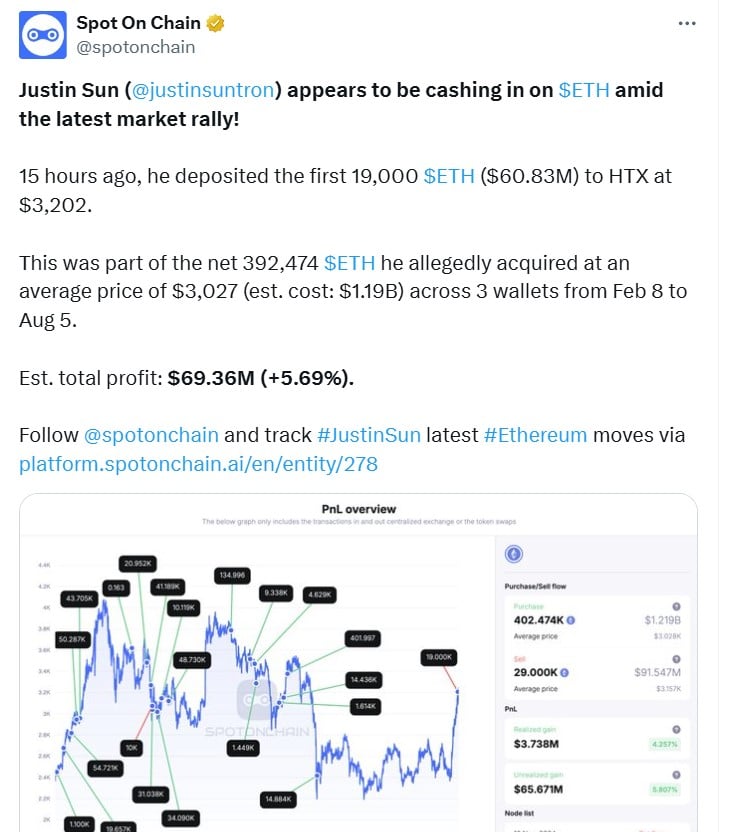

According to data, Ethereum’s parabolic rise has catalyzed notable manoeuvres from heavyweight holders, including Justin Sun, creator of Tron. In a single transaction, Sun disposed of 19,000 ETH near the then-price of $3,202 per coin. This generated $69.36 million in gains for Sun, supplementing the lengthening ledger of etherine heavyweights crafting considered changes.

Sun’s sale, signifying a slim section of his enduring ETH reserves, has kindled discourse among cryptocurrency members regarding the conceivable affects on ethereum’s ongoing surge and the more extensive implications of leviathan activities on market permanence. Concurrently, such substantial actions raise questions about whether short-term optima may conflict with long-term ideals of decentralization.

Amid a 29% surge in Ethereum’s value, Sun’s latest transaction saw him deposit the cryptocurrency onto HTX, positioning him as one of the most recent prominent players to cash out during this upswing. Sun had accumulated a total of 392,474 ETH earlier in the year across numerous digital wallets, representing an estimated $1.19 billion investment with a typical purchase price of $3,027. While his current deposit aligns with Ethereum’s peak at $3,200, it remains just a small portion of his holdings, easing anxieties of significant selling pressure from his account.

This sale, combined with activities of other crypto whales, indicates a developing tendency among Ethereum’s top holders to realize profits amid ascending prices. The complex transactions reflect both the growing complexity of digital assets and fluctuations in investors’ risk tolerance as value climbs. Overall, market behaviour signals both assurance and uncertainty regarding crypto’s staying power.

Ethereum’s $60 Billion Transaction Week Reflects Network Resilience

Ethereum’s price surge has been reinforced by a notable uptick in network activity, with over $60 billion worth of transactions logged in a solitary week, the maximum level since July. This ascent in deal volume proposes developing requests, demonstrating robust system use that lines up with bullish market patterns. Blockchain investigations stage IntoTheBlock announced that high-esteem exchanges, those surpassing $100,000, contributed $51 billion to the weekly all-out, pointing to supported interest from enormous financial specialists.

The expanding notoriety of the Ethereum organize is clear, as indicated by a developing number of dynamic locations and new pocket creations, further upholding the bullish state of mind. As of now, a significant level of 78% of ETH holders are benefitting, a key metric that has encouraged maintain positive market feeling. Numerous examiners see the monstrous transaction volume as an indication of Ethereum’s strength and significance in digital currency advertising, and it is similarly an indicator of expanding institutional and retail interest.

Whales Signal Mixed Sentiment Amid Strong Price Performance

In addition to Sun’s sale, Ethereum co-founder Vitalik Buterin recently deposited 200 ETH (approximately $530,000) into Kraken, a move observed with interest by the market. Across two major addresses, other Ethereum whales unloaded a combined total of 33,701 ETH, with a valuation reaching roughly $89.72 million. This spate of activity from major investors has coincided with Ethereum scaling new heights in recent months, reinforcing conjecture about coming market patterns.

The broader whale movements hold implications for Ethereum’s projected value trajectory. On-chain analytics reveals that presently, Ethereum’s RSI stands at 74, signalling the asset has entered the overbought territory. History indicates an overbought RSI frequently foreshadows a potential reversal, which means in the near term, bearish pressures may influence the market. Nonetheless, underlying bullish momentum remains robust, propelled by a fusion of marketplace zeal, swelling adoption rates, and a favourable macroeconomic landscape.

With heavyweights like Sun and Buterin manoeuvring, the crypto community has posed mixed reactions. “He’ll leverage it to pump another Tron meme like $sundog,” one online user quipped flippantly, while others view the wave of whale activity as “bullish” for Ethereum, given the amplified attention it brings. As Ethereum continues scaling to new highs, market members are keen to see if the asset can sustain its momentum or encounter corrections in the weeks ahead.

The Final Words on Justin Sun

Ethereum’s impressive surge underscores the digital asset’s growing importance in the cryptocurrency market, drawing noticeable nods from heavy hitters like crypto kingpin Justin Sun and ethereal evangelist Vitalik Buterin through their recent high-profile transactions. Ethereum’s weekly workload of $60 billion in exchanges and continuing profitability among long-term holders signals an engaged network in robust working order, despite signs of wavering sentiment among mega investors hinting at mixed messaging in the monetary markets.

While Ethereum’s robust relative strength indicator raises the possibility of continuing bullish momentum, the overextended outlook could indicate looming volatility over the near future. As Ethereum’s journey progresses, financial watchers and venture capitalists alike stand poised to observe whether this torrid trend will solidify into a sustained increase or if a short-term slump lays in the lanes ahead.

Stay tuned to TheBITJournal and keep an eye on Crypto’s updates. Follow us on Twitter and LinkedIn, and join our Telegram channel to be instantly informed about breaking news!