In a landmark regulatory decision that signals the United States’ increasing activism in the Crypto industry, President Donald Trump has proclaimed the creation of a US Crypto Strategic Reserve. This move would put the nation down a trajectory to become a global leader on digital assets, marking a considerable turn in federal policy toward adopting< blockchain technology and cryptocurrencies.

The Announcement and Its Immediate Impact

On March 2, 2025, President Trump unveiled plans for the U.S. Crypto Strategic Reserve, which will include major cryptocurrencies such as Bitcoin (BTC), Ethereum (ETH), Ripple (XRP), Solana (SOL), and Cardano (ADA). In a post on his social media platform, Truth Social, Trump stated:

“A U.S. Crypto Reserve will elevate this critical industry after years of corrupt attacks by the Biden Administration. I will make sure the U.S. is the Crypto Capital of the World.”

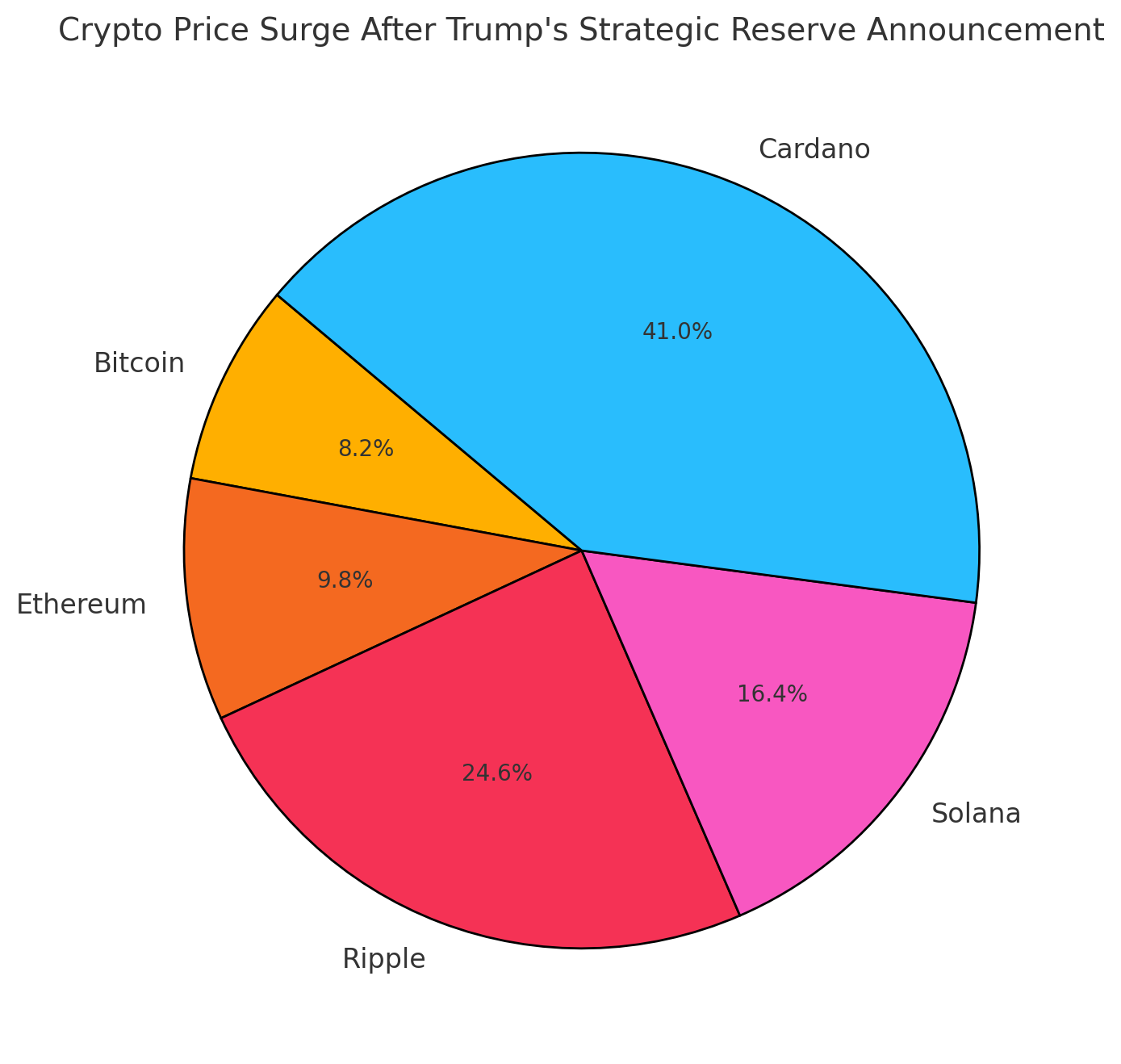

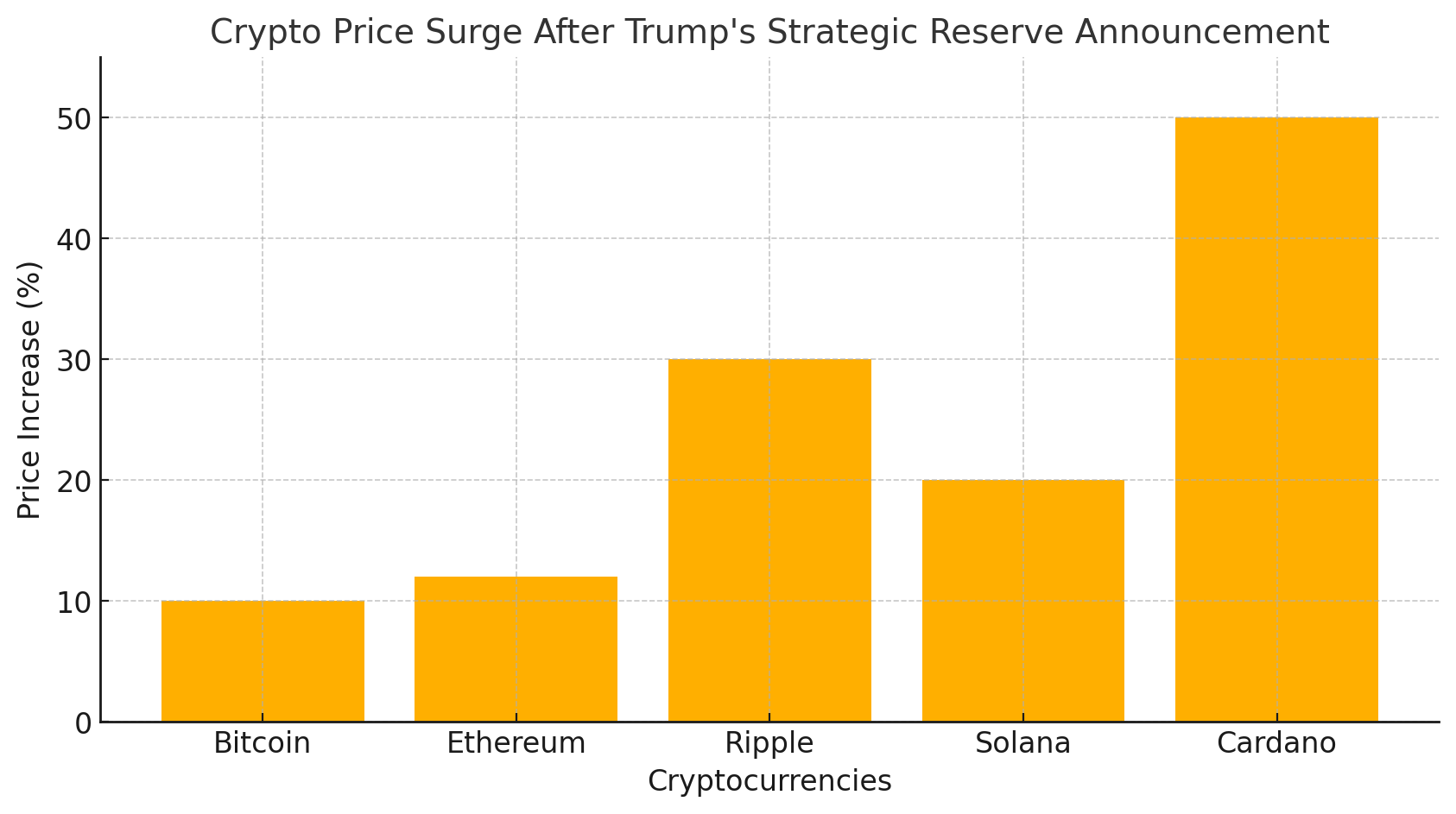

The announcement had an immediate and profound effect on the cryptocurrency markets. Bitcoin’s price surged by approximately 10%, reaching a peak of $94,821, while Ethereum saw a 12% increase. Other cryptocurrencies mentioned for inclusion in the reserve experienced even more substantial gains: Ripple