The cryptocurrency market faced significant volatility today, with Bitcoin (BTC) managing to hold its position around the $60,000 mark, while major altcoins like Ethereum (ETH), Solana (SOL), and XRP experienced notable declines. The global crypto market capitalization also dropped by 0.63%, settling at $2.11 trillion. In addition, total market volume decreased by 11.70%, reaching $81.57 billion.

Bitcoin and Ethereum Lead Market Trends

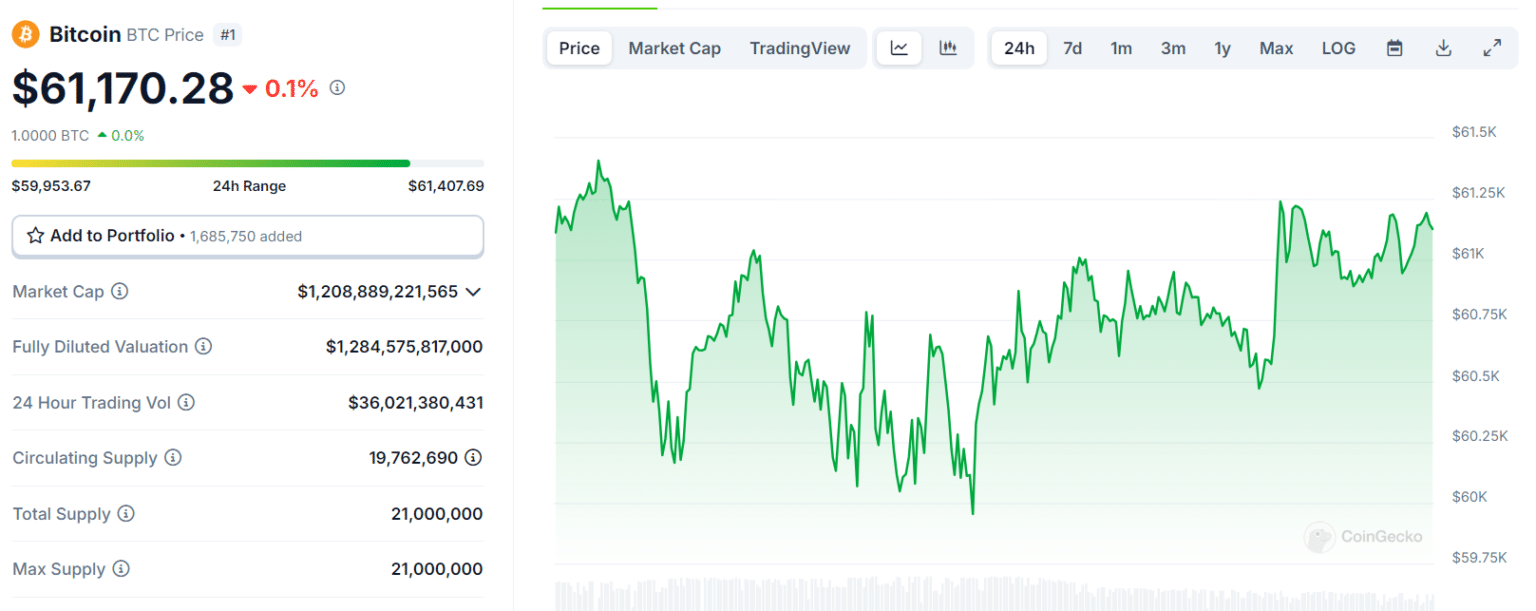

Bitcoin, the leading cryptocurrency, saw a slight decrease of 0.5% over the past 24 hours, with its price landing at $60,943. The day’s low and high were $59,878.80 and $61,469.04, respectively. Interestingly, this dip coincided with a significant outflow of $54.13 million from spot Bitcoin ETF investments. Despite this, Bitcoin’s market dominance rose by 0.19%, reaching 56.97%. Whale Alert, a platform tracking large transactions, reported a surge in whale activity, sparking speculation among market watchers.

