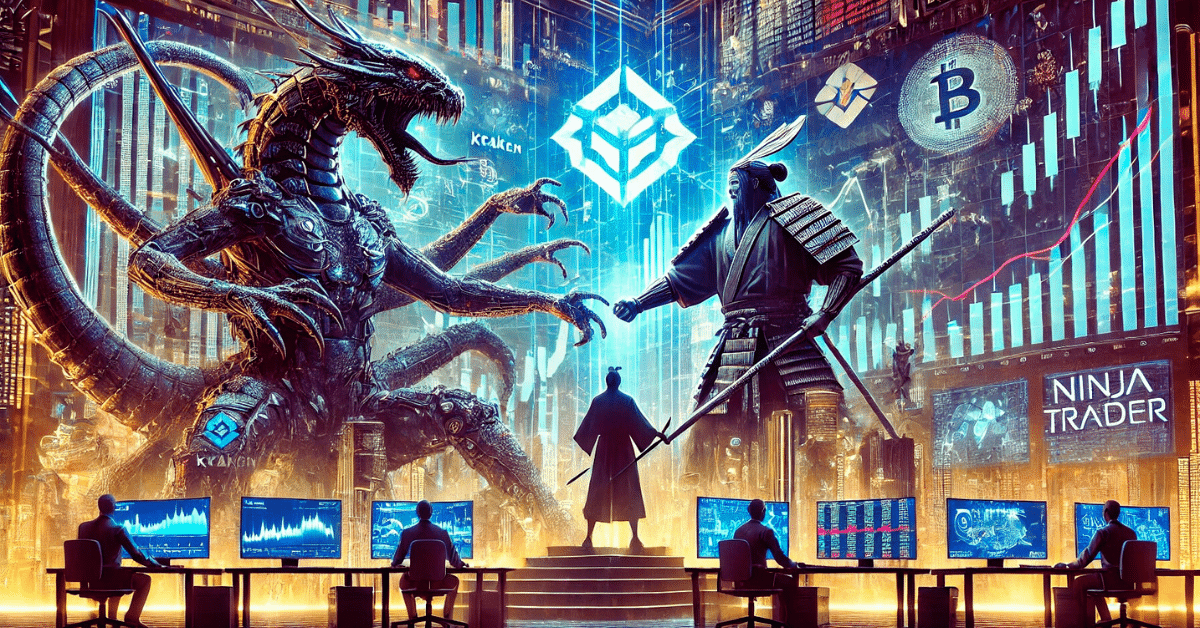

US-leading crypto exchange Kraken is reportedly close to inking a $1.5 billion deal to acquire crypto futures trading platform NinjaTrader.

According to a media report in the Wall Street Journal (WSJ) citing sources familiar with the matter, the deal that could enable the exchange to expand its customer base by offering derivative and crypto futures trading will be announced officially early Thursday, March 20, 2025.

Looking to Expand its Offerings

By acquiring NinjaTrader, crypto exchange Kraken can leverage the platform’s Futures Commission Merchant License to expand its product offerings within the United States. Established in 2003, NinjaTrader has a global customer base of over 1.8 million retail investors, meaning that Kraken could expand its user base into the UK, Europe, and Australia.

Kraken is among the world’s leading and most established crypto exchanges, and it has been keenly looking for ways to expand its product offerings. The potential acquisition of NinjaTrader aligns with the exchange’s long-term vision of offering its users more than spot crypto trading and joining the emerging crypto futures and derivatives markets.

Kraken’s Strong Financial Position

The exchange’s licenses that could help ease the process include the Electronic Money Institution license from the UK’s Financial Conduct Authority and its MiFID license for the EU. Moreover, the exchange brings a strong financial position, with reported earnings of over $1.5 billion in 2024, over two times the previous year’s. According to the company’s January 31 financial report, Kraken boasts at least $42.8 billion in assets and operates over 2.5 million funded accounts with a total trade volume of $665 billion for 2024.

Customized for Retail and Institutional Customers

This latest move could be strategic, giving the exchange a competitive edge against the other leading cryptocurrency exchanges, including Coinbase, Binance, and others, all of which have been gradually expanding to offer derivative trading. Through the partnership, the exchange will integrate the platform’s advanced trading technology with its crypto infrastructure, enabling the exchange to provide a more sophisticated trading experience customized to meet the needs of retail and institutional investors.

As the industry waits for the official announcement, market analysts believe that it will have a powerful impact on the crypto sector. Besides reinforcing its position as a significant player in that sector, it will also highlight the growing convergence of traditional investment vehicles into the digital asset market.

Conclusion

As the crypto regulatory landscape continues to evolve, the exchange remains one of the firms that stand to benefit from a well-structured environment under the current Trump administration. The move to acquire the trading platform, a crypto futures trading platform, could set a precedent for other cryptocurrency exchanges to seek to extend their services by integrating trading instruments associated with mainstream financial markets. The next few months remain crucial in determining whether Trump’s pledge to make America the crypto capital of the planet will materialize.

Frequently Asked Questions (FAQs)

What are crypto futures trading?

Futures contracts refer to an agreement to buy or sell a predetermined amount of a crypto asset on a specified date. Unlike an actual crypto token or coin, a crypto futures contract has a fixed lifetime, meaning it will expire at some point.

What kind of profits can be made?

Trading futures mostly involves investing at least 5% of the overall value into controlling a more prominent position in cryptocurrency futures such as Micro Bitcoin futures. Leverage allows for potentially more significant profits, but with more excellent opportunities comes increased risk and the potential for substantial losses.

What risks are associated with trading futures contracts?

Digital assets are known for their volatile price swings, which makes investing in cryptocurrency futures relatively risky. Anyone interested can trade cryptocurrency futures at brokerages approved for futures and options trading and on many decentralized exchanges.

Appendix: Glossary to Key Terms

Crypto Exchange: A platform or website where individuals can buy, sell, and trade cryptocurrencies like Bitcoin or Ethereum – it acts as a digital marketplace for these cryptocurrencies.

Futures Trading: Buying or selling contracts that obligate the buyer to purchase or the seller to sell an asset at a predetermined price on a future date.

Derivative Trading: Trading financial contracts whose value is derived from the price of an underlying cryptocurrency. This allows traders to speculate on future price movements without owning the asset.