The crypto market experienced an extreme shake-up, with $863.08 million in liquidations over the past 24 hours, reportedly affecting nearly 191,903 traders. Sources say this sudden surge in liquidations was triggered by Donald Trump’s announcement of a U.S. Crypto Strategic Reserve, designed to strengthen the country’s stance on digital assets. As traders reacted to this policy shift, both long and short positions were wiped out, leading to one of the largest liquidation events in months.

Among the market-wide liquidations, the most significant occurred on Binance’s BTCUSDT trading pair, where a single trader reportedly lost $15.49 million. This massive wipeout highlights the high volatility and risk exposure in the current market environment. As the crypto industry adjusts to shifting regulatory narratives, traders continue to experience sharp price swings, reinforcing the need for risk management strategies in leveraged trading.

How the Liquidations Played Out: Longs vs. Shorts

The liquidation frenzy affected both long (bullish) and short (bearish) positions, demonstrating how high leverage can lead to market chaos. While long traders lost $298.66 million, the majority of liquidations—$547.17 million—came from shorts, as Trump’s announcement fueled rapid price surges. This event underscores the dangers of over-leveraging, especially in highly reactive news-driven markets where policy shifts can cause unexpected price movements. The market saw a massive liquidation wave, affecting both bullish (longs) and bearish (shorts) positions.

Total Liquidations Breakdown:

