Ethereum price prediction has lately shown strong indications that its climb may be far from finished. A steep reduction in exchange reserves, more than 1 million ETH removed in the last month, combined with record ETF inflows and soaring derivative transactions, reinforces one of the most attractive bullish setups this year.

Exchange Reserve Collapse Points to Institutional Accumulation

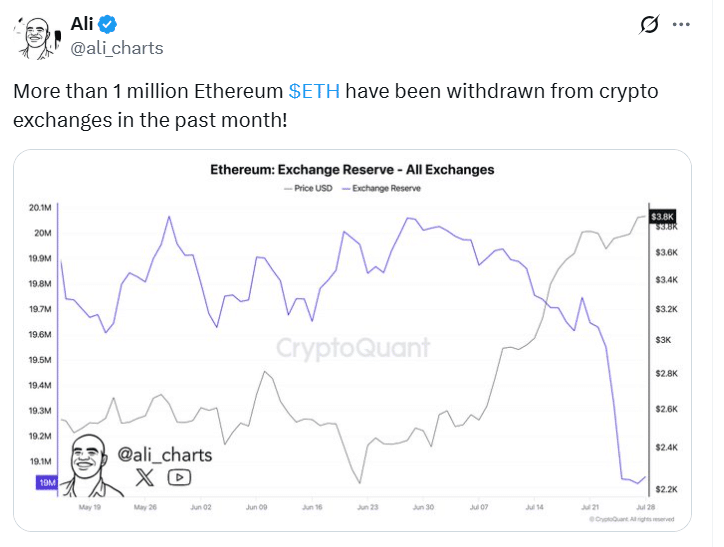

Recent weeks have seen over 1 million ETH withdrawals from centralized exchanges, according to on-chain indications. When major holders migrate tokens to cold wallets or staking systems, selling pressure is reduced.

Analysts see this as an indication of long-term stockpiling and a decline in floating supply. One analyst remarked that investors are “shifting assets into self-custody,” reducing market liquidity options.

ETF Capital Floods In, Reinforcing Bull Case

Institutional demand for spot Ethereum ETFs remains extremely high. In July, net inflows exceeded $5 billion, with single-day inflows approaching $533 million. BlackRock’s ETHA fund contributed significantly to this total.

As ETF AUM approaches $10 billion, fund inflows drive open market purchases, resulting in price increases. Experts believe that this increase will support any Ethereum price prediction that anticipates additional gains.

Derivatives Activity and Technical Momentum

Ethereum price prediction retraced from near-term highs, while futures volume increased by over 28%. Open interest only marginally decreased, suggesting rotation rather than liquidation. Technicals continue positive, with the price hanging above major moving averages and momentum indicators displaying strong MACD alignment.

Analysts believe that short fatigue has led to stabilization, but that further inflows might take ETH toward, and perhaps beyond, the $4,000 level.

Outlook: Bullish Forecasts Echo Across Markets

Price forecasts remain optimistic. One model predicts a year-end range of $4,000 to $6,000 for ETH, while optimistic scenarios put it between $6,000 and $8,000, with extreme projections reaching $10,000 or more. Ethereum price prediction is based on factors such as ETF demand, exchange withdrawals, staking yield potential, and on-chain development. New regulatory clarification and anticipated ETF staking clearance may bolster bullish optimism.

Price Table: Key Forecast Ranges

| Forecast Scenario | ETH Price Range |

|---|---|

| Baseline prediction | $4,000 – $6,000 |

| Moderate bull | $6,000 – $8,000 |

| Aggressive bull / Supercycle | $10,000 or above |

New Developments Strengthening the Case

Corporate Treasury ESG Shift Toward Ethereum

Corporations are increasingly using Ethereum as a treasury asset. Companies such as BitMine Immersion and SharpLink Gaming now own hundreds of millions of ETH, frequently staking chunks to create returns. Tom Lee of Fundstrat aims to stake 5% of the Ethereum supply, and investors linked to Peter Thiel and Cathie Wood support this effort.

Underground Whale Accumulation and Structural Supply Squeeze

Since early July, whale addresses and institutional wallets have contributed over $2.5 billion of ETH, contributing to an optimistic Ethereum price prediction.

What Analysts Are Saying (Expert Views)

Financial experts argue that less liquid supply, along with consistent ETF demand, provides a favorable environment for growth. Technical analysts at TradingNEWS recommend buying dips between $3,200-$3,400, noting ETH’s long-term setup and ability to recapture new highs by Q4. Others cite the Pectra upgrade and automated fee burn as sources of deflationary pressure.

For Traders and Investors: Why Now Could Be a Strategic Entry Point

Retail and institutional participants are aligned as inflows stay constant, on-chain data indicates long-term accumulation, and support mechanisms such as staking yield are pending regulatory clearance. Market mood is still cautiously positive, with low exchange reserves implying minimal negative conviction.

Those trying to develop positions may see falls around $3,700 as strategic chances, while waiting for a short squeeze near $4,000 caused by margin liquidations.

Conclusion on Ethereum Price Prediction

According to financial headlines in the United States, Ethereum’s prognosis is becoming progressively favorable. Exchange outflows, institutional ETF demand, corporate treasury adoption, whale accumulation, and technical alignment all contribute to more accurate Ethereum price prediction.

While macroeconomic risks persist, ETH’s internal dynamics indicate a compelling future. If inflows and accumulation continue and staking is legalized, Ethereum might reach new all-time highs by late 2025 or later.

For more crypto predictions, visit our platform.

FAQs

What is exchange reserve and why does it matter?

Exchange reserve refers to ETH held on centralized platforms. A decline signals less immediate sell pressure and increased long‑term holding.

Why are ETF inflows so important?

When funds receive capital, they must buy ETH in open markets, creating buying pressure that supports price gains.

Could ETH hit $10,000?

Aggressive models suggest yes. Combined institutional demand, staking yield prospects, and supply tightening could support such targets.

What risk factors could derail this?

Macroeconomic shocks, regulatory setbacks, or negative on‑chain events (like protocol exploits) could reverse momentum.

Glossary

Exchange reserve: Amount of ETH stored on centralized exchanges.

Open interest: Outstanding futures contracts not yet settled.

ETF inflows: Net capital entering ETH-based funds.

Pectra upgrade: Recent Ethereum protocol update enabling gas-paid-in-other-tokens and auto-fee burning.

Staking yield: Reward earned by validating transactions on a proof-of-stake network.