Litecoin (LTC), one of the most established cryptocurrencies, has seen significant price fluctuations in recent months. After dropping nearly 40% from $147 to $86.69 in December 2024, LTC has since been consolidating within a tight range, signaling potential for a recovery.

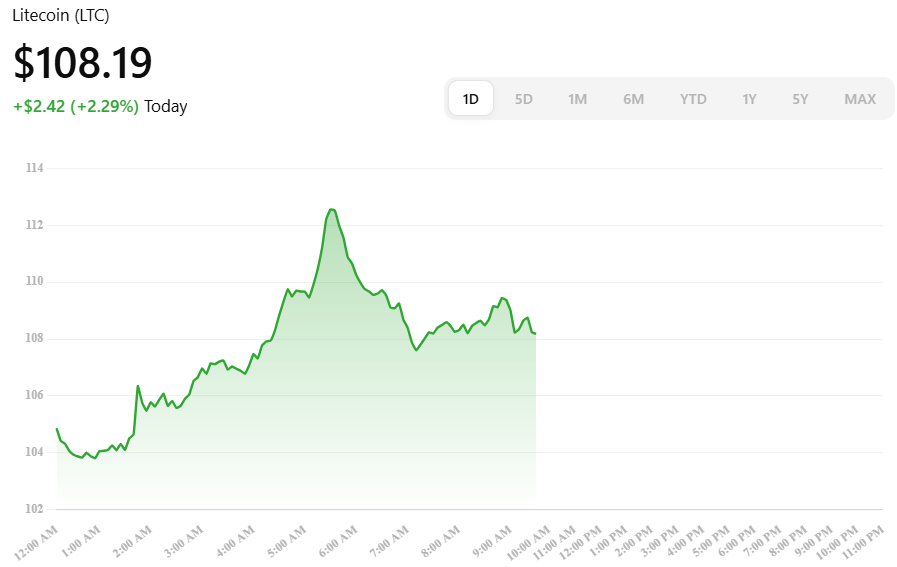

As of March 6, 2025, Litecoin is trading at $108.19, marking a 2.42% increase over the last 24 hours. This modest recovery has sparked optimism among traders and analysts.