- Total Market Liquidations: $863.08M

- Longs Liquidated: $298.66M

- Shorts Liquidated: $547.17M

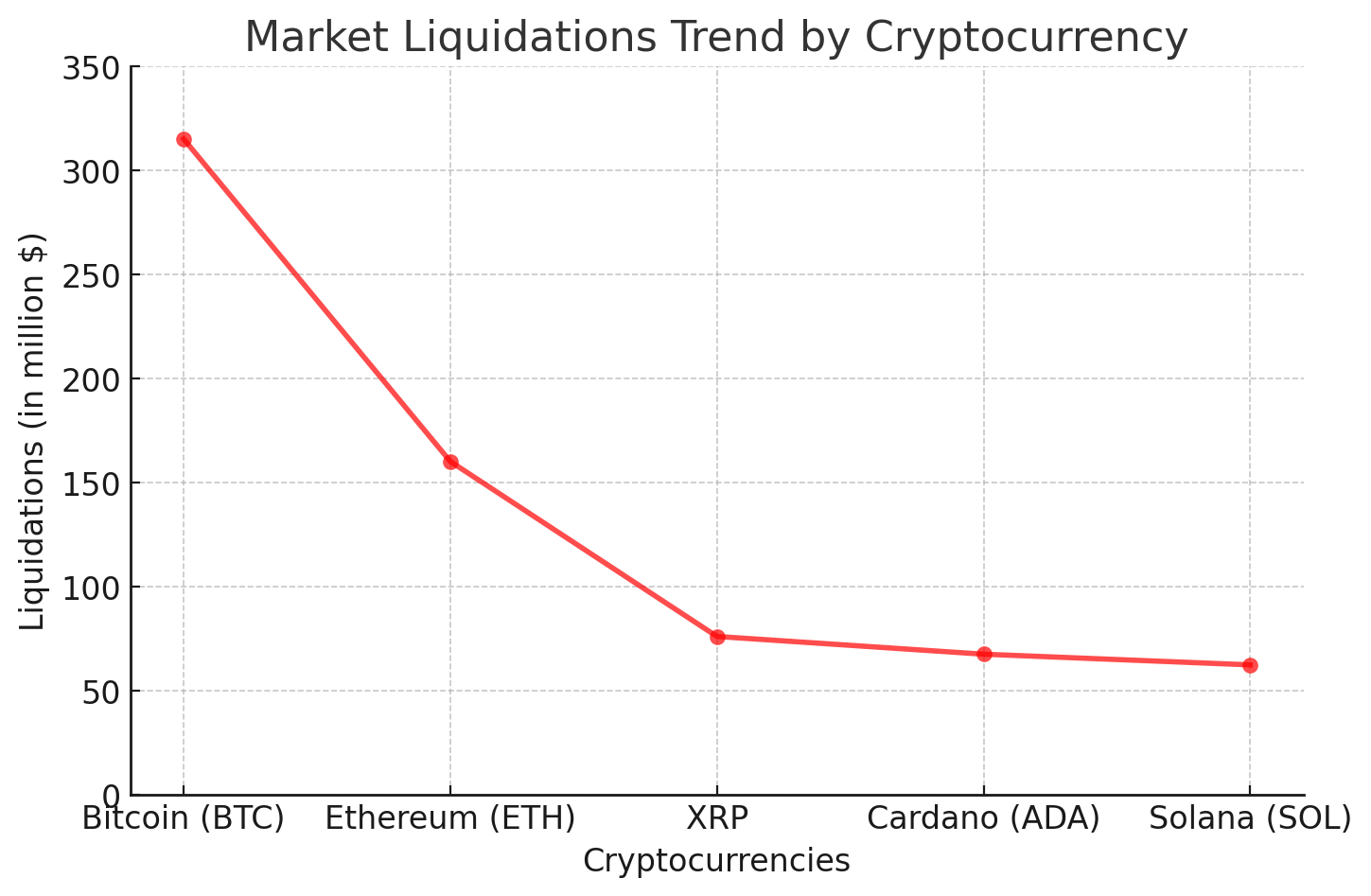

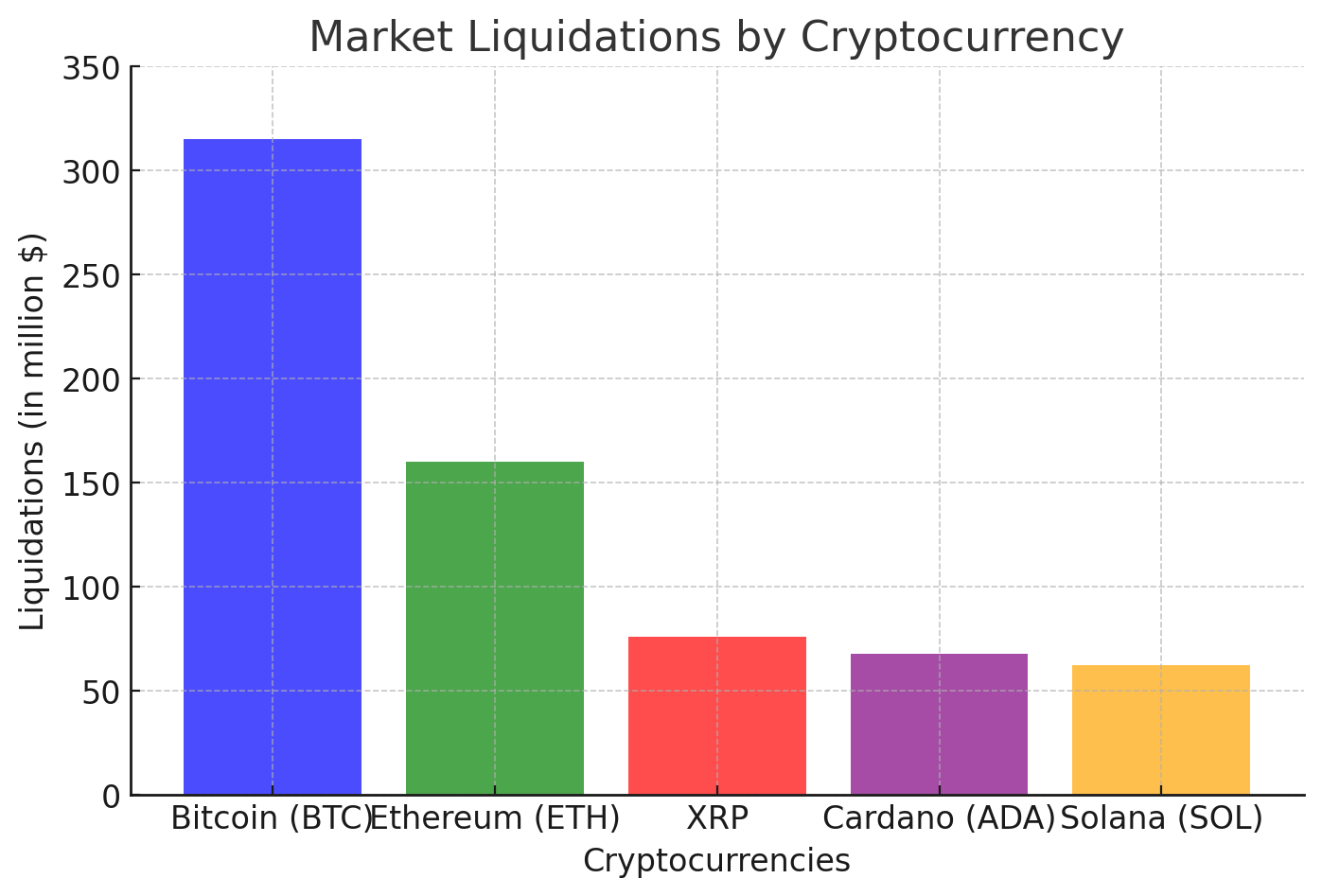

Liquidation Breakdown by Cryptocurrency

The impact of Trump’s crypto reserve plan was widespread, hitting multiple digital assets. Bitcoin (BTC) led the liquidations with $315.14 million, while Ethereum (ETH) followed with $160.23 million. Other major altcoins, including XRP ($76.13M), Cardano ($67.61M), and Solana ($62.48M), also suffered heavy losses. The liquidation breakdown reveals how policy-driven market reactions create ripple effects across multiple assets, reinforcing the interconnected nature of crypto markets.

