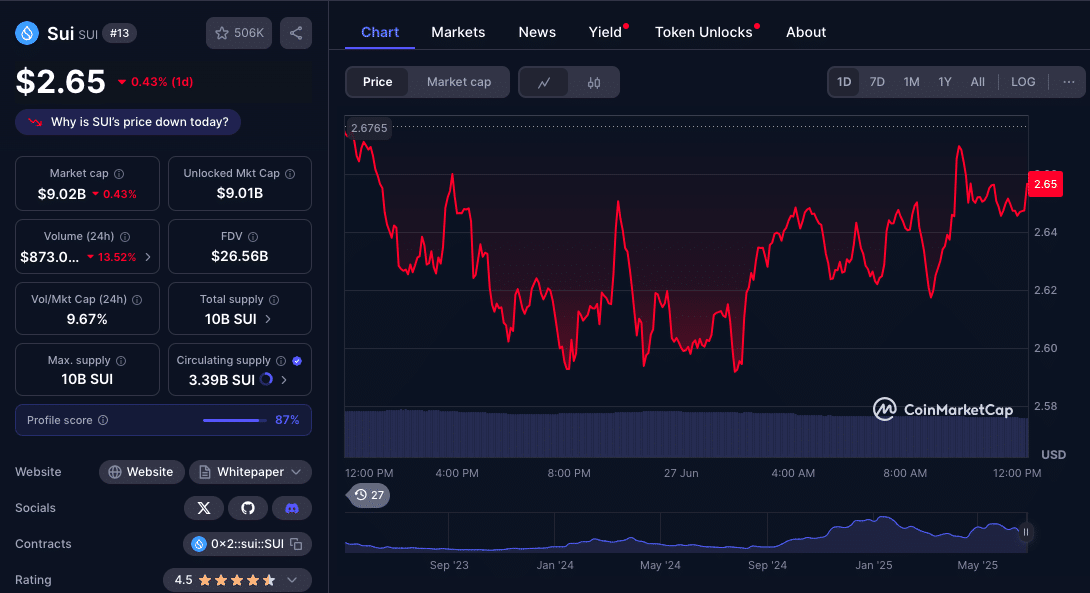

The SUI price prediction narrative has taken a new turn following a sharp rebound off the $2.58 support level. This came shortly after Nasdaq-listed Lion Group Holding Ltd. confirmed plans to acquire SUI tokens using proceeds from its $600 million convertible facility.

SUI price today is currently $2.65, down 2.03% in the past 24 hours, but the recent recovery from intraday lows has caught the attention of traders. Market data showed a V-shaped recovery between June 26 and 27, with a spike in trading volume reinforcing renewed buying pressure. According to market analysis, demand built steadily near $2.60, further validating this price zone as a near-term support.

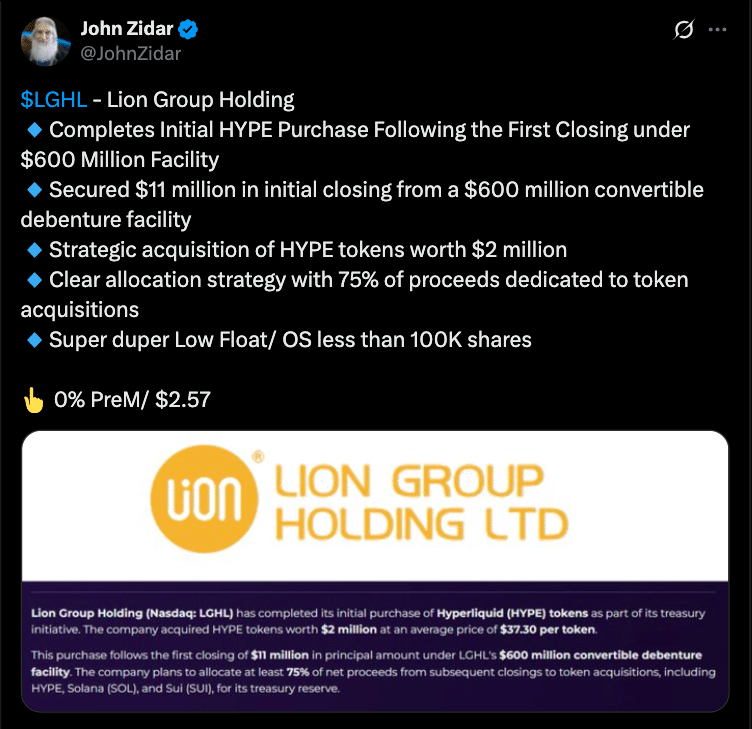

SUI price prediction outlook has improved in light of Lion Group’s calculated turn toward Layer-1 assets. The Singapore-based company announced on June 26 that it had made an initial $2 million purchase of HYPE tokens and intends to allocate a sizable portion of future funds toward acquiring SUI and SOL tokens. These moves will be funded through closings of its $600 million convertible debenture facility.

