The cryptocurrency market is experiencing one of its most volatile weeks in months, as traders react to growing uncertainty around a potential U.S. Crypto Reserve. Per our previous reports, as proposed by President Donald Trump, this initiative aims to position the U.S. as a leader in digital assets. However, skepticism is rising over its potential impact—will it legitimize crypto on a national scale, or will it serve as a tool for market manipulation?

The bigger concern among investors is how this reserve might be structured. Which assets will be included? While Bitcoin, Ethereum, XRP, Solana, and Cardano are leading contenders, many argue that political favoritism and market control strategies could skew the selection. Meanwhile, Trump’s escalating tariff policies on Canada, Mexico, and China are also rattling markets, adding another layer of uncertainty.

As debates heat up, Bitcoin struggles to find stability, dipping below $85K again after briefly reclaiming $91K. Traders remain divided on whether this is a buying opportunity or the start of a prolonged bearish phase.

Altcoins in Freefall—AI and Layer 2 Tokens Hit Hardest

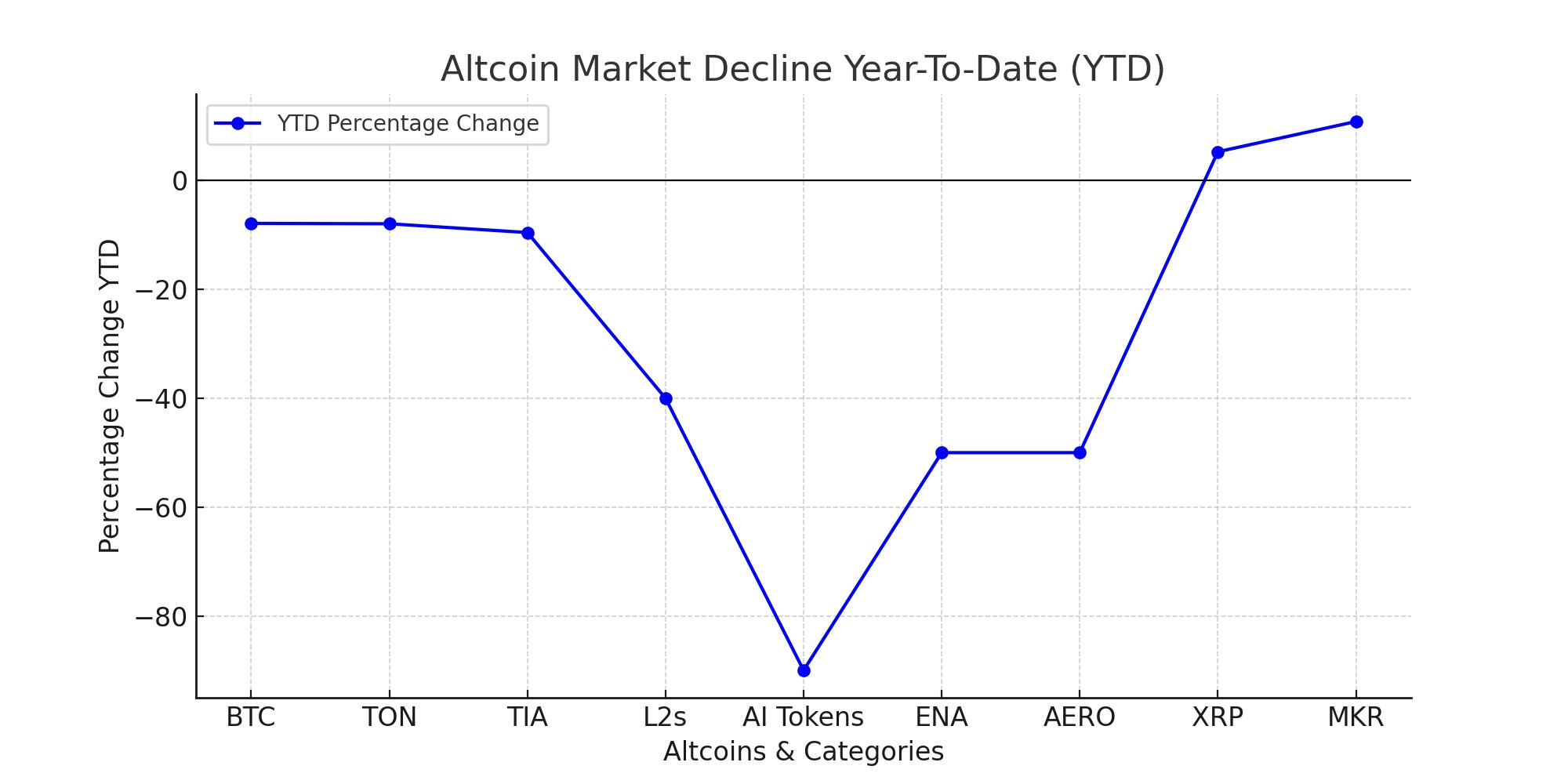

Altcoins are facing brutal losses, with most Layer 1 projects deep in the red for the year. XRP (+5.3%) stands as the lone exception, showing resilience despite the broader downturn. In contrast, Bitcoin (-7.87%), TON (-7.94%), and TIA (-9.55%) have all suffered significant declines.