Bitcoin (BTC) Liquidations:

- Total: $315.14M

- Longs Liquidated: $73.30M

- Shorts Liquidated: $241.84M

Ethereum (ETH) Liquidations:

- Total: $160.23M

- Longs Liquidated: $73.98M

- Shorts Liquidated: $86.24M

XRP (XRP) Liquidations:

- Total: $76.13M

- Longs Liquidated: $31.92M

- Shorts Liquidated: $44.21M

Cardano (ADA) Liquidations:

- Total: $67.61M

- Longs Liquidated: $31.24M

- Shorts Liquidated: $36.38M

Solana (SOL) Liquidations:

- Total: $62.48M

- Longs Liquidated: $24.71M

- Shorts Liquidated: $37.77M

Trump’s Crypto Strategic Reserve Plan Sends Shockwaves

This marketwide liquidation spree was allegedly fueled by Donald Trump’s announcement on Truth Social on March 2, 2025. Trump revealed plans to establish a U.S. Crypto Strategic Reserve, aiming to boost digital assets after years of suppression under the Biden administration.

Trump’s Endorsement of Major Cryptocurrencies

In his post, Trump explicitly mentioned XRP, Solana, and Cardano as key assets in his crypto reserve initiative, later expanding his support to Bitcoin and Ethereum, stating that he’s a fan of them all.

Macro analyst Greg Foss commented on the move:

“Trump’s pro-crypto stance could accelerate institutional adoption in the U.S. If a digital asset reserve becomes reality, it could shift global demand in a big way.”

Market strategist Alex Krüger noted:

“The market reacted instantly. Shorts got obliterated as Trump’s statement ignited a surge in bullish sentiment. It’s a turning point for U.S. crypto policy.”

How the Crypto Market Reacted

Trump’s announcement acted as a catalyst, forcing short sellers to exit their positions rapidly, triggering a massive short squeeze. As short liquidations piled up, prices surged, further compounding the liquidations of traders betting against the market.

Expert Insights: Is This the Start of a Policy-Driven Crypto Boom?

Trump’s crypto reserve proposal has raised significant debate among analysts and industry leaders. While some believe it could accelerate mainstream adoption, others warn of potential regulatory risks. Experts weigh in on the potential long-term impact of Trump’s pro-crypto stance, analyzing whether this marks the beginning of a new policy-driven bull cycle or simply a short-term market reaction. The key question remains—will Trump follow through with this plan, or is this just political rhetoric?

Former CFTC Chairman Chris Giancarlo weighed in:

“If the U.S. seriously backs a digital asset reserve, it legitimizes crypto as a strategic financial tool. This would be a massive shift in regulatory perception.”

Crypto analyst Adam Cochran added:

“The liquidation numbers show the market is still highly reactive to government policies. If Trump follows through with this initiative, we could see sustained bullish momentum.”

Economist Raoul Pal highlighted potential long-term implications:

“A crypto reserve means the U.S. would be treating digital assets as part of its economic future. The question is—will this lead to further government accumulation?”

Final Verdict

The $863M liquidation event underscores how government actions can instantly reshape crypto markets. Trump’s pro-crypto stance has already created a new wave of market momentum, and if the Crypto Strategic Reserve becomes a reality, it could signal a significant policy shift in the U.S. toward embracing digital assets as a national economic tool.

For now, traders must navigate extreme volatility, as policymaker-driven price swings become a growing force in crypto markets. Whether this pump is temporary or the start of a new bull phase will depend on the Trump administration’s follow-through on its crypto commitments.

The BIT Journal is available around the clock, providing you with updated information about the state of the crypto world. Follow us on Twitter and LinkedIn, and join our Telegram channel.

FAQs

1. Why did Trump’s announcement cause a crypto market surge?

Trump’s statement about a U.S. Crypto Strategic Reserve sparked bullish sentiment, forcing short sellers to exit and leading to a massive liquidation event.

2. How much money was liquidated due to Trump’s statement?

In the past 24 hours, the crypto market saw $863.08 million in liquidations, impacting nearly 191,903 traders across Bitcoin, Ethereum, XRP, Solana, and other major assets.

3. What is crypto liquidation?

A liquidation happens when a trader’s leveraged position is automatically closed due to insufficient margin, forcing the sale of assets at market price.

4. What’s next for crypto after Trump’s announcement?

If the Crypto Strategic Reserve proposal moves forward, it could increase government involvement in digital assets, potentially leading to higher institutional demand and regulatory clarity.

Glossary

Crypto Strategic Reserve: A proposed U.S. government-held reserve of digital assets aimed at supporting the crypto economy.

Liquidation: Forced closing of leveraged positions when traders fail to meet margin requirements.

Short Squeeze: A rapid price surge caused by the mass liquidation of short positions.

Long Position: A bet that an asset’s price will increase.

Short Position: A bet that an asset’s price will decrease.