Bitcoin’s rally paused today as investors turn their focus to upcoming U.S. CPI inflation data, leading to a cautious atmosphere among market analysts. While some expect a slight pullback before further gains, legendary trader Peter Brandt has shared an optimistic forecast, stirring bullish sentiment for BTC.

Could Bitcoin Reach $327,000?

In a recent post, Peter Brandt shared a chart outlining two potential price trajectories for Bitcoin: one at $134,000 and a higher target of $327,000. According to Brandt, these scenarios could see Bitcoin either move conservatively to $134,000 or embark on an aggressive rally toward the $327,000 mark. While some investors are cautious, believing BTC has reached overbought levels and may settle around $134,000, others see this as the start of a long-term uptrend, potentially bringing BTC close to Brandt’s higher target.

Brandt highlighted both upside and downside possibilities, noting that the $327,000 goal could gain traction if regulatory clarity and favorable policies emerge, possibly under an administration with pro-crypto leanings. In a recent prediction, Brandt also projected that BTC could reach $200,000, aligning with similarly bullish outlooks from analysts at Bernstein.

Challenges Ahead for Bitcoin?

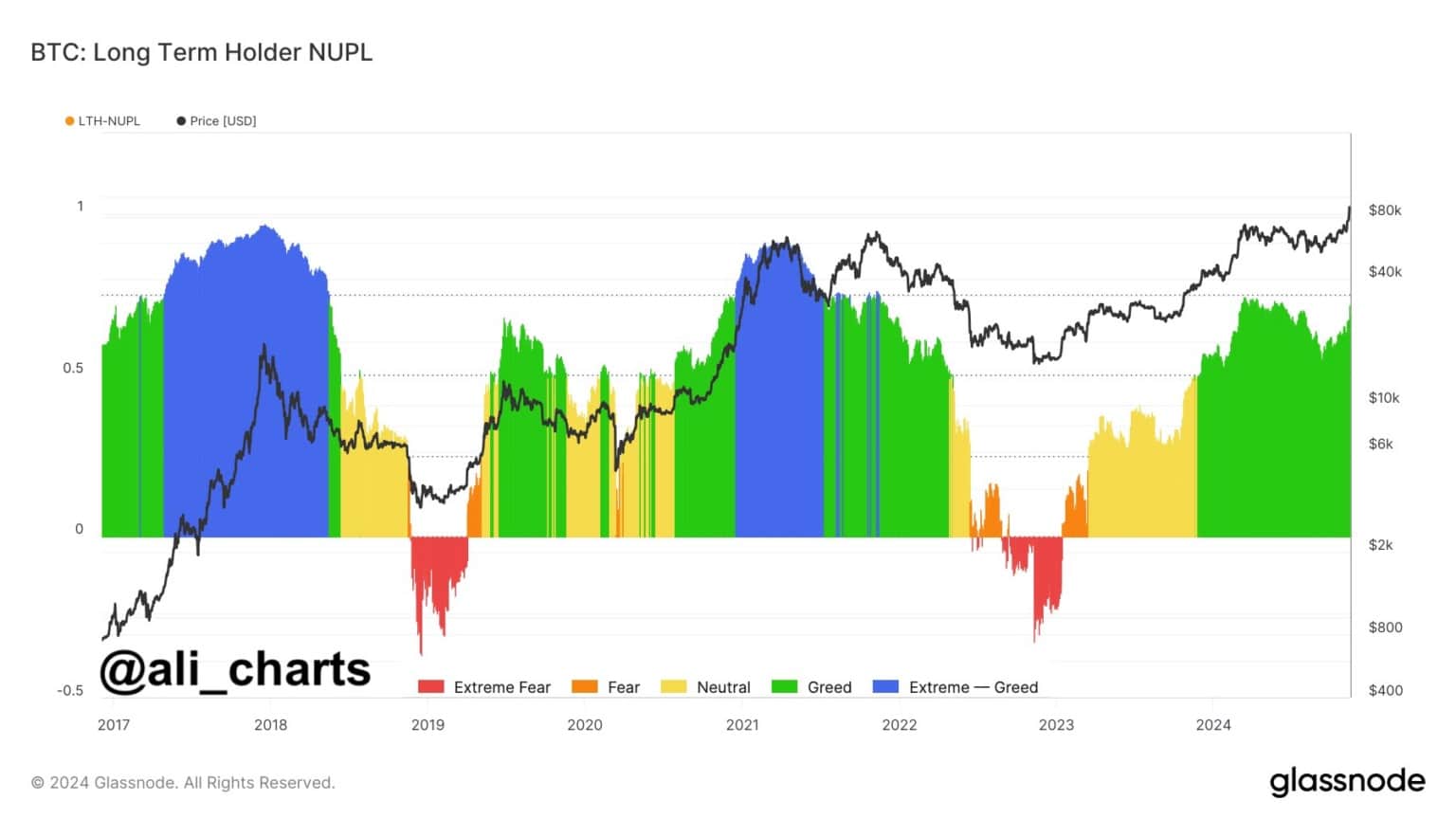

While Peter Brandt remains optimistic, other analysts are focusing on near-term hurdles. Prominent crypto analyst Ali Martinez pointed out that long-term holders have shown restraint amid recent price increases, signaling confidence in BTC’s stability but also caution. This measured approach often reflects general market sentiment and suggests that any potential gains may build gradually rather than surge overnight.

Immediate outlooks are also clouded by U.S. CPI data, expected to influence sentiment across financial markets. With the possibility of Fed rate cuts on the horizon, many experts foresee a short-term dip as investors digest economic updates. At present, Bitcoin is down over 2%, trading at $87,540, with trading volume dropping by 14% to $119 billion. BTC also touched a 24-hour peak at $89,915 after reaching a weekly high of $89,956.

Short positions on Bitcoin futures have decreased by roughly 3%, indicating that investors are largely adopting a wait-and-see approach ahead of critical economic releases.

Momentum Building Amid Economic Uncertainty

As the market awaits key economic data, the momentum behind Bitcoin is gathering. While Brandt’s predictions signal potential for a major rally, the path forward will likely be shaped by regulatory developments and broader economic conditions. For now, the sentiment in the crypto market remains mixed, balancing cautious optimism with the volatility inherent to Bitcoin’s journey.

- https://twitter.com/Thebitjournal_

- https://www.linkedin.com/company/the-bit-journal/

- https://t.me/thebitjournal

Follow us on Twitter and LinkedIn and join our Telegram channel to be instantly informed about breaking news!