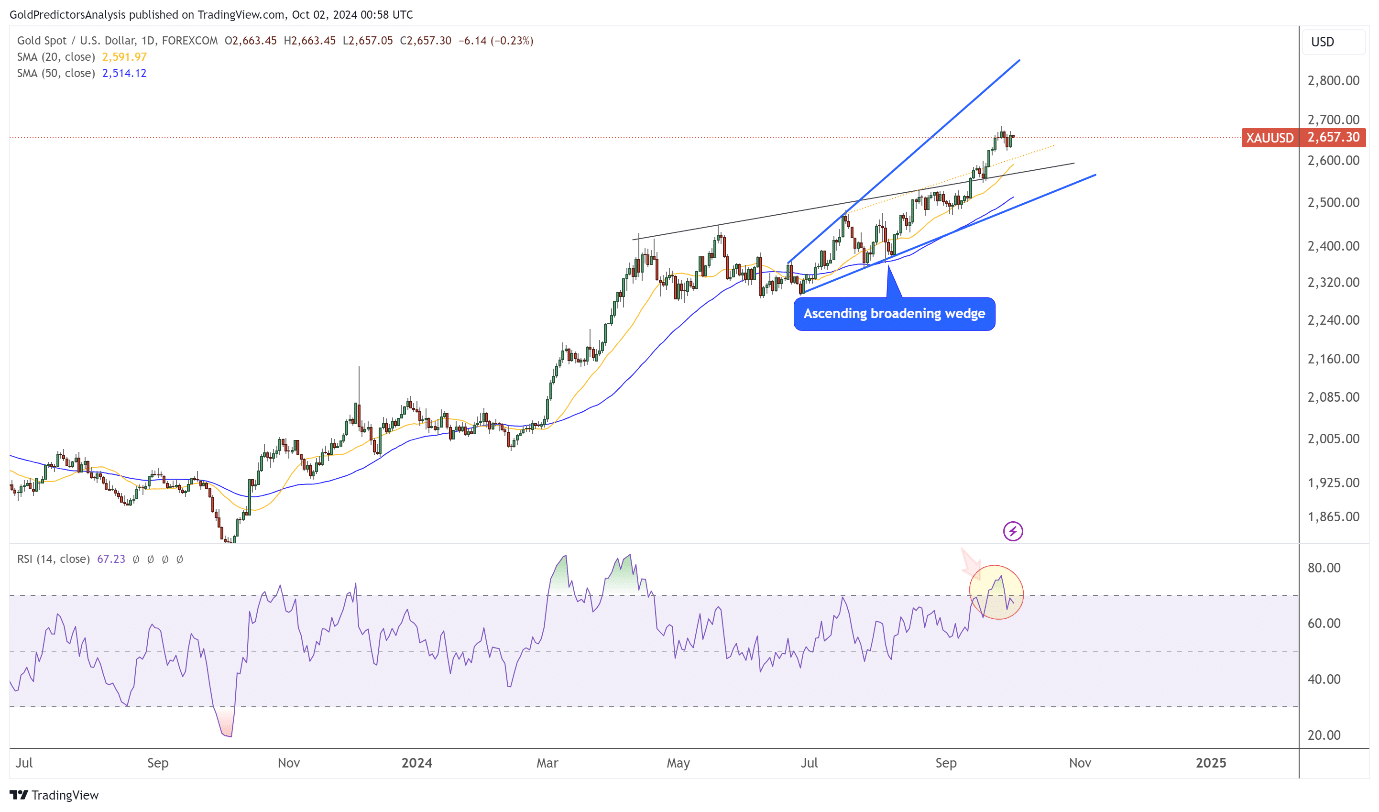

Gold Daily Chart – Is Price Correction Coming to an End?

Gold prices are on the increase and are contained within an ascending broadening wedge. The overall trend is still positive because the price has remained above its 20-day and 50-day simple moving averages (SMA).

However, in the immediate context, gold remains in the overbought status, as measured by RSI. Therefore, the price is now operating around the yellow dotted trendline, which coincides with the 20-days SMA.

This buying pressure may be met at the 20-days SMA, where there could be a valid buy trigger. As long as prices do not drop below $2,514, the uptrend in gold shall be sustained.

According to the analysts, the “debasement trade” is key to driving Bitcoin and Gold prices. However, Gold’s traders should still look out for inflation, geopolitical tensions, and a loss of trust in traditional currencies as other factors to affect price.

Stay in touch with TheBITJournal follow on Twitter and LinkedIn, and join the Telegram channel to be instantly informed about breaking news!