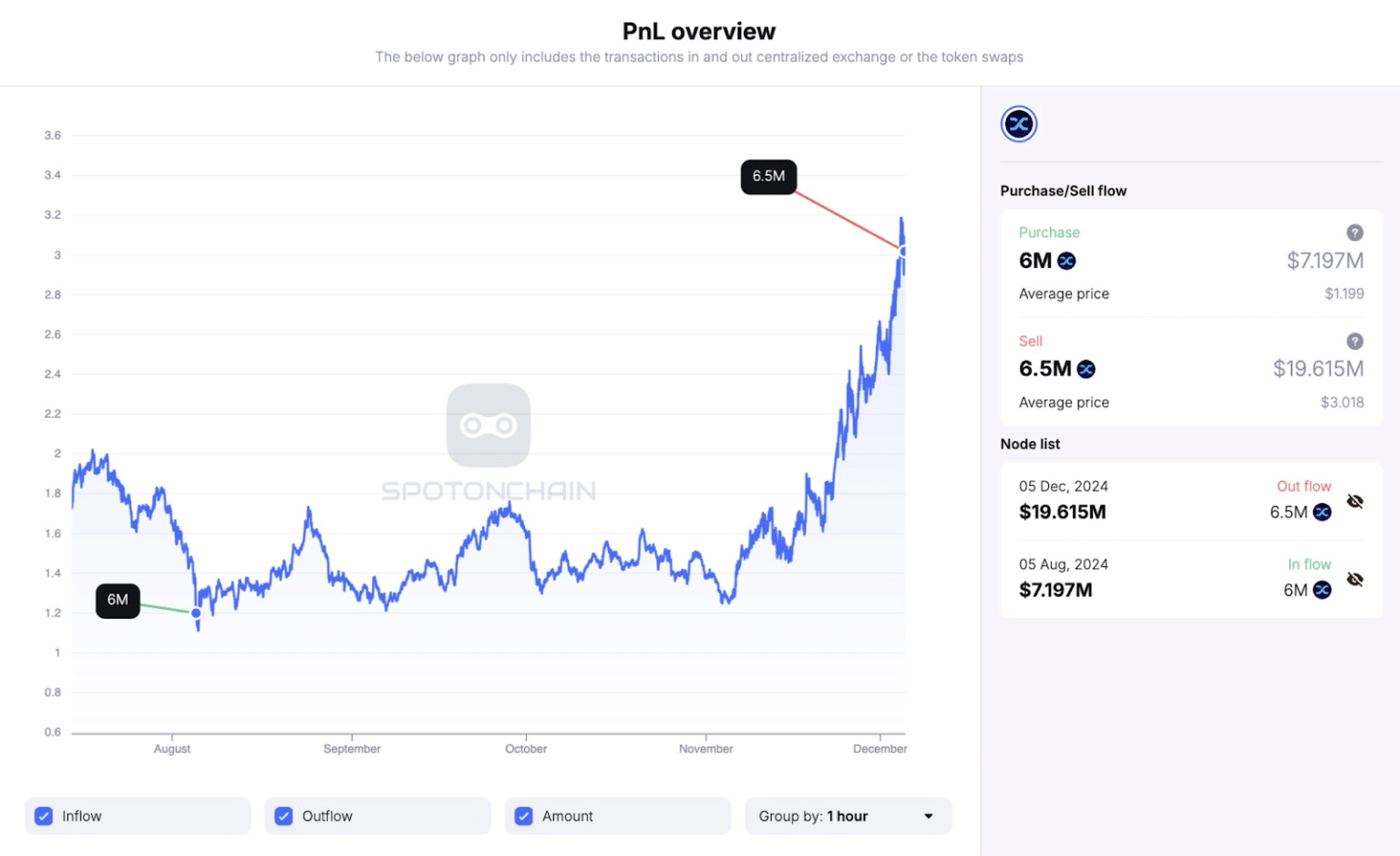

Leading crypto venture firm Framework Ventures, known for its substantial investment in Synthetix (SNX), has taken a significant step by transferring 6.5 million SNX tokens to Coinbase Prime. This move strongly suggests a profit-taking strategy following SNX’s recent price surge.

Framework Ventures Transfers SNX Tokens to Coinbase Prime

As The Bit Journal highlights, the crypto market is entering a profit-taking phase after its latest rally. This aligns with Bitcoin’s dip below $100,000 and large investors cashing in on gains. Framework Ventures’ deposit comes just four months after withdrawing 6 million SNX tokens, then valued at $7.2 million, during a market dip.

Now, the same tokens are worth $10.9 million, reflecting a 152% profit. With SNX’s market capitalization soaring by 129% in the last 30 days, Framework Ventures is capitalizing on the accrued gains. At the time of writing, SNX trades at $3.24.

Framework Ventures’ Long-Term Position in Synthetix

Despite the recent sale, Framework Ventures remains a key player in Synthetix, holding 17.9 million SNX tokens worth approximately $54 million. This significant stake underscores the firm’s commitment to Synthetix and its belief in the long-term potential of decentralized finance (DeFi).

As the broader crypto market stabilizes, Framework Ventures’ strategic actions showcase its dual approach: short-term profit-taking while maintaining a strong presence in key ecosystems like Synthetix.

Other Strategic Whale Moves in the Market

SNX isn’t the only token under selling pressure. Spot On Chain analysis reveals another whale recently deposited $7.3 million worth of PEPE tokens into Kraken, realizing a 31x profit. The whale acquired the tokens for just $237,000 in September 2023 and strategically offloaded them across decentralized exchanges (DEXs) and Kraken, netting $7.54 million by February 2024.

These examples of whale activity emphasize the tactical maneuvers shaping the crypto landscape. As The Bit Journal notes, understanding these moves can provide valuable insights for retail and institutional investors alike.

- https://twitter.com/Thebitjournal_

- https://www.linkedin.com/company/the-bit-journal/

- https://t.me/thebitjournal

Follow us on Twitter and LinkedIn and join our Telegram channel to get instant updates on breaking news!