The LIBRA case, which was previously touted as a possible agent of economic empowerment in Argentina is now at the center of a huge global crypto scandal. What had started as a very public social media endorsement has boiled over into a multi-million-dollar class-action lawsuit filed in a New York federal court.

With $280 million worth of crypto assets now locked up, the case is attracting international attention and serious allegations regarding political interference in the crypto markets.

How LIBRA case rose and the Milei Tweet changed Everything

On February 14, 2025, Argentine President Javier Milei sent a message on X, in support of the LIBRA case token and the “Viva La Libertad!” private project. Its price jumped almost instantly, with thousands of investors and traders from both Argentina and overseas rushing to get it.

The project was marketed as a means to fund small businesses and education projects, a welcome offer in Argentina’s flagging economy.

But the thrill was short-lived. Hours later, President Milei removed his post. In minutes, LIBRA’s value collapsed. Developers of the token are said to have pulled out an estimated $100 million during this time, prompting allegations of a “pump and dump” scam. The episode spurred outrage among investors who watched their money dissolve in real time.

Hayden Davis Responds: “It Wasn’t a Scam.”

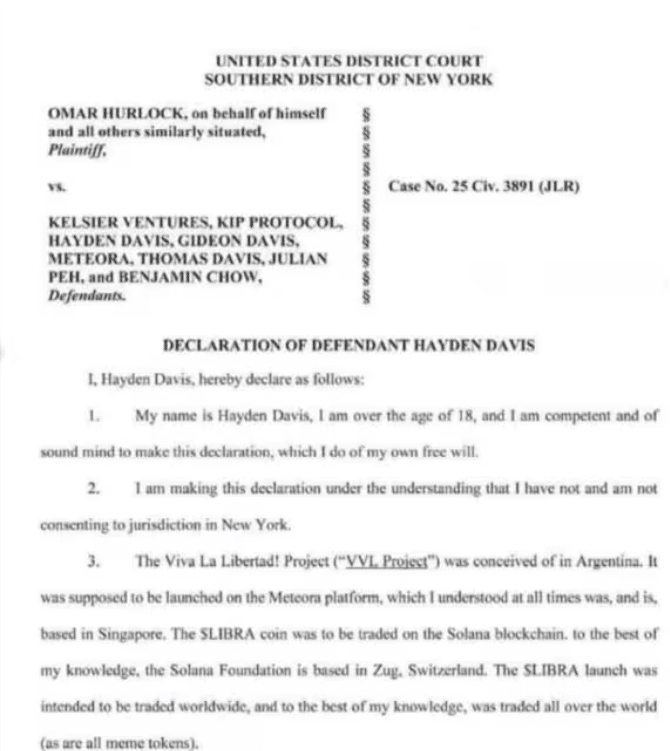

Hayden Mark Davis, CEO of Kelsier Ventures and the founder of LIBRA, soon turned out to be the face of the scandal. On June 23, Davis had filed a voluntary declaration in a New York court, rejecting all charges of fraud, insider trading, or participation in any conspiracy to manipulate the token’s price.

In his statement, Davis blamed the sudden collapse of LIBRA case on Milei’s deleted tweet, claiming that the removal sparked rumors and accusations that the project was a scam. “Those accusations were, and continue to be, false,” Davis said, maintaining that LIBRA case was created with the genuine intention of funding Argentine businesses and education.

New York Steps In, The Legal Proceedings Begin

In spite of Davis claiming that he and his firm do not do business in New York, the Southern District of New York took up the class-action suit initiated by U.S. investor Omar Hurlock. Burwick Law represents the plaintiff, who accused the promoters of LIBRA case of misleading the public by means of false advertising and false representations.

The court issued a Temporary Restraining Order (TRO) on May 30, 2025, freezing USDC $58 million and SOL $50 million, as well as other cryptocurrency assets. The order aims to maintain investor money and keep suspicious assets from being further moved as the case is investigated.

Davis’s statement contained a stern assertion of the non-jurisdiction of the U.S. court, claiming that LIBRA and LIBRA case was developed in Argentina and, therefore, any proceedings needed to happen there. He also asserted that he had indeed met with President Milei months prior to the launch of the token, something critics claim shows pre-coordination between the authorities and the developers of the project.

Milei, nonetheless, hasn’t been officially charged in the case. He explained he removed the tweet because he hadn’t had full information on the project. Nevertheless, Argentine legislators have started their own probe, and an extraordinary congressional committee is now studying the case.

What Happens Next?

While both the U.S. and Argentina continue to investigate the LIBRA case investors worldwide are holding their breaths. The case is a stark reminder of how swiftly hype-fueled crypto launches can go into sheer legal and financial pandemonium, particularly when influential public figures are involved.

With more than $280 million on ice, the LIBRA case has the potential to create new benchmarks for the protection of crypto investors and might drastically influence how future international crypto ventures are regulated.

Summary

The LIBRA token, which was initially marketed as a financial instrument for micro businesses in Argentina, was at the center of a dramatic crypto scandal early in 2025. Following a tweet by President Javier Milei, its price shot through the roof before suddenly crashing, inspiring U.S. investors to sue for a class action in New York. With over \$280 million in crypto assets frozen, CEO Hayden Davis denies all wrongdoing and blames the crash on Milei’s deleted tweet. The case highlights the dangers of unregulated crypto hype and political influence.

FAQs

Why is the LIBRA token in legal trouble?

The price of LIBRA soared after LIBRA case that when Argentina’s president posted a tweet about it, but when the tweet was removed, the token plummeted. Investors in the U.S. assert that this was a “pump and dump” and filed a class-action lawsuit in New York.

Why is the case occurring in New York?

Even though the project was Argentine, U.S. investors were impacted. The suit was filed in a New York federal court so investor losses could be recovered under U.S. consumer protection laws.

How much has been frozen in the lawsuit?

More than $280 million in crypto assets, such as USDC and Solana (SOL), have been put on hold by court order pending the outcome of the case.

Glossary

Class-Action Suit: A court action brought by a group of individuals with comparable grievances, in this instance, investors who lost funds in LIBRA.

Temporary Restraining Order (TRO): A judicial order that temporarily inhibits a party from accessing or transferring funds, utilized herein to freeze crypto assets tied to LIBRA.

Kelsier Ventures: Hayden Davis’s company, which developed the LIBRA token project.