Despite a recent price dip of 10.75%, Litecoin (LTC) has shown remarkable market activity, closing at $111.06 within 24 hours. Whale trading activity at $113.4 triggered significant movement, contributing to a trading volume of $1.06 billion during this period. Key technical indicators suggest that Litecoin’s bullish momentum remains intact, with its mark price currently at $128.01.

Whale Activity Anchors Litecoin’s Growth

Whales played a central role in stabilizing LTC’s price during market turbulence. Large-scale trades at $113.4 provided much-needed liquidity and kept the price trend upward. Their consistent presence signaled confidence in LTC’s potential and highlighted their ability to steer price dynamics effectively.

Market participants have noticed that whenever whales step in, they create stability while enabling upward momentum. This influence fosters optimism for the asset’s future value, even during volatile phases. With sustained whale activity, Litecoin maintains a solid foundation for growth.

Key support remains visible at $120, with resistance expected between $130 and $135, giving traders precise levels to watch. This balance of support and resistance underscores the significance of whale-driven liquidity, which has kept market sentiment optimistic.

Technical indicators point to LTC’s stability

Technical analysis measurements indicate Litecoin operates in a lucrative yet steady market atmosphere. The Upward Trend continues to strengthen, as indicated by both the Moving Average (MA) and the Exponential Moving Average (EMA), confirming long-term growth potential together. Bollinger Bands shows controlled market volatility while giving traders dependable tools to understand price movements.

With an RSI level of 57.04, the Relative Strength Index remains neutral, signaling the potential for additional price increases. Litecoin’s current price levels show neither extreme buying nor selling to existing market participants who can speculate briefly and long-term.

The Moving Average Convergence Divergence (MACD) reveals a rising purchasing force, consolidating a strong bullish trend. Multiple technical signals show whales’ continued activity, suggesting the price will keep gaining value.

On-chain data reflects Litecoin’s stable performance

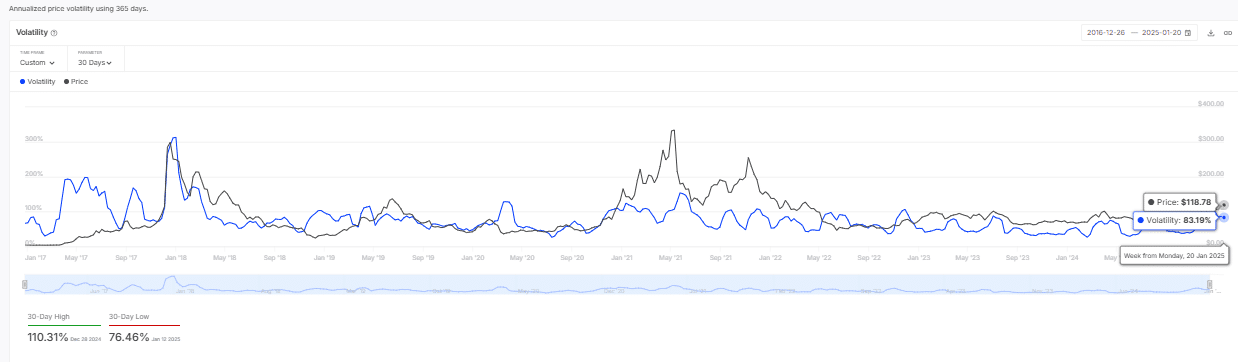

A 30-day annualized volatility of 83.19% shows how dynamic Litecoin functions as a digital asset. Historical evidence shows that prices rise sharply when volatility hits current levels, as seen during December 2024’s major price movement. These fluctuations, while risky, often present lucrative opportunities for active traders.

Long-term investors must operate within volatile environments while focusing on continuous growth. LTC holds a stable investment position as frequent market price fluctuations occur within a sustained interest framework and adequate market liquidity.

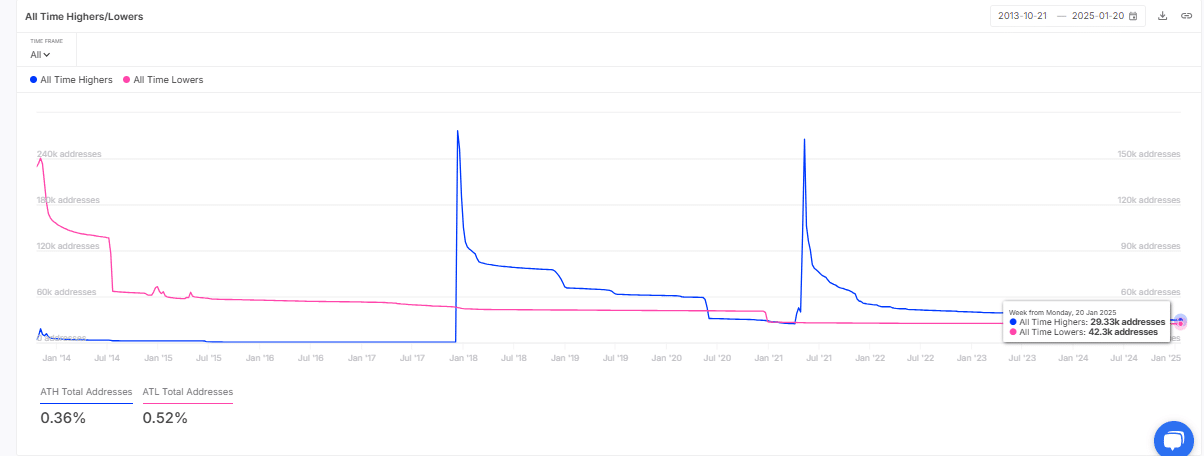

The on-chain data confirms healthy market distribution through active address numbers at new peak and bottom records. About 0.36% of addresses reach their highest values, whereas 0.52% reach their lowest values. According to these figures, market balance exists amongst participants who avoid extremes in both optimism and bearish expectations.

Optimistic market outlook drives LTC potential

The combination of whale activity, technical stability, and market sentiment paints a promising picture for Litecoin’s growth. The steady rise in trading volume, driven by whales, ensures sufficient liquidity and price stability, making LTC an attractive option for institutional and retail investors.

The broader market remains optimistic as Litecoin navigates resistance levels near $130 to $135. Technical indicators continue to support bullish momentum, and the influence of whales adds a layer of confidence to its trajectory.

Litecoin’s growth is underpinned by whale activity, technical strength, and balanced market sentiment. While volatility creates challenges, it also brings opportunities, particularly for traders who can capitalize on price shifts. Litecoin’s potential for further price appreciation appears solid if external conditions remain favorable.

Stay tuned to The BIT Journal and keep an eye on Crypto’s updates. Follow us on Twitter and LinkedIn, and join our Telegram channel to be instantly informed about breaking news!

FAQs

What caused Litecoin’s recent market activity?

Litecoin’s recent activity was driven by whale trading at $113.4, contributing to a $1.06 billion trading volume.

What role did whales play in Litecoin’s growth?

Whales provided liquidity and stabilized the market, enabling upward momentum and signaling confidence in LTC’s potential.

What are the key support and resistance levels for LTC?

Litecoin has strong support around $120 and resistance between $130 and $135, offering clear levels for traders to monitor.