Ethereum (ETH) saw a more pronounced drop, falling over 1% to $2,364. Its intraday low and high were recorded at $2,311.03 and $2,402.86. Furthermore, spot Ethereum ETF funds saw a $3.20 million outflow, further contributing to the downward pressure. Large Ethereum transactions were also on the rise, according to Whale Alert, fueling rumors of increased market activity. The market cap of Ethereum dropped to $284.76 billion, underscoring the broader market decline.

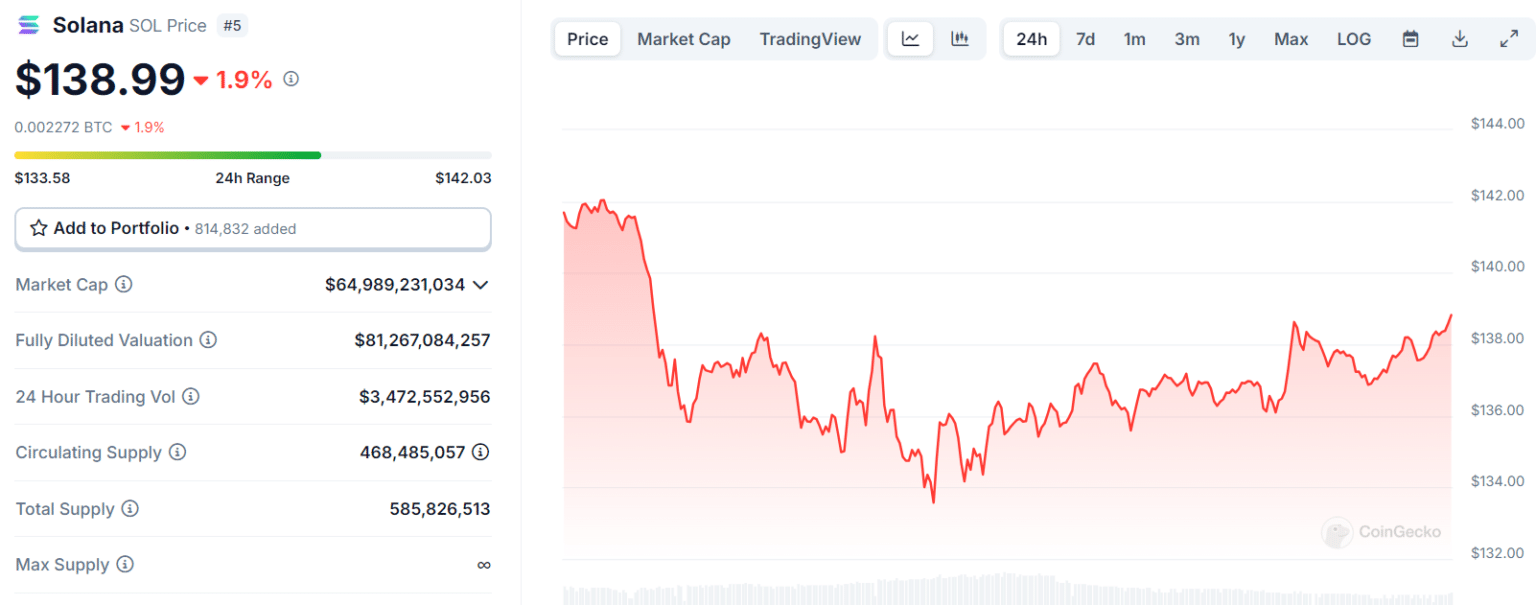

Solana and XRP Under Pressure

Solana (SOL) faced a more dramatic decline, with its price dropping 4% over the past 24 hours to $137.32. SOL’s daily range fluctuated between $133.55 and $142.81, and its market cap decreased to $64.35 billion. These movements reflect the broader market’s ongoing volatility, leaving investors concerned about the future of Solana.

