Kraken’s highly anticipated layer-2 Ethereum scaling solution, Ink Network, is officially launching its native utility token, INK. Unlike many recent token launches that prioritize speculative trading or governance, INK is being positioned as a utility-first token designed to power on-chain activity and drive long-term adoption of decentralized finance (DeFi) on the Ink ecosystem.

The move is being led by the newly formed Ink Foundation, a separate entity from Kraken that will oversee token distribution and protocol governance. This structural separation ensures that Kraken, the centralized exchange, does not directly control Ink’s decentralized infrastructure or its new token.

Fixed Supply, No Governance Power

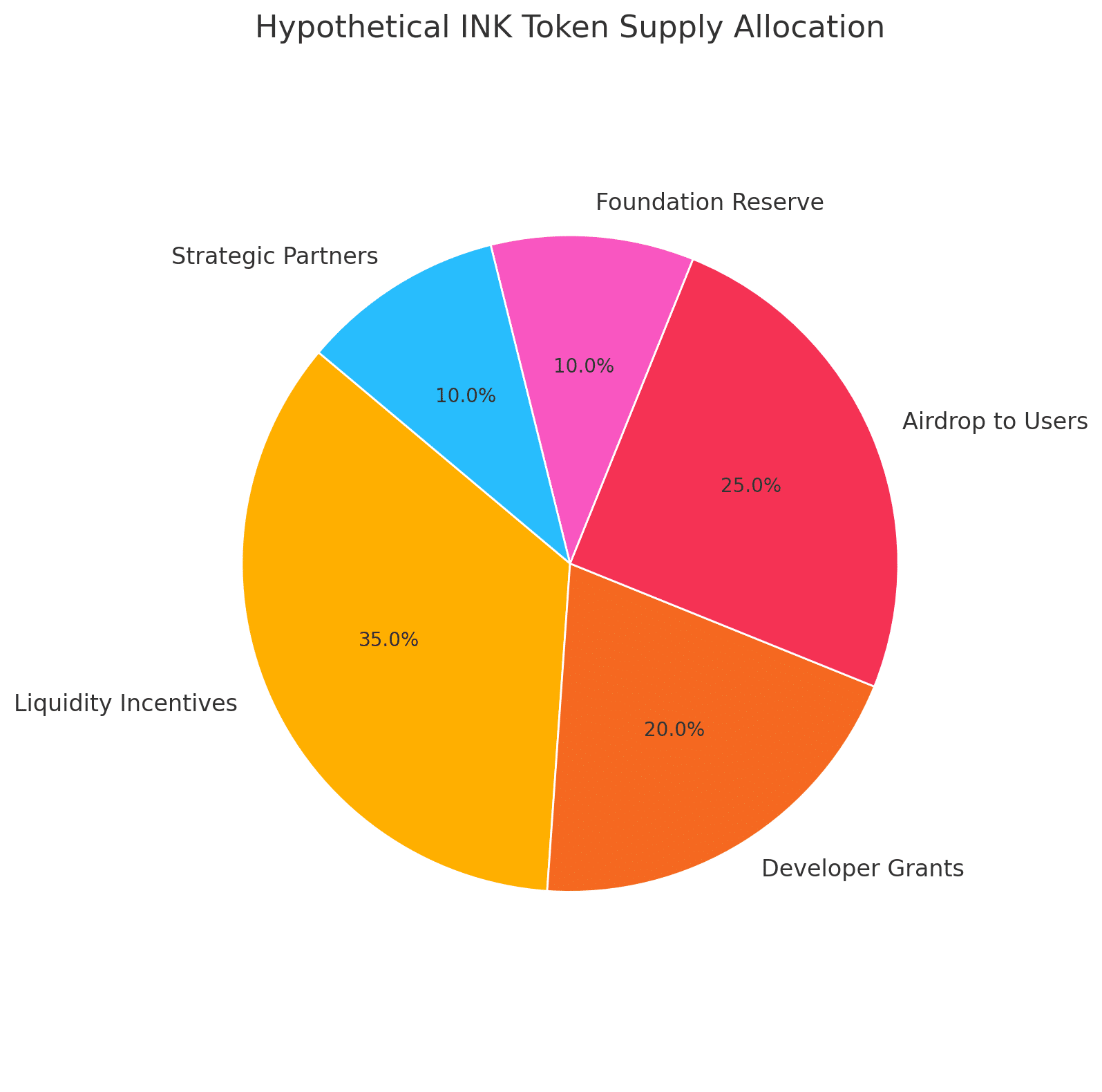

One of the most unique aspects of the INK token launch is its fixed supply of 1 billion tokens. The supply cap is permanent and cannot be changed through community governance or technical amendments. This design choice immediately sets INK apart from many of its peers in the layer-2 space, where token inflation and governance disputes have often plagued user confidence.

