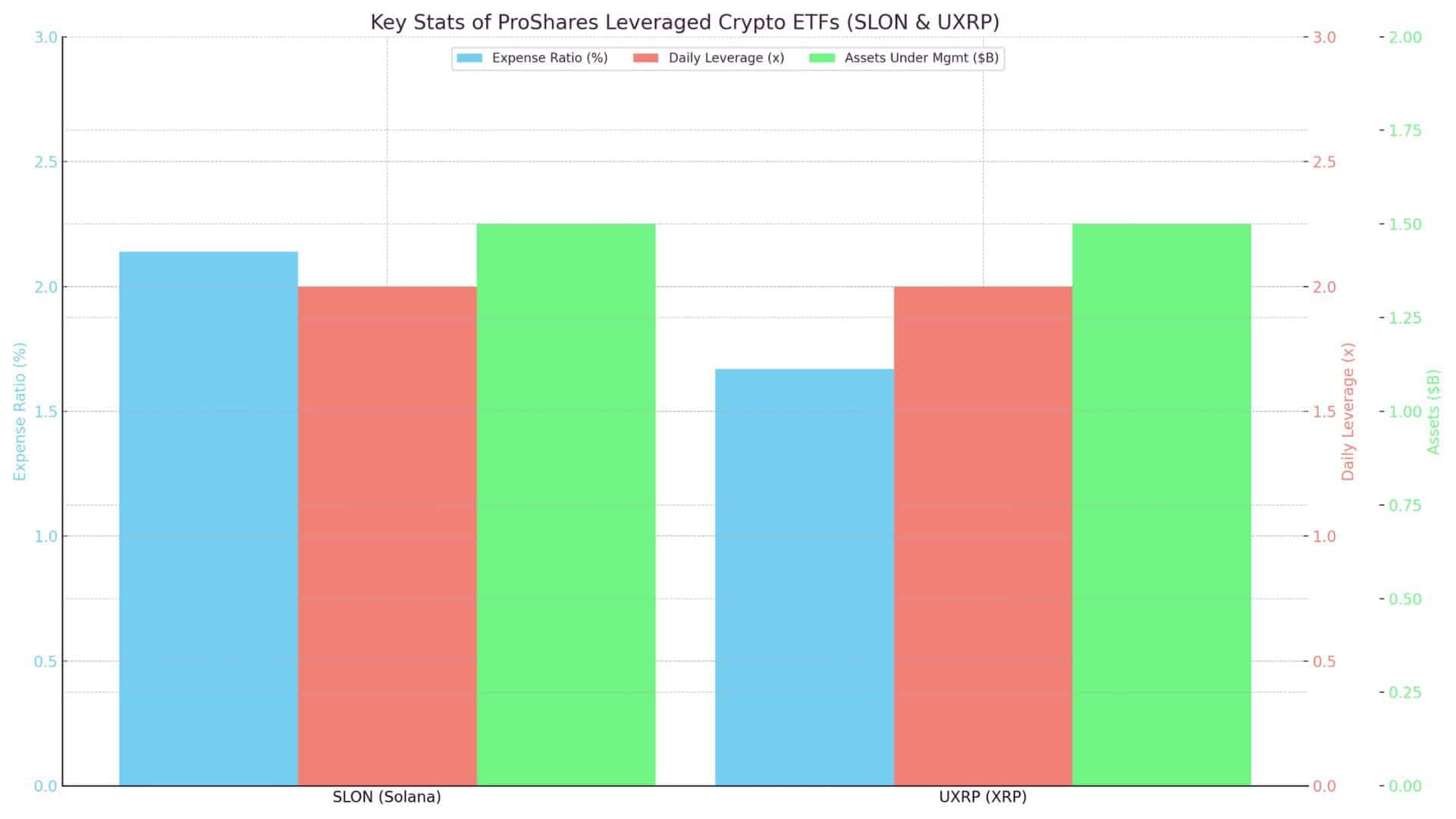

According to official sources, ProShares has launched two new leveraged crypto ETFs focused on Solana (SLON) and XRP (UXRP). These funds aim to deliver a double daily return on their underlying tokens, offering an exciting but high-risk investment opportunity for active traders.

2x crypto ETFs are now carving a place in the market, drawing attention from both institutions and experienced crypto participants.

