The cryptocurrency market has been shaken today, sparking fresh speculation among global investors. Bitcoin (BTC) has seen its value dip to $61,000, while Ethereum (ETH), Solana (SOL), and XRP have also experienced fluctuations. Despite the broader market downturn, EigenLayer (EIGEN) and FTX Token (FTT) emerged as the top performers of the day.

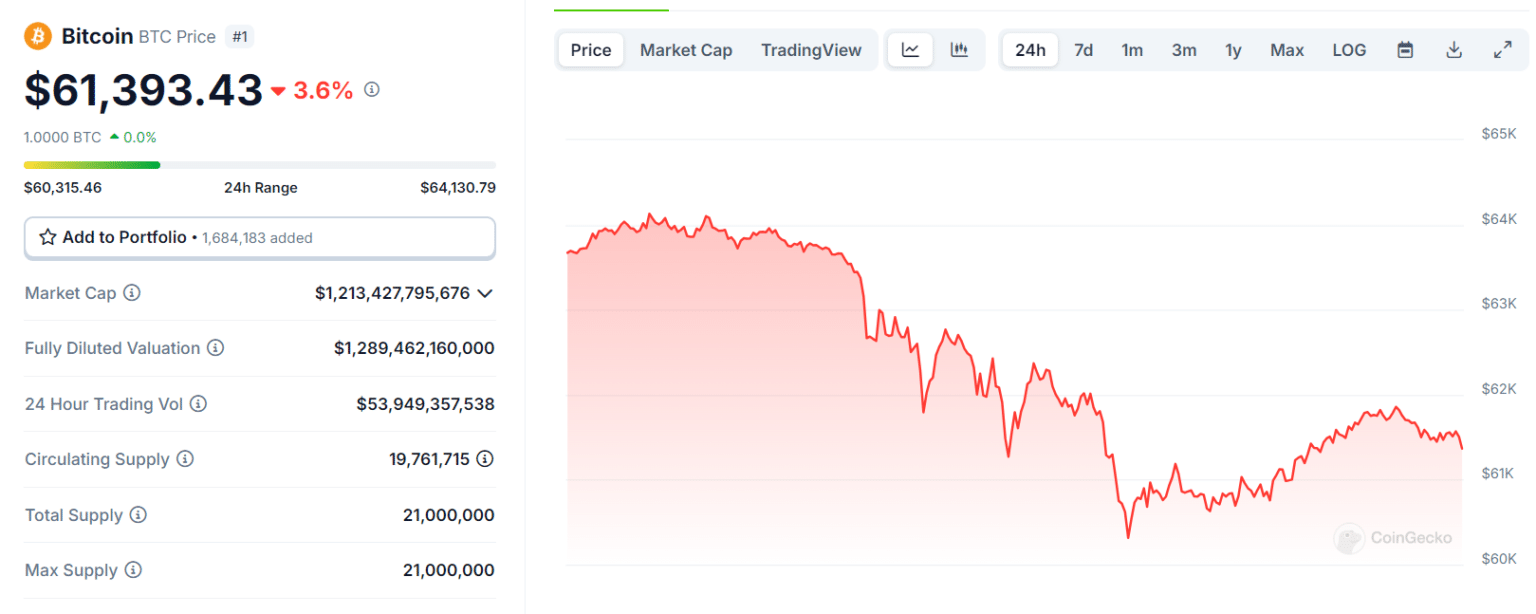

BTC and ETH Price Update

As of today, BTC is trading at $61,867, marking a 3% drop over the past 24 hours. The coin’s lowest and highest intraday levels were $60,189 and $64,110, respectively. Data from The Bit Journal shows that $242.53 million has been withdrawn from Bitcoin ETFs as of October 1st. Despite this, Bitcoin’s market dominance rose by 0.4%, reaching 56.31%. Bitcoin’s total market cap also slipped to $1.22 trillion. Although optimism had been building in recent weeks, Bitcoin is now facing significant downward pressure in line with the broader market decline.

