Today marks a pivotal moment for the cryptocurrency market, as over $10 billion in Bitcoin and Ethereum options are set to expire. This event has drawn significant attention from market observers, given its potential to influence short-term price trends. Key metrics like put/call ratios and maximum pain points offer valuable insights into what could unfold.

$10 Billion in Bitcoin and Ethereum Options Expire Today

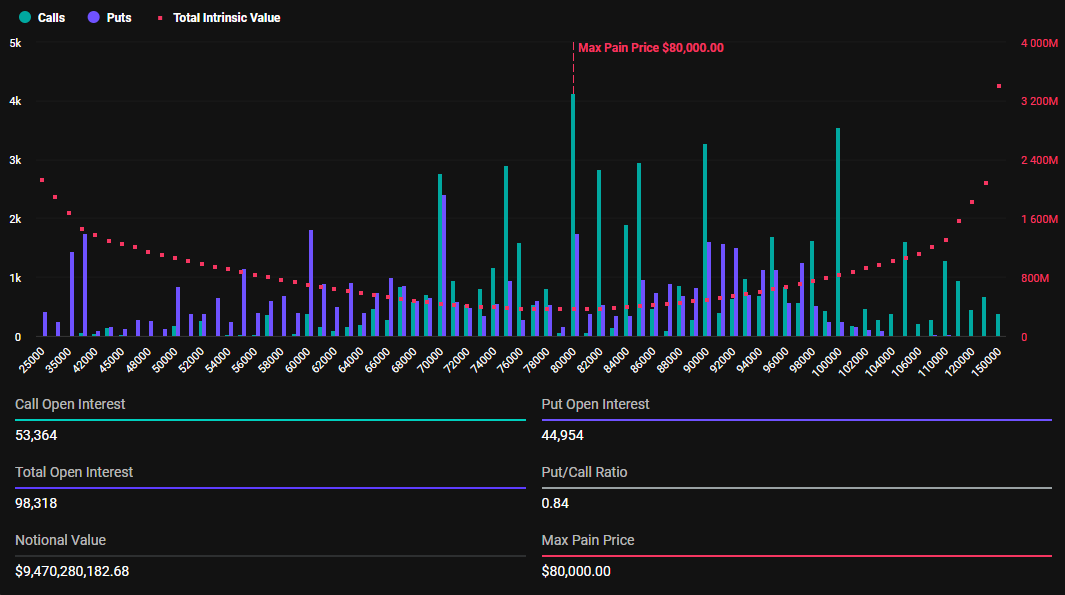

According to data from Deribit, the nominal value of expiring Bitcoin options is a staggering $9.47 billion. This includes 98,309 contracts, with a put/call ratio of 0.84, indicating a higher number of call options compared to puts. The maximum pain point—the price at which most options expire worthless—for Bitcoin is $80,000.

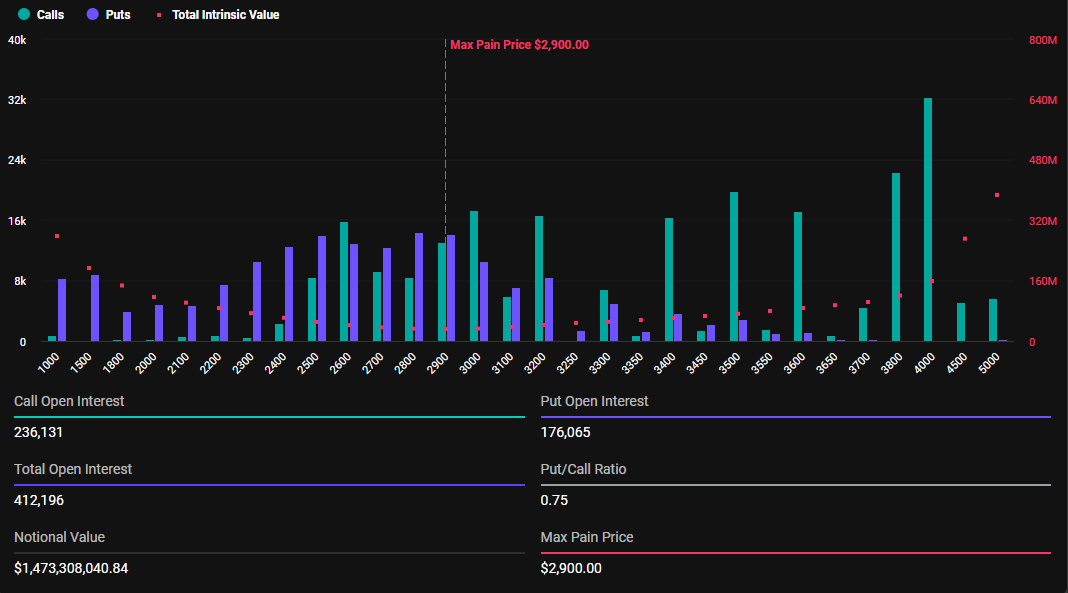

Ethereum options are also in the spotlight, with 412,116 contracts expiring today, representing a nominal value of $1.47 billion. The put/call ratio for Ethereum stands at 0.75, and its maximum pain point is $2,900.

What Does This Mean for Bitcoin and Ethereum?

As of now, both Bitcoin and Ethereum are trading above their respective maximum pain points, with Bitcoin at $96,353 and Ethereum at $3,573. If these prices hold, it could result in losses for many options holders. The impact on individual traders will depend on their specific strike prices and positions.

Expert Opinions on the Expiry’s Impact

Analysts at Greeks.live have highlighted the nuanced investor sentiment surrounding this event. They note an 11% retracement in Bitcoin and emphasize how quickly market narratives can shift. Jeff Liang, CEO of Greeks.live, shared his perspective, stating:

“While the volatility implied by these options isn’t excessively high, even a 5% spot price increase could offset the difference. I’ve opted to wait it out, and I recently acquired a set of call options, expecting some movements this morning.”

Broader Market Sentiment and Influences

In addition to the options expiry, the market is closely monitoring the release of U.S. inflation data. Optimism in the crypto market has also been linked to speculation about a new, more crypto-friendly SEC chair following Gary Gensler’s resignation. Bybit analysts noted that Ethereum options show slightly more bullish sentiment compared to Bitcoin. They also observed that the recent pullback in Bitcoin from $100,000 has flattened ATM volatility structures, reflecting a broader rebalancing in the market.

Key Takeaways

Today’s Bitcoin and Ethereum options expiry could significantly shape market trends in the short term. Traders should stay vigilant and consider all factors, including current market prices, open interest, and the broader macroeconomic landscape, to make informed decisions.

- https://twitter.com/Thebitjournal_

- https://www.linkedin.com/company/the-bit-journal/

- https://t.me/thebitjournal

Folgen Sie uns auf Twitter und LinkedIn und treten Sie unserem Telegram-Kanal bei, um sofort über aktuelle Nachrichten informiert zu werden!