What Are Leveraged Crypto ETFs?

ETFs that are classified as leveraged are meant to increase the price change of Bitcoin, Ethereum, Solana, and XRP on a daily basis. Anyway, leverage crypto ETFs mostly use derivatives like futures and swaps to aim for 2x or 3x daily performance, unlike traditional ETFs that 1:1 track the price of the assets.

In this case, ProShares’ SLON targets twice the daily gains or losses of Solana, while UXRP does the same for XRP. These ETFs do not hold the actual tokens but rely on financial contracts that simulate price movements.

SLON and UXRP: Who Are They For?

These ETFs are not for casual investors. “Leveraged crypto ETFs are meant for short-term positioning,” says ProShares in its product summary. That’s because daily compounding can distort long-term returns. If Solana gains 5% in a day, SLON could earn around 10%. But the reverse is also true.

These funds appeal to:

- Active day traders

- Crypto hedge funds

- Technical analysts targeting short-term moves

| ETF | Tracks | Daily Target | Expense Ratio |

|---|---|---|---|

| SLON | Solana (via futures) | 2x | 2.14% |

| UXRP | XRP (via futures) | 2x | 1.67% |

Market Impact and Growing Interest in Leveraged Crypto ETFs

Leveraged crypto ETFs are gaining momentum. With ProShares already managing over $1.5 billion in crypto ETF assets, the addition of SLON and UXRP broadens access to altcoins within regulated markets. According to CoinDesk, early trading volume signals growing interest in these instruments.

“Balchunas views this as a strong indicator of surging investor demand for XRP-related financial instruments,” noted analyst Alex Choi. This reflects a shift in how institutional and retail traders are approaching altcoin exposure—through regulated and leveraged vehicles.

Why This Matters for the Industry

These ETFs can attract new participants who prefer regulated, exchange-traded access over direct token ownership. They also help pave the road toward future spot ETFs for altcoins. Analysts believe that if these leveraged products succeed, regulatory doors might open wider for more offerings in the coming quarters.

Risks You Should Know

- High volatility: Double the exposure means double the risk.

- Daily reset: Returns are based on daily performance, not long-term trends.

- Expense ratio: Fees are higher than traditional ETFs.

Investors should understand how these products work before jumping in. Leveraged crypto ETFs may offer thrilling rewards but require careful timing and awareness of market swings.

Conclusion

Based on the latest research, Leveraged Crypto ETFs are gaining serious traction among active traders and institutional participants looking for regulated exposure to amplified crypto returns. While they can help maximize short-term profits, that also means they come with an equal amount of risk.

These products show increasing maturity in the digital asset space, in this case, innovating to be easily accessible. As demand grows for advanced trading tools, we anticipate leveraged crypto ETFs being in the limelight, rewarding those who know its jargon, risks, and market rhythm.

For continuous updates and thorough analyses on digital currencies, make sure to check out our regularly updated content.

Summary

ProShares just announced that two leveraged crypto ETFs for Solana and XRP have been launched: SLON and UXRP, respectively, with each offering 2x daily exposure through futures, thus catering to active traders who want more significant returns within a regulated framework. There are chances of making some greater gains-but they also mean higher risk and are highly unsuitable for long-term investment purposes. Their arrival is an indication of the different advantages that advanced crypto trading tools are starting to offer and the growing trend for institutional adoption of digital assets.

FAQs

Q1: What is a leveraged crypto ETF?

A leveraged crypto ETF is an instrument publicly traded working to achieve a stated multiple (for instance, 2x) of the daily return of an underlying cryptocurrency.

Q2: Do SLON and UXRP actually hold any Solana or XRP?

No, they use futures contracts to achieve price movement tracking.

Q3: Are these ETFs considered good for investment in the long term?

No, they are short-term trading vehicles.

Q4: Where do I buy these ETFs?

They are on NYSE Arca, via brokerage accounts.

Glossary

ETF: Exchange-traded fund, a type of investment product that trades on stock exchanges.

Leveraged ETF: An ETF that uses financial tools to amplify daily returns.

Futures Contract: A legal agreement to buy or sell an asset at a predetermined price.

Expense Ratio: Annual fee expressed as a percentage of total assets.

Sources/References