On Tuesday, both Bitcoin (BTC) and Ethereum (ETH) ETFs experienced significant outflows. Bitcoin ETFs alone saw a staggering $242.6 million withdrawn, reversing the recent positive market trend and causing a sharp decline in the value of crypto assets. These developments came in the wake of escalating tensions in the Middle East, as Iran’s missile attacks on Israel triggered serious volatility in the crypto markets.

A Historic Day for Crypto ETFs

U.S.-based Bitcoin ETFs recorded one of their worst days in history. According to SoSoValue, a total of $242.6 million was pulled out on this single day, marking the largest outflow since September 3. As a result, Bitcoin’s value dropped by approximately 6%, falling to $60,300. This decline effectively erased nearly all the gains the cryptocurrency had made following the U.S. Federal Reserve’s interest rate cut last month.

Middle East Tensions Shake Investor Confidence

The rising tensions in the Middle East have significantly impacted markets. Iran’s launch of nearly 200 ballistic missiles at Israel disrupted the sense of security within the markets. This attack followed Israeli military operations against Hezbollah in Lebanon. Israeli Prime Minister Benjamin Netanyahu vowed a strong response, and the markets reacted accordingly. Historically, October is a month when Bitcoin often experiences significant gains. However, this year, the anticipated “Uptober” has fallen short, with Bitcoin losing 2.6% of its value since the start of the month.

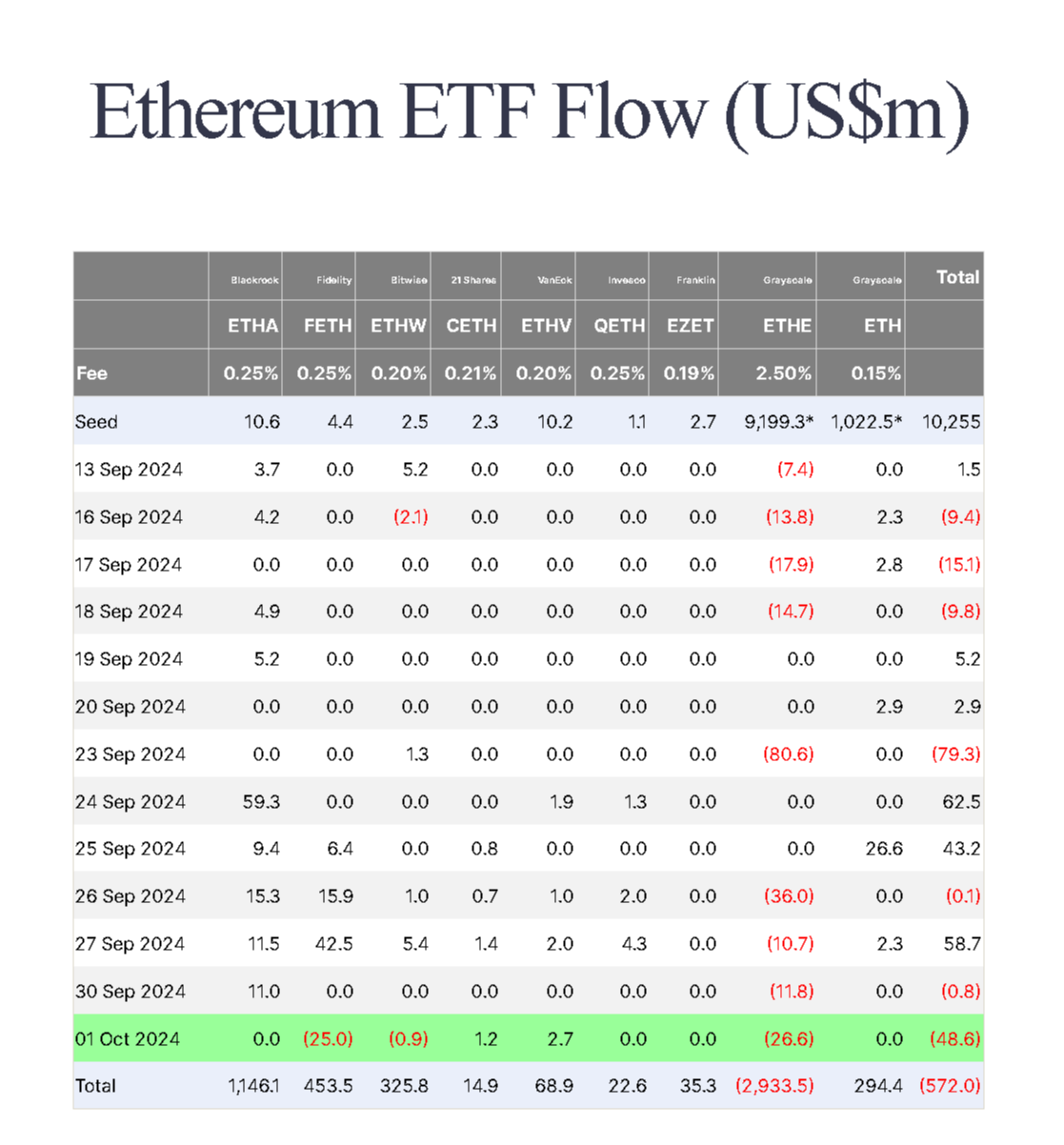

Ethereum ETFs Face Similar Pressure

It wasn’t just Bitcoin; Ethereum ETFs also saw major outflows on Tuesday. A total of $48.5 million was withdrawn from U.S.-based Ethereum ETFs, marking the worst day since September 23. Notably, Fidelity Ethereum Fund (FETH) experienced an outflow exceeding $25 million. Additionally, Grayscale Ethereum Trust (ETHE) and Bitwise Ethereum ETF (ETHW) saw outflows of $26.6 million and $0.9 million, respectively.

Despite this negative trend, some Ethereum ETFs saw modest net inflows. The 21Shares Core Ethereum ETF (CETH) and VanEck Ethereum ETF (ETHV) recorded positive net inflows of $1.2 million and $2.7 million, respectively. However, the overall Ethereum ETF market remains under significant pressure, with Grayscale’s ETHE continuing to hold the record for daily outflows.

The Bigger Picture for Bitcoin and Ethereum

As for the Bitcoin ETF market, it followed a similar trajectory to Ethereum. On October 1, Bitcoin ETFs recorded a total outflow of $242.6 million, one of the largest outflows in the past month. The Fidelity Wise Origin Bitcoin Fund (FBTC) led this trend with a withdrawal of $144.7 million, followed by the ARK 21Shares Bitcoin ETF (ARKB) with an outflow of $84.3 million. Following these outflows, Bitcoin’s price dropped from $61,474 to $60,300 but has since slightly rebounded to $61,750 at the time of writing.

These significant outflows in Bitcoin and Ethereum ETFs highlight the vulnerability of the cryptocurrency markets to geopolitical events. In addition to the Middle Eastern tensions, global economic fluctuations continue to reduce investor risk appetite. Despite the optimism following the Federal Reserve’s interest rate cuts, investors remain cautious. Ultimately, these massive outflows serve as a reminder of the impact volatility and geopolitical risks can have on the crypto markets.

- https://twitter.com/Thebitjournal_

- https://www.linkedin.com/company/the-bit-journal/

- https://t.me/thebitjournal

Follow us on Twitter and LinkedIn and join our Telegram channel to be instantly informed about breaking news!