Bitcoin and Ethereum users are experiencing exceptionally low fees, but why? While this may seem like good news for users, it prompts a deeper examination of the factors driving these fee reductions and their potential long-term impacts.”

On June 23, the average Bitcoin (BTC) transaction fee dropped to an eight-month low of $1.93. Likewise, Ethereum (ETH) transaction fees were $0.70 on June 22, a stark contrast to the highs of $2.50 seen as recently as March.

Vitali Dervoed, the CEO and co-founder of the onchain decentralized exchange Spark, told Cointelegraph, “The drop in Bitcoin transaction fees is largely tied to reduced network congestion and an adjustment in mining activities following the latest halving event.”

Dervoed, with over a decade of experience in financial institutions, fintech ventures, and DeFi, noted that this drop was not entirely unexpected. “[The] halving often leads to a temporary decrease in mining activity as miners adjust to lower profitability. This reduction in activity can decrease the competition for block space, thereby lowering fees,” he said.

Potentially Bad News for Bitcoin Miners

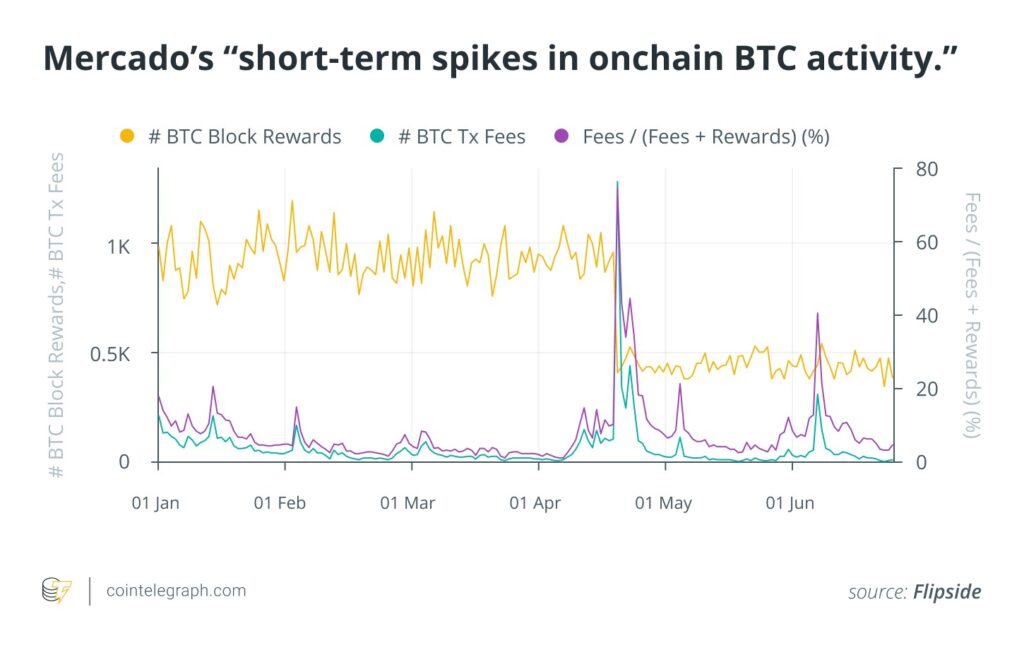

While the drop in fees is good news for users, it poses challenges for miners. Mercado pointed out that “BTC fees [were] making up for lost block rewards,” at least until recently. He added, “Long term, for Bitcoin to remain secure, miners performing proof-of-work must be able to recoup their real-world electrical/compute costs. With halvings reducing their revenue in half overnight, the only way to compensate for the loss is higher prices or more revenue from [transaction] fees.”

D’Anethan echoed similar concerns. He noted that whether fees were up or down had little direct impact on Keyrock, but other miners might be feeling the pinch. “From our perspective, this [low fees] is neither positive nor negative,” he said. “Bitcoin endures as is […] Miners must be feeling the pain, though, as the blow the halving must have dealt them was, for a while, softened by the higher transaction count.”

D’Anethan observed that some miners are already selling BTC to compensate for lower gains and cover expenses.

Low Bitcoin And Ethereum Fees Linked to Dencun Update

In contrast to Bitcoin’s fee reduction due to the halving, Ethereum’s low fees stem from the Dencun update in March. D’Anethan added, “The perverse but obvious dynamic has always plagued Ethereum that if more people want to use the network, it also becomes more expensive and so makes less people want to use it, which in turn would make it cheaper.”

Ethereum traffic has largely shifted to layer-2 solutions like Arbitrum, Optimism, and Base, as intended. “The Dencun upgrade aimed at making layer-2 activity much cheaper […] this has pushed both builders and users away,” said d’Anethan.

Vitali Dervoed agreed, noting that this move is driving fees down. “Ethereum’s fee decline is primarily a result of the increasing adoption of L2 solutions, such as Optimistic and zero-knowledge rollups. With most complex operations and derivative trading moving to these L2 platforms, Ethereum’s main chain is becoming more streamlined for basic transactions, resulting in lower fees,” he said.

Are Low Transaction Fees Good News?

The interpretation of low fees varies depending on perspective. Dervoed sees it as a positive development for the ecosystems. “Lower fees can be seen as bullish signals for the ecosystems. The shift toward efficient L2 solutions marks significant progress in Ethereum’s scalability and advanced technology roadmap. This positions it as a more adaptable framework for future applications,” he said.

However, there are varying interpretations of the sustainability of this low-fee environment. Dervoed added, “The ecosystem may see periodic fluctuations due to mining economics and network activity changes. However, for Ethereum, the low fees are likely to persist as the adoption and development of layer-2 solutions continue to grow, enhancing the network’s capacity and efficiency without sacrificing security.”

D’Anethan highlighted the volatile nature of the crypto sector, stating, “Without a clear catalyst for either ecosystem, Bitcoin or Ethereum, it’s hard to imagine the transaction count and ensuing fees going up in any significant fashion. Crypto remains a very volatile and fast-paced sector, where new memes, new products, new hypes can take on in a flash.”

Low Bitcoin And Ethereum Fees –The Contrarian View

While Dervoed and d’Anethan were optimistic about low fees, Mercado was cautious. He said, “The same trend on Bitcoin and Ethereum (L1 fees are dropping) have arguably similar bearish interpretations. BTC is issuing $27 million per day worth of BTC to miners, with only about 5% of that matched with direct [transaction] fees.”

Mercado warned that continuous halvings might force miners to scale back proof-of-work activities if fees or prices don’t rise.

For Ethereum, he noted that issuance might outstrip burns, leading to long-term ETH inflation. “The burn occasionally exceeds issuance, but not recently, as so much activity has compressed on L2s,” he said. This could result in less security if consensus centralizes over time due to Ethereum’s proof-of-stake mechanism.

While lower transaction fees present opportunities for Bitcoin and Ethereum users, they also bring challenges for miners and raise questions about the long-term sustainability of these networks. For more updates, stay tuned to BIT Journal.