The Litecoin market is experiencing a downward trend with LTC trading at $127.97 following a 0.46% drop during the previous day according to data from CoinMarketCap. Despite its present downturn market participants keep anticipating success thanks to big investors buying lots and talk about creating a Litecoin ETF fund.

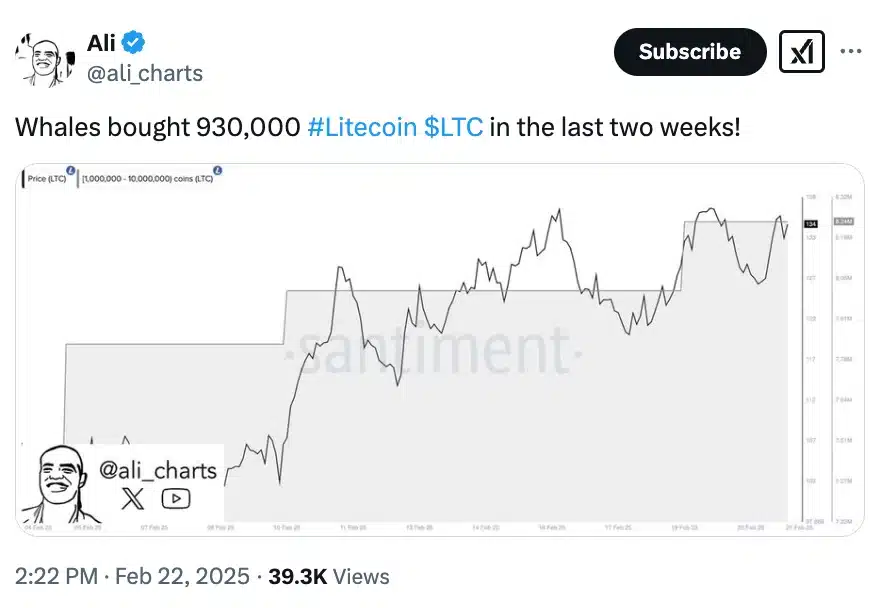

Crypto analyst Ali Martinez spotlights large Litecoin holders who bought more tokens during the past two weeks. Large holders demonstrated their LTC faith by acquiring nearly a million tokens during the past fourteen days. Large investors are adding LTC to their holdings which creates market excitement for future price gains despite ongoing volatility.

Canary Capital’s Litecoin ETF Gains Traction

Canary Capital received a major endorsement when its Litecoin ETF debuted on the Depository Trust & Clearing Corporation (DTCC). The exchange shows the path to official approval and wider LTC use. Institutional interest in DTCC listing indicates that companies are ready for a potential LTC launch even though the listing alone does not grant permission.

The senior ETF analyst at Bloomberg named Eric Balchunas assesses the ETF approval chances at 90% through regular market observations. Market analysis from Polymarket suggests that Litecoin’s ETF has a good chance of being approved by the market’s current standings of 85% before 2025. Investors can safely launch institutional LTC investments through this approved fund and increase market value.

Litecoin Joins Altcoins Eyeing ETF Approval

As the probability of a LTC exchange-traded fund (ETF) grows stronger the asset becomes part of a group with other significant altcoins such as SOL, DOGE and ADA. Investors expect these coins will secure ETF listings in 2025. A large number of altcoin ETFs entering the market will transform cryptocurrency businesses while increasing digital asset acceptance.

Professionals in the financial industry agree that launching many altcoin ETFs will give investors, both large firms and small investors, fresh investment options. ETFs give investors a safe way to enter the cryptocurrency market through regulated products that passively track token price trends.

Whale Accumulation Signals Confidence in LTC

Litecoin’s current price doesn’t mean that the sentiment is bearish as there are fundamental factors like whale accumulation and ETF speculation that show a different picture.Investors from institutions now show strong interest in LTC while the possibility of ETF approval will probably cause big price changes soon.

In the run up to 2025, regulatory authorities and their stances on cryptocurrency ETFs are being watched by all. The market may experience a major price explosion if LTC obtains necessary approvals which solidifies its role as a leading cryptocurrency.

Conclusion

The approval of Litecoin ETF status would bring crucial institutional funding and foster crypto market balance. Whale investment continues to grow, and investor faith increases, making LTC a leader in crypto development. The upcoming period will decide if Litecoin succeeds as a cryptocurrency.

Stay tuned to The BIT Journal and keep an eye on Crypto’s updates. Follow us on Twitter and LinkedIn, and join our Telegram channel to be instantly informed about breaking news!

FAQs

1. Why is Litecoin’s market sentiment still positive?

Whale accumulation and ETF speculation are driving optimism despite the price dip.

2. What does the DTCC listing mean for Litecoin?

It signals readiness for an ETF but doesn’t guarantee approval.

3. What are the chances of Litecoin ETF approval?

Analysts estimate an 85–90% chance by 2025.

4. How would a Litecoin ETF impact the market?

It could boost institutional adoption and LTC’s price.

Glossary of Key Terms

Litecoin (LTC): A fast, low-fee cryptocurrency.

Bearish Phase: A period of falling prices.

Whales: Large crypto investors.

ETF (Exchange-Traded Fund): A fund that tracks an asset’s price.

DTCC: A clearinghouse for financial trades.

Institutional Investors: Large firms investing in crypto.