Similarly, ETH has dropped more than 5% in the past 24 hours, currently trading at $2,491. Ethereum’s lowest and highest intraday levels were $2,415 and $2,657, respectively. The coin’s market cap has fallen to $299.88 billion. With $48.52 million flowing out of spot Ethereum ETFs, the price drop has been further accelerated. However, long-term investors remain hopeful for a recovery in both Bitcoin and Ethereum, despite current market trends.

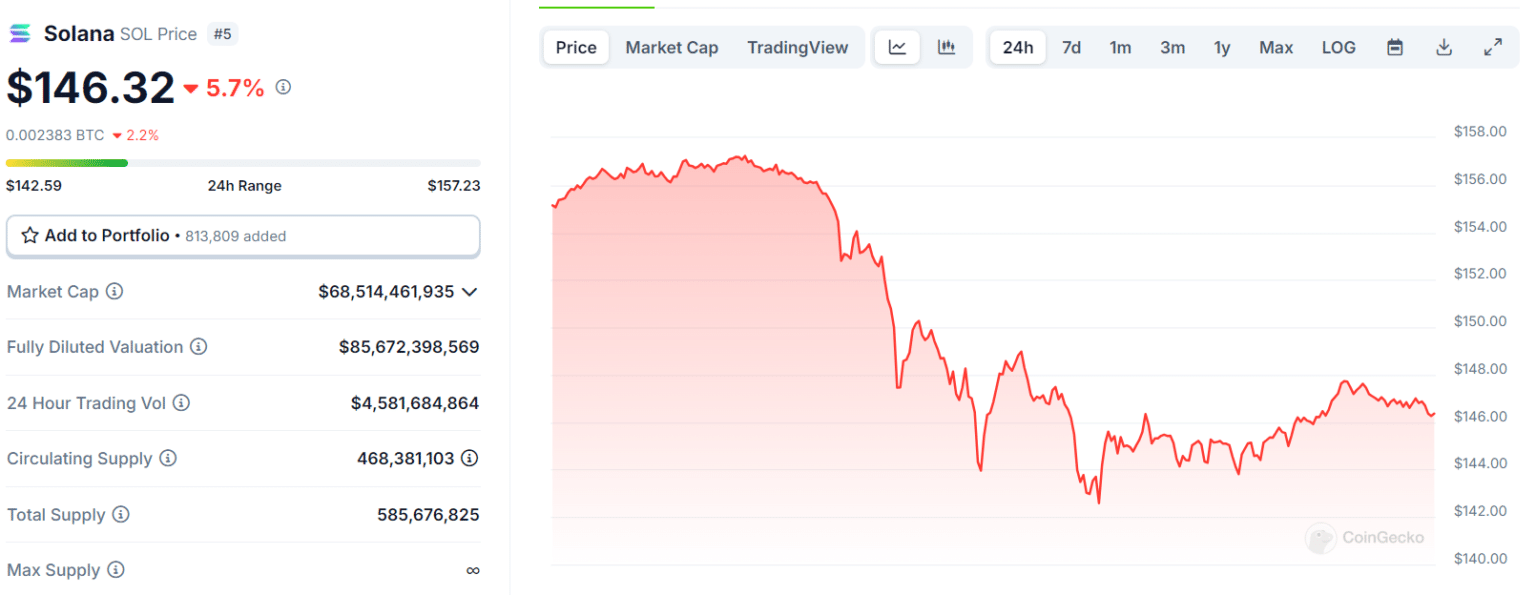

Solana and XRP Follow the Downward Trend

Solana (SOL) fell 5%, reaching $147, with its lowest and highest points recorded at $142.84 and $157.26. Meanwhile, XRP declined by over 3%, trading at $0.6019. XRP’s intraday low was $0.5843, and its high was $0.6336. Both Solana and XRP are tracking broader market trends, with short-term volatility expected to continue.