Notably, the INK token will not include voting rights over protocol upgrades or changes. Governance decisions remain with the broader Optimism ecosystem, since Ink is built on the OP Stack and integrated into the Optimism Superchain. Instead, INK’s core purpose is to reward and incentivize participation in DeFi services on the network.

DeFi at the Core: Aave-Backed Liquidity Protocol and Airdrop Plan

To jumpstart ecosystem participation, the Ink Foundation will launch a DeFi liquidity protocol in partnership with Aave. Early users who supply liquidity or participate in lending and borrowing activities will be eligible for airdrop rewards in INK tokens.

The airdrop is carefully structured with anti-Sybil measures, meaning fake or duplicate accounts will be filtered out. This helps ensure that real, organic users benefit from the initial token distribution rather than opportunistic whales or bots.

Kraken and the Ink Foundation emphasize that this airdrop is not just a giveaway. It is a calculated mechanism to bootstrap the liquidity and usage of Ink’s DeFi infrastructure. The more a user contributes to real on-chain activity, the greater their airdrop allocation will likely be.

Ink vs. Base: Competing Visions in the L2 Space

The launch of the INK token marks a notable departure from the path taken by Coinbase’s layer-2 chain, Base, which has so far opted to operate without a native token. While Base has focused on ecosystem growth through infrastructure and apps, Ink is choosing to combine incentive mechanisms with utility by offering a token that rewards network participants without handing over governance power.

Analysts suggest that Kraken’s tokenized approach could attract developers and users who prefer incentivized participation, especially those building or interacting with DeFi apps.

What Sets INK Apart

Beyond the token, the Ink Network is strategically aligned with the Optimism Superchain. This gives it access to shared security, cross-chain compatibility, and faster development tools. By being a part of this larger rollup ecosystem, Ink can benefit from infrastructure upgrades and network effects that smaller standalone L2s may struggle to achieve.

INK’s fixed supply, lack of governance influence, and focus on DeFi utility place it in a unique position. Rather than trying to do everything at once, the Ink Foundation appears to zero in on a clear vision: become a reliable, utility-driven layer-2 solution that complements Ethereum’s scaling needs.

What Comes Next

With the Ink token launch on the horizon, attention now turns to key milestones including:

Airdrop criteria and participant eligibility

Launch timeline of the Aave-powered DeFi protocol

Initial INK trading markets and listings

Onboarding of developers and liquidity providers into the Ink ecosystem

Investors, builders, and early adopters should prepare for announcements in the coming weeks. Given Kraken’s strong brand and the carefully thought-out tokenomics behind INK, the project could see rapid traction if delivered as promised.

Final Thoughts

The INK token launch is not just another airdrop. It represents a new kind of design philosophy in the layer-2 ecosystem. With a utility-first framework, a fixed supply, and a DeFi-centric rollout plan, Kraken’s Ink Network is taking a calculated yet innovative step toward long-term blockchain adoption.

As the broader crypto market evolves, the success of INK could influence how other exchanges and projects approach token launches in the future.

FAQs: Kraken’s Ink Network and INK Token Launch

1. What is Kraken’s Ink Network?

Ink is Kraken’s Ethereum layer-2 network built using the OP Stack. It aims to improve scalability and DeFi performance on Ethereum.

2. What is the purpose of the INK token?

The INK token is designed for utility within the Ink ecosystem, including incentivizing DeFi liquidity, not for governance or speculation.

3. Is Kraken directly managing the INK token?

No. The INK token is managed by the independent Ink Foundation, which is separate from the Kraken exchange to ensure decentralization.

Glossary of Key Terms

Ink Network

Kraken’s Ethereum-based layer-2 blockchain is built on the Optimism Stack and is designed to support fast, scalable DeFi operations.

INK Token

The native utility token of Ink Network, with a fixed supply of 1 billion, used to reward ecosystem participation without governance power.

Layer-2 (L2)

A secondary blockchain built on top of a main network (like Ethereum) to improve scalability, speed, and reduce transaction costs.

OP Stack

A modular open-source framework from Optimism that allows the creation of scalable layer-2 blockchains on Ethereum.

DeFi (Decentralized Finance)

Blockchain-based financial applications that operate without centralized intermediaries, offering services like lending and liquidity.

Anti-Sybil Measures

Techniques used to prevent fake or duplicate identities from gaming token airdrops or reward systems.