Lion Group’s Treasury Plan Sparks Interest in SUI

Lion Group operates a multi-asset trading platform that supports CFDs, total return swaps, and stock options. The company says it plans to use at least 75% of the net proceeds from each tranche of its fundraising program for crypto acquisitions, with SUI among the top priorities.

In a press release, CEO Wilson Wang referred to HYPE as a “foundational execution-first asset” and noted that Layer-1 tokens like SUI are critical to the firm’s long-term blockchain strategy. This alignment with next-generation infrastructure has helped push the SUI price prediction higher, at least in the short term.

As more corporations emulate this model, SUI price prediction sentiment could benefit further, particularly if volume remains elevated.

Technical Outlook: Support Holds But Resistance Looms

The current SUI price prediction also factors in a technical structure that suggests early accumulation at key levels. Over the past 24 hours, the token traded within a range of $2.58 to $2.70. Several bullish signals emerged during the rebound, including a series of higher lows and a minor bullish reversal pattern.

Notably, rejection wicks were observed near $2.66, showing this level as a short-term resistance zone. The price bounced from $2.58 at 21:00 UTC on June 26 and gradually recovered to $2.63 by 08:24 UTC the next day. This momentum was supported by an 18% spike in volume compared to the 24-hour average, suggesting sustained interest from traders.

However, accounting for the technical barrier around $2.66. A clean break above this could set the stage for a push toward $2.75 or even higher in the near term.

| Metric | Value |

| 24-Hour Range | $2.58 – $2.70 |

| Intraday Bottom | $2.58 |

| Intraday Recovery | $2.61 – $2.63 |

| Short-Term Resistance | $2.66 |

| Volume Spike | +18% (vs 24h avg) |

| Current Price | $2.65 |

Expert SUI Price Predictions

According to CoinCodex’s real-time forecast, SUI is expected to fall to $2.00 by July 1. However, the platform also projects a rebound to $2.64 by late June 2025, suggesting a potential stabilization over the longer term. The site rates SUI’s current trend as neutral and advises caution for short-term traders.

Changelly offers a more bullish short- and mid-term perspective, estimating an average price of $2.17 for July and projecting a rise toward $3.60 by September 2025, provided that network adoption and ecosystem development remain on track.

CoinPedia’s analysis echoes Changelly’s optimism. In its most recent projection, it set a 2025 year-end high target of $7.01, hinging on ecosystem maturity and macro-level crypto recovery. The outlet cites Lion Group’s move as a sign of institutional faith in SUI’s potential.

What This Means for Investors and Traders

While SUI price today may appear modest in percentage terms, the institutional validation through Lion Group’s planned purchase adds weight to the argument for a medium-term recovery. The price hovering near $2.65 while resisting dips below $2.58 shows that this level has strong buyer interest, at least in the current cycle.

If SUI can decisively break through the $2.66–$2.70 resistance zone, it could open the door for a return to $3.00+ levels, though macro market trends and broader altcoin performance will also play a role.

Conclusion

SUI’s bounce from the $2.58 support, amid heavy volume and institutional involvement, shows renewed confidence in the project. With Lion Group positioning itself for substantial token accumulation and expert forecasts ranging from $2.64 to $7.01, the short-term volatility may give way to longer-term momentum. However, caution remains necessary until key resistance zones are flipped into support.

Summary

SUI has rebounded strongly from a $2.58 dip, fueled by Lion Group’s confirmation of treasury-backed token acquisitions. The price is currently consolidating near $2.65 with resistance just above. Expert predictions offer a wide range: CoinCodex expects $2.64 by June 2025, Changelly projects $3.60 by September 2025, and CoinPedia sees a bullish high of $7.01 by year-end 2025.

FAQs

What is driving SUI’s latest rebound?

SUI rebounded after strong buying near $2.58 and Lion Group’s announcement to acquire SUI tokens as part of its $600 million crypto treasury initiative.

Can SUI break above $2.70 soon?

That will depend on whether current demand sustains and if resistance at $2.66–$2.70 can be cleared convincingly.

What are experts predicting for SUI?

Forecasts vary: CoinCodex projects $2.64 by June 2025, Changelly sees $3.60 by September 2025, and CoinPedia estimates a potential $7.01 high by end of 2025.

Glossary

Support: A price level where demand historically outpaces selling pressure, often triggering rebounds.

Resistance: A price point where selling tends to overpower buying, leading to potential pullbacks.

Convertible Facility: A financial arrangement allowing companies to raise capital that may convert into equity.

V-shaped Recovery: A sharp, quick reversal in asset price following a steep decline.

Layer-1 Blockchain: A base protocol like Sui or Ethereum that processes and finalizes transactions without relying on external chains.