The TON Foundation, the team behind The Open Network (TON) blockchain, has declared 2025 as the “Year of DeFi” on the TON platform. Taking a major step in decentralized finance (DeFi), TON has partnered with Curve Finance to build a new generation of DeFi projects. According to the TON Foundation, this process will be accelerated by integrating Curve Finance’s technologies into the TON platform.

DeFi Giants Form Altcoin Partnership

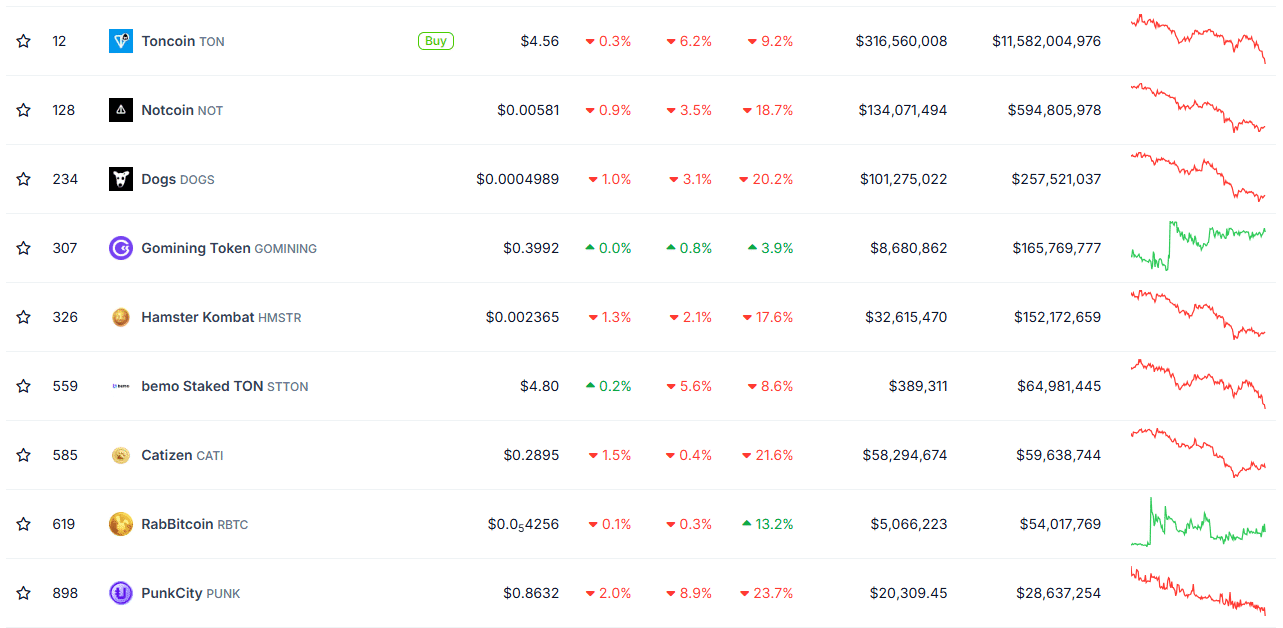

By announcing 2025 as the DeFi year for TON blockchain, the TON Foundation highlighted key projects in its ecosystem, including TON, NOT, DOGS, and HMSTR. With the initial stages of its DeFi infrastructure complete, TON is set to offer solutions such as lending, liquidity provisioning, and Constant Product Market Maker (CPMM) protocols. According to TON’s DeFi lead, Vlad Degen, these foundational technologies are building the first layer of DeFi projects on the network. Following this, second-layer projects such as launchpads, options, and derivatives are expected to be rolled out.

TON’s roadmap includes creating bridges with Bitcoin (BTC) and other Ethereum Virtual Machine (EVM) networks. This will facilitate the addition of new assets and enable popular stablecoins to enter the TON ecosystem, furthering TON’s goal of expanding its reach into broader networks.

CFMM Technology in Focus

The partnership between TON Foundation and Curve Finance has brought Curve’s Constant Functional Market Maker (CFMM) technology to the TON network. CFMM minimizes transaction slippage by stabilizing price fluctuations, offering substantial benefits in liquidity management for DeFi markets. By incorporating Curve’s licensed technology, TON has taken a significant step toward its DeFi ambitions, allowing for seamless swap transactions on its blockchain.

As part of this collaboration, a competition was held in September, attracting over 70 DeFi teams aiming to create new stablecoin pools using Curve’s technology. Among the top five finalists, Torch Finance and Crouton Finance secured positions, each receiving $150,000 in funding and initial liquidity support for their stablecoin pools from TON Foundation.

Torch Finance and Crouton Finance will integrate with the CrossCurve protocol, a cross-chain trading and yield protocol supported by Curve’s founder Michael Egorov. CrossCurve combines existing Curve pools into a single liquidity market, strengthening TON’s strategy to broaden its presence in the DeFi space.

$2.3 Million Investment and $500,000 Incentive Fund

In addition, seven venture capital firms have committed to investing a combined $2.3 million in Torch Finance and Crouton Finance, enhancing TON’s position in the DeFi sector and deepening its integration with Curve’s technology. Looking ahead, TON and Curve Finance announced a $500,000 incentive fund to support stablecoin swaps between the TON ecosystem and EVM networks. This fund aims to improve cross-chain compatibility and expand the use of stablecoins across a wider DeFi ecosystem, thereby increasing liquidity on the TON blockchain and simplifying stablecoin exchanges.

For further updates on TON’s DeFi journey and other blockchain developments, stay connected with The Bit Journal.

- https://twitter.com/Thebitjournal_

- https://www.linkedin.com/company/the-bit-journal/

- https://t.me/thebitjournal

Follow us on Twitter and LinkedIn and join our Telegram channel to be instantly informed about breaking news!