Meanwhile, XRP experienced a 2% drop, trading at $0.5248. Its intraday low and high were $0.5101 and $0.5412, respectively. Whale Alert data revealed significant XRP transfers to exchanges, raising fears of a further price drop. XRP’s market cap fell to $29.69 billion, further heightening concerns about its near-term performance.

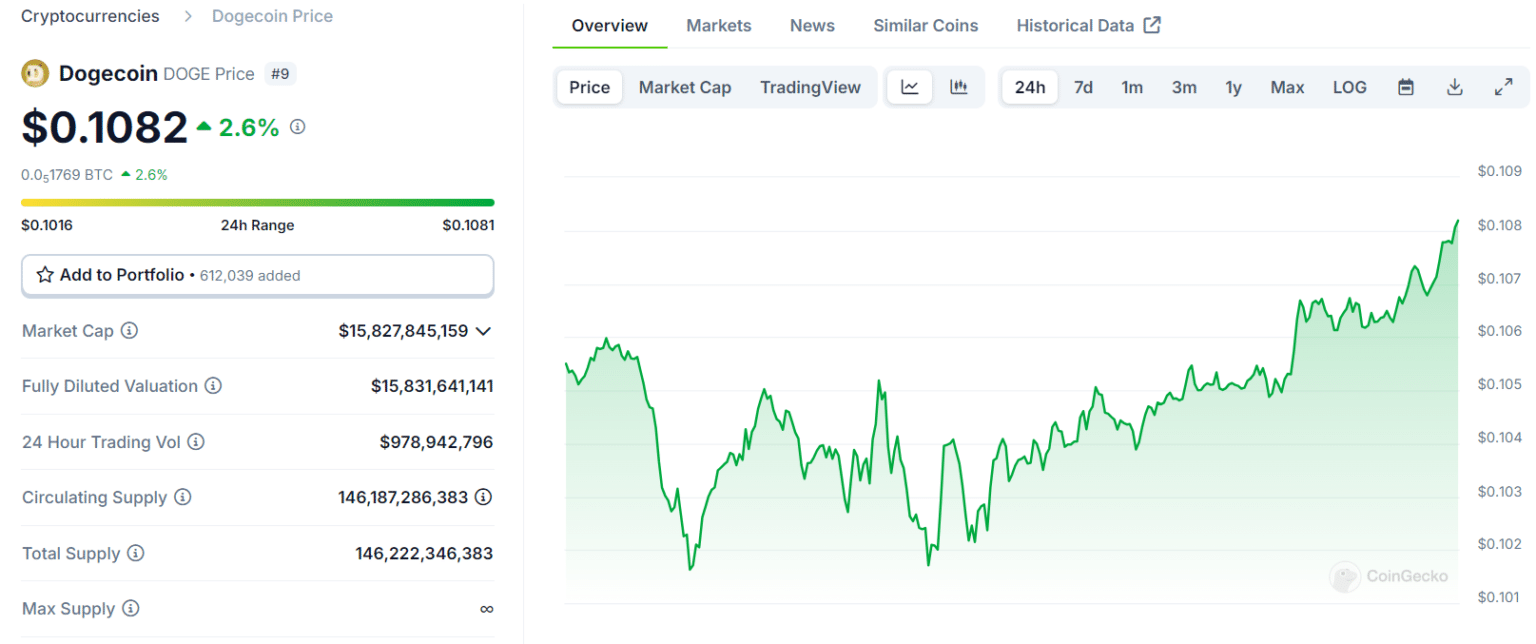

Meme Coins and Top Movers

Meme coins presented mixed performances, with Dogecoin (DOGE) rising by 0.5% to $0.1067, while Shiba Inu (SHIB) declined by 1% to $0.0000165. Other meme coins, such as PEPE, WIF, and BONK, saw steeper drops, ranging between 7% and 12%, signaling their sensitivity to market volatility.