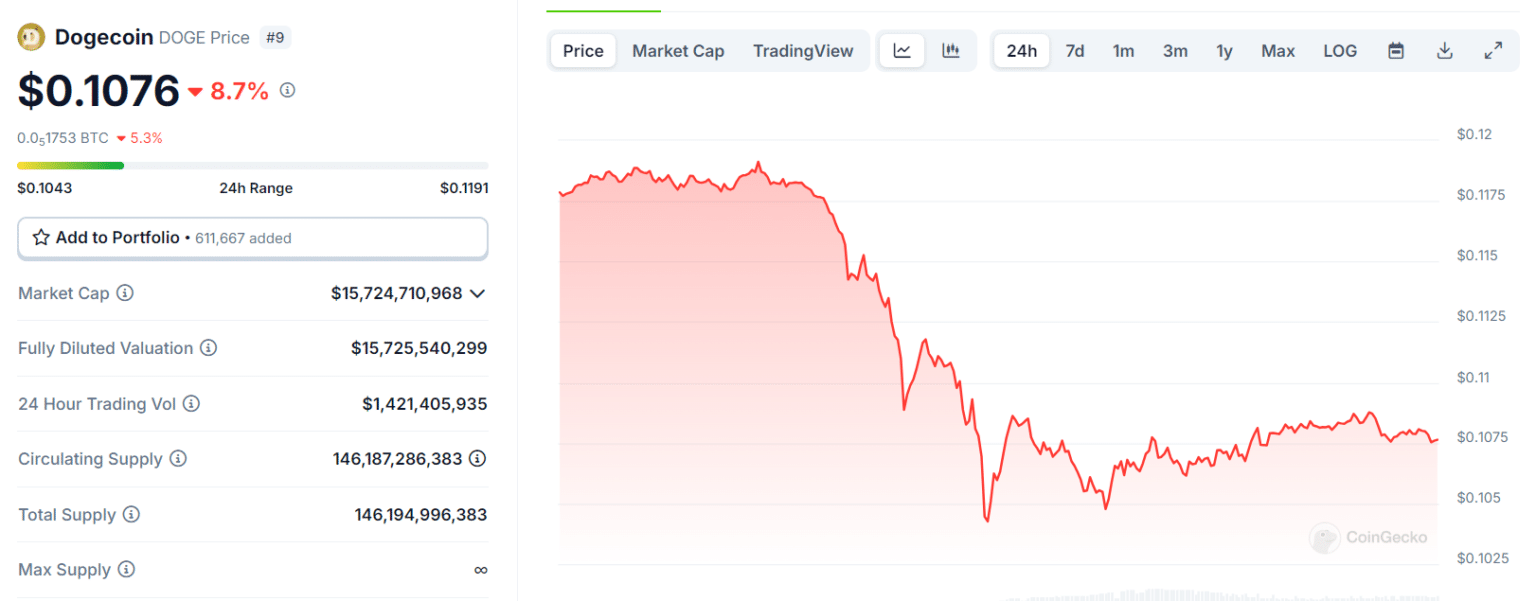

Meme Coins Take a Hit, FTT and EIGEN Stand Out

The downturn has also affected meme coins like Dogecoin (DOGE) and Shiba Inu (SHIB). DOGE dropped 8% to $0.1079, and SHIB fell over 8% to $0.00001678. Other meme coins, such as PEPE and BONK, saw losses ranging from 2% to 9%. Analysts attribute these drops to the overall decline in BTC prices, which typically influence meme coin performance.

However, not all coins followed this downward trajectory. FTX Token (FTT) and EigenLayer (EIGEN) were among the few to see gains, with FTT climbing 13% to $2.15 and EigenLayer rising over 10% to $4.09. These coins attracted attention as investors sought alternatives amidst the market chaos.

The Bit Journal continues to monitor market movements closely, as BTC volatility significantly impacts the entire cryptocurrency landscape.

- https://twitter.com/Thebitjournal_

- https://www.linkedin.com/company/the-bit-journal/

- https://t.me/thebitjournal

Follow us on Twitter and LinkedIn and join our Telegram channel to be instantly informed about breaking news!