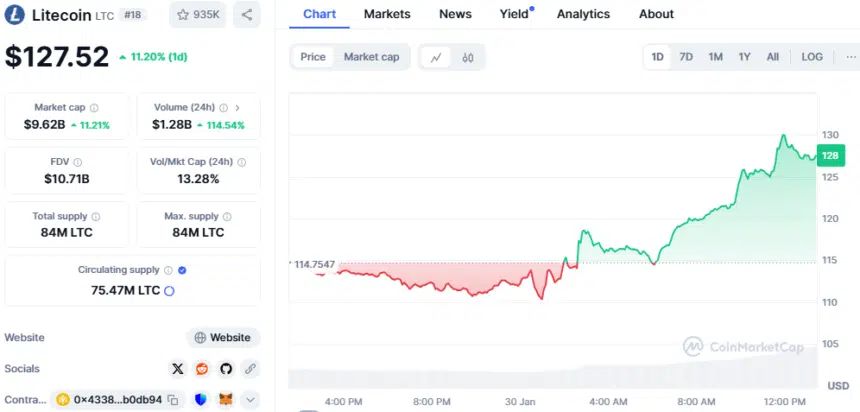

Litecoin, or LTC, has recently become the hottest word in the cryptocurrency market. This was after the U.S. Securities and Exchange Commission acknowledged the application of Canary Capital for a Litecoin ETF. The news saw Litecoin jump up 11%, now trading at $129.23 as at the time of this publication. Thus, this will be a novel development in the crypto ETF landscape because this could be the very first Altcoin ETF to be addressed formally by the SEC.

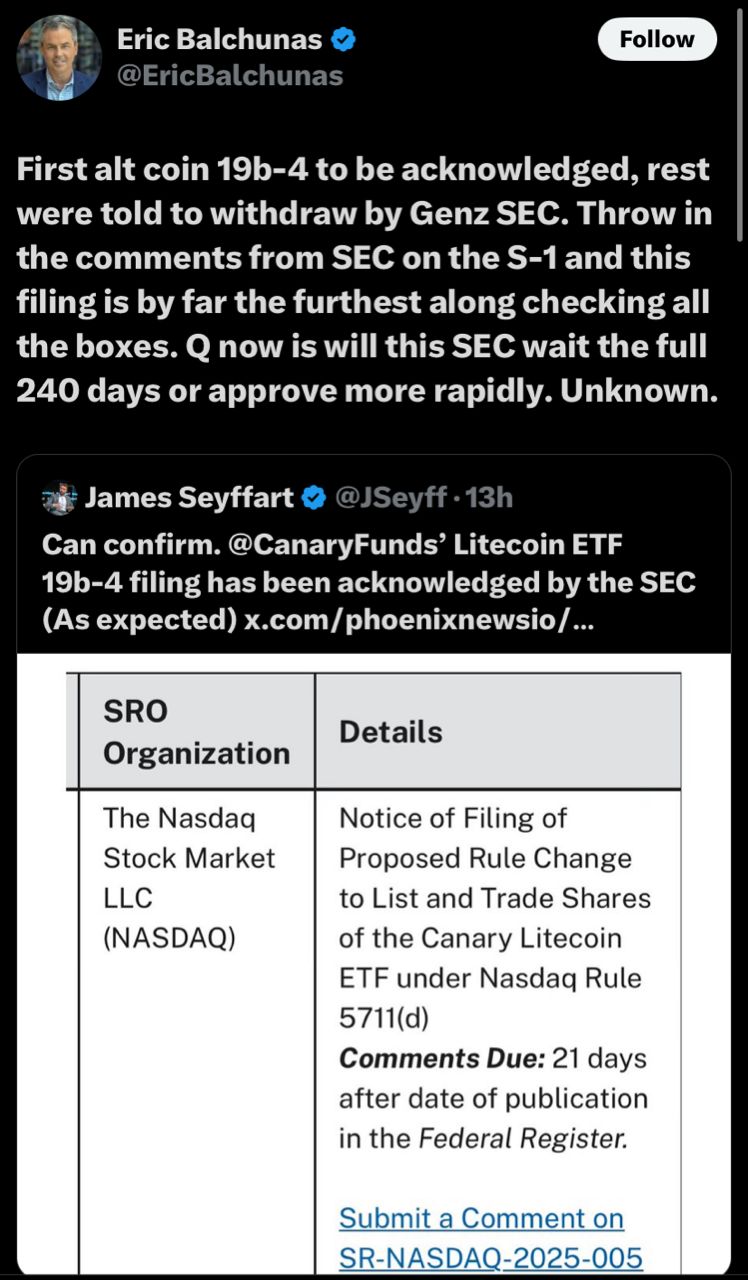

Bloomberg senior ETF analyst Eric Balchunas said the filing has essentially cleared regulatory hurdles that have held up other applications. With market expectations heightening, the SEC is closely monitoring a full 240-day review period. The acknowledgment of the Litecoin ETF proposal lit the torch of new investor optimism as speculations began to arise on whether Litecoin would finally see institutional adoptions through a publicly traded fund.

Why Is a Litecoin ETF Important?

Litecoin has been called Bitcoin’s silver many times because it embodies many of the key aspects of BTC but with greater speed and lower fees. With much in common with Bitcoin, it finds itself well-positioned for an ETF, considering institutional investors want to diversify their crypto exposure.

Investment firm Canary Capital filed with the SEC in October 2024 for an S-1 registration statement that would create a Litecoin ETF to provide accredited and institutional investors with regulated access to LTC. It will be the latest development in the growing number of crypto ETF adoptions following the SEC’s historic approval of Bitcoin spot ETFs earlier in the past year.

According to Balchunas, the Canary Capital filing does look pretty complete and has some chance of being approved, at least as regulators start loosening their strict stance on crypto-based investment products.

However, obstacles are still ahead. The SEC has always been cautious with crypto ETFs, often bringing up concerns of market manipulation and investor protection. Whether or not, and when Litecoin breaks past these hurdles, the acknowledgment of the filing in itself is a big step forward.

Nasdaq’s Role in the Push for a Litecoin ETF

The recent turn of events began to gather steam when Nasdaq officially filed for a Litecoin spot fund application on January 15, 2025. It is supposedly the second important phase in the entire process since Nasdaq would become the Litecoin ETF listing exchange by Canary Capital.

This would theoretically allow for trading in Litecoin on mainstream U.S. stock exchanges and give investors exposure to LTC without the complexity of direct ownership, wallets, or private keys.

This filing follows the increasing institutional interest in crypto ETFs, with applications for XRP and Solana-based ETFs also making rounds. Just a week before Litecoin’s filing came, Canary Capital applied for its XRP-based ETF, a sign that the market was very slowly beginning to go beyond Bitcoin and Ethereum.

Given that Nasdaq is involved, the SEC’s decision on the Litecoin ETF could set a precedent for other altcoins, opening the door to a wider array of crypto-backed investment products.

Market Reactions and Litecoin’s Price Outlook

The crypto market has welcomed the acknowledgment of the Litecoin ETF filing by the SEC with a remarkably positive reaction: LTC surged upwards by more than 11% in just a 24-hour period. Analysts say a further development on the proposal would likely mean a further uptrend in Litecoin, perhaps to retest key resistances near $150-$160.

There are several factors that could drive the price of Litecoin higher in coming months. The SEC Approval of the Litecoin ETF is expected to bring in large-scale institutional influx into LTC, probably elevating its price really high. The pace of institutional adoption would increase as big ones like Nasdaq and Canary Capital continue to believe in Litecoin.

The permission to trade Bitcoin spot ETFs early in 2024 ushered in a bull run within the crypto market. If Litecoin happens to follow this trend, it is not very far from setting a new all-time high. Increased regulatory recognition increases Litecoin’s status as a viable investment instrument, luring both institutional and retail investors.

However, it is not without certain risks that include SEC delays, possible rejections, or market volatility based on greater macroeconomic circumstances.

Conclusion

The SEC’s recognition of Canary Capital’s Litecoin ETF filing marks a new moment for crypto adoption into traditional finance. Being the first altcoin ETF filing recognized, this may mean that regulators are warming up to a broader array of digital assets.

With Nasdaq now involved and Litecoin’s historical positioning as a reliable digital asset, the chances of institutional adoption are growing. While the final decision of the SEC is still in doubt, market optimism is high, and investors are closely watching how this unfolds.

If approved, the Litecoin ETF could mark a turning point, opening the doors for further crypto-backed investment products in the U.S. financial markets.

The BIT Journal is available around the clock, providing you with updated information about the state of the crypto world. Follow us on Twitter and LinkedIn, and join our Telegram channel.

FAQs

1. Why is the SEC’s acknowledgment of the Litecoin ETF proposal huge?

It is a huge milestone since the Litecoin ETF proposal by Canary Capital could be the first officially recognized among the altcoins ETF, and upon approval, it might spark an increase in institutional investment and wider adoption of the digital currency.

2. How does the Nasdaq filing affect the Litecoin ETF?

Nasdaq has filed for a spot in the Litecoin fund, which is the second step in the approval process. If successful, Nasdaq will act as the listing exchange, and investors can trade Litecoin through traditional stock markets without owning the asset directly.

3. What are the chances of the Litecoin ETF getting approved?

While the SEC has historically been cautious with crypto ETFs, the acknowledgment of the Litecoin ETF proposal suggests a changing regulatory landscape. Analysts believe Litecoin’s structural similarities to Bitcoin improve its chances, but the SEC’s final decision remains uncertain.

4. How could a Litecoin ETF approval impact LTC’s price?

If the Litecoin ETF gets a green light from the SEC, serious institutional inflows into LTC could drive prices higher. Analysts speculate that LTC could once again test $150-160 levels in the short run and may achieve new all-time highs in the long-term run.

5. How does Litecoin compare to Bitcoin in terms of ETF potential?

Litecoin shares many technical similarities with Bitcoin, including proof-of-work mining and fixed supply, making it a strong candidate for an ETF. However, Bitcoin has greater adoption and market dominance, which made it the first choice for ETF approval. Litecoin’s acknowledgment by the SEC suggests altcoins may follow suit.