Layer 2 solutions have been hit even harder, with some AI-driven projects plunging nearly 90% from their highs. Ethereum’s on-chain activity is slowing, with median gas fees dropping to just 1 GWEI—the lowest level in over a year. Even as Ethereum Layer 2 networks like Base remain active, overall market participation appears to be fading.

The DeFi sector has also seen heavy losses, except for Maker (MKR), which is up 10.85% thanks to its growing adoption of USDS stablecoin integration. Meanwhile, ENA and AERO—once DeFi favorites—have collapsed, losing over 50% year-to-date (YTD).

This pattern reflects an overall shift in market sentiment: investors are prioritizing capital preservation over speculative gains, opting for stablecoin yield farming rather than chasing risky altcoin pumps.

Bitcoin Struggles Below $85K—Where Is It Headed Next?

Bitcoin’s price action continues to frustrate traders, as the flagship cryptocurrency remains trapped in a volatile range. After failing to hold above $91K, BTC has slipped back to $85K, fuelling concerns that a deeper correction may be ahead.

Market analysts remain divided over the short-term outlook. Some believe this dip is part of a bearish retest, potentially leading to further downside. Others argue that Bitcoin’s re-entry into its previous range suggests that a recovery may be just around the corner.

According to blockchain analytics firm Nansen, short-term price action remains weak despite institutional adoption trends. Traders are becoming more risk-averse, shifting focus to longer-term plays and yield-generating assets rather than attempting to time the market’s next big move.

With altcoins bleeding and Bitcoin struggling to hold key levels, the crypto market remains in a holding pattern until a clearer trend emerges.

Expert Insights: How the U.S. Crypto Reserve Debate Is Shaping Market Sentiment

As uncertainty grips the crypto market, analysts and traders are weighing in on the potential impact of a U.S. Crypto Reserve. While some experts see it as a game-changer for institutional adoption, others warn that it could centralize control and increase market manipulation risks. With Bitcoin struggling below $85K and altcoins facing sell-offs, experts share their perspectives on where the market is headed next.

Blockchain Analyst, Kevin Carter:

“The uncertainty around Trump’s crypto policies is keeping traders on edge. The market wants regulatory clarity before making any major moves.”

Crypto Trader, Elaine Murphy:

“Bitcoin’s failure to hold $91K is concerning, but as long as it stays above $80K, bulls have hope. If it breaks lower, expect a sharper sell-off.”

DeFi Strategist, Paul Matthews:

“Layer 2 and AI tokens are suffering because traders are moving capital to safer assets. The trend of yield farming over high-risk trading will likely continue until the market stabilizes.”

Final Verdict: Will the Crypto Market Recover or Sink Further?

The debate over the U.S. Crypto Reserve, combined with Trump’s tariffs and market manipulation fears, has created an atmosphere of extreme uncertainty. Bitcoin’s struggle below $85K is weighing heavily on sentiment, while altcoins remain deep in the red. Traders should expect heightened volatility and unpredictable market swings until regulatory clarity improves and Bitcoin reclaims key support levels.

Some see the current dip as a chance to accumulate BTC, SOL, and TIA, while others warn that further downside is possible.For now, the crypto market remains in limbo, waiting for a clear trend reversal before making its next decisive move.

The BIT Journal is available around the clock, providing you with updated information about the state of the crypto world. Follow us on Twitter and LinkedIn, and join our Telegram channel.

FAQs

1. What is the U.S. Crypto Reserve, and how will it impact the market?

The U.S. Crypto Reserve is a proposed government-backed fund that may hold Bitcoin, Ethereum, XRP, Solana, and Cardano. While some see it as legitimizing digital assets, others fear it could lead to market manipulation by centralized control.

2. Why are AI and Layer 2 tokens crashing more than Bitcoin?

AI and Layer 2 tokens are high-risk assets, and investors are shifting towards safer assets like BTC and stablecoins. Many AI projects have dropped over 90% from their highs, reflecting low confidence in speculative sectors.

3. Should traders buy Bitcoin now or wait for further dips?

Bitcoin is back in its previous range, but it remains uncertain whether this is a buying opportunity or a bear trap. Traders should monitor BTC’s reaction at key levels like $85K and $80K before making major moves.

4. Will Ethereum’s Layer 2 networks recover soon?

Ethereum’s on-chain activity has slowed, and gas fees are at a yearly low, suggesting reduced market participation. Layer 2 solutions may recover when the broader market stabilizes, but for now, investors are cautious.

Glossary

Crypto Reserve: A proposed U.S. government-backed crypto fund that could influence market liquidity and regulations.

Liquidity Grab: A market move designed to trigger stop-losses before reversing.

Bearish Retest: A price action pattern where assets temporarily recover before continuing downward.

Yield Farming: A DeFi strategy where investors earn passive income by providing liquidity to protocols.

References

Disclaimer

This article is for informational purposes only and does not constitute financial advice. Cryptocurrency markets are highly volatile, and past performance does not guarantee future results. Always do your own research (DYOR) before making any investment decisions.