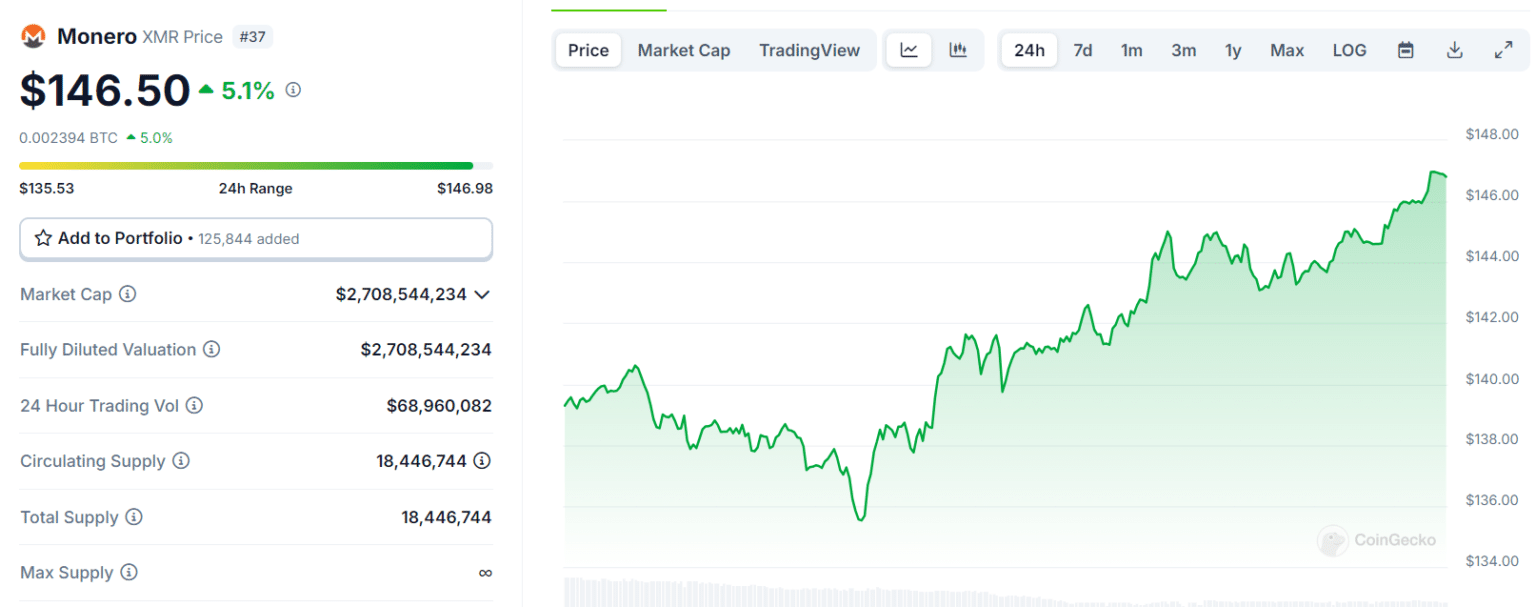

In contrast, Monero (XMR) surged by 4%, reaching $144, with its daily low and high at $135.40 and $145.24, respectively. Similarly, Aave (AAVE) rose by 3%, hitting $146, while Stacks (STX) gained 1%, settling at $1.89. These altcoins managed to defy the broader market trends, posting gains despite the turbulence.

However, not all coins fared as well. Sui (SUI) plummeted by 16%, dropping to $1.63, and Conflux (CFX) fell by 12%, trading at $0.1616. These sharp declines reflect the increasing uncertainty and risk aversion among investors in the current market environment.

- https://twitter.com/Thebitjournal_

- https://www.linkedin.com/company/the-bit-journal/

- https://t.me/thebitjournal

Follow us on Twitter and LinkedIn and join our Telegram channel to be instantly informed about breaking news!