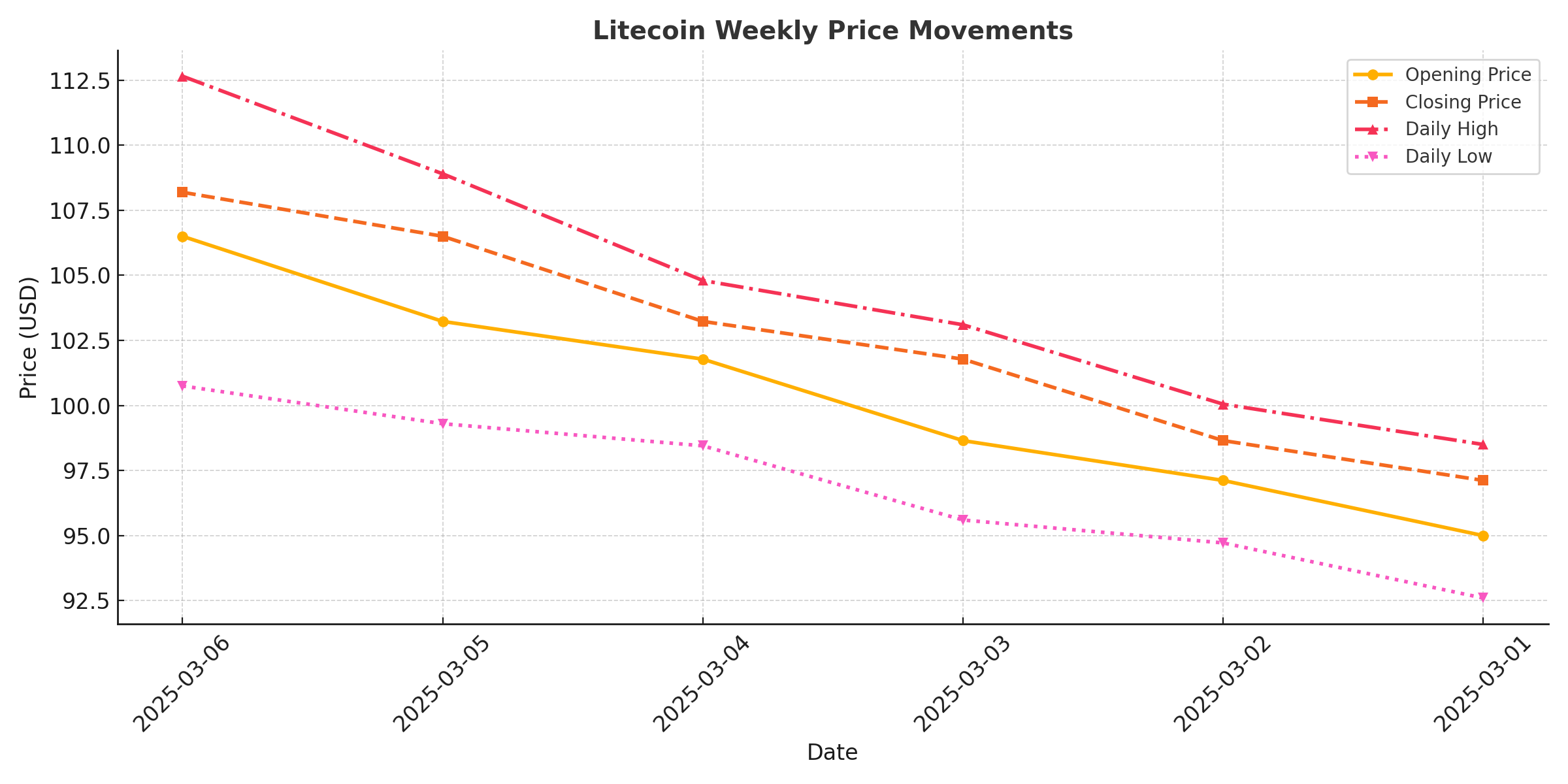

Litecoin Weekly Price Overview

Below is a summary of Litecoin’s price performance over the past week:

| Date | Opening Price | Closing Price | Daily High | Daily Low |

|---|---|---|---|---|

| 2025-03-06 | $106.50 | $108.19 | $112.65 | $100.75 |

| 2025-03-05 | $103.23 | $106.50 | $108.90 | $99.30 |

| 2025-03-04 | $101.78 | $103.23 | $104.80 | $98.45 |

| 2025-03-03 | $98.65 | $101.78 | $103.10 | $95.60 |

| 2025-03-02 | $97.12 | $98.65 | $100.05 | $94.72 |

| 2025-03-01 | $95.00 | $97.12 | $98.50 | $92.60 |

Litecoin’s On-Chain Metrics and Market Sentiment

1. Whale Accumulation

A significant indicator of potential bullish momentum is whale activity. Large investors have accumulated over 1.6 million LTC in recent months, signaling confidence in the asset’s long-term growth.

2. Network Hash Rate Reaches Record High

Litecoin’s network hash rate has hit an all-time high, reflecting strong miner participation and network security. Historically, a rising hash rate often precedes bullish price movements.

3. Declining Exchange Reserves

Exchange reserves of Litecoin have dropped considerably, suggesting that investors are withdrawing their holdings for long-term storage. Lower exchange reserves typically indicate reduced selling pressure, which could contribute to an upward price movement

Technical Analysis: Is Litecoin Ready for a Breakout?

1. Key Support and Resistance Levels

- Support Level: $94 – If LTC stays above this level, further gains are likely.

- Resistance Level: $120 – Breaking this barrier could push LTC toward $150.

2. Oversold Conditions on RSI

The Stochastic RSI has entered the oversold zone, indicating that LTC may be undervalued and primed for a potential rebound.

Litecoin Price Prediction for 2025

Although cryptocurrency price predictions are speculative, historical data and technical indicators suggest the following potential price trajectory for Litecoin:

Short-Term Prediction (March – June 2025)

- If Litecoin breaks above $120, a rally toward $140-$150 is possible.

- A rejection at resistance could lead to consolidation between $95 – $120.

Long-Term Prediction (End of 2025)

- Bullish Case: Litecoin could reach between $186 and $201 if positive momentum continues.

- Bearish Case: If the market faces further corrections, LTC may remain in the $100-$120 range.

Conclusion

Litecoin has faced a significant price drop but is now showing early signs of recovery. The increasing hash rate, whale accumulation, and declining exchange reserves suggest that a price rebound is likely.

Litecoin presents a strong buying opportunity for investors at current levels, especially if it maintains support above $94 and breaks through $120 resistance in the coming weeks.

Final Thoughts

Litecoin’s recent recovery signals a potential breakout, making it one of the top altcoins to watch in 2025. While risks remain, technical indicators and on-chain data suggest that LTC could be gearing up for a strong bull run in the coming months.

Will Litecoin reach $200 in 2025? Only time will tell—but the signs are promising.

Stay tuned to The BIT Journal and keep an eye on Crypto’s updates.

FAQs

1. Why did Litecoin’s price drop recently?

Litecoin saw a 40% decline in December 2024 due to profit-taking and broader market corrections.

2. Is Litecoin a good investment in 2025?

Based on on-chain metrics and technical analysis, Litecoin shows strong recovery potential, making it an attractive investment.

3. What is Litecoin’s price prediction for 2025?

Analysts predict LTC could reach $186 – $201 by the end of 2025 if market conditions remain favorable.

4. What is the key support level for Litecoin?

The major support level is $94—staying above this level is crucial for further gains.

5. Can Litecoin hit $200 in 2025?

If bullish momentum continues and market sentiment improves, LTC has the potential to reach or surpass $200.

Glossary

1. Stochastic RSI

A momentum indicator used in technical analysis to determine if an asset is overbought or oversold.

2. Whale Accumulation

Refers to large investors purchasing significant amounts of a cryptocurrency, often influencing price movements.

3. Hash Rate

The total computational power used to mine and secure the Litecoin network. A higher hash rate indicates strong network security.

4. Support and Resistance

- Support: A price level where buying pressure is strong enough to prevent further declines.

- Resistance: A price level where selling pressure is strong enough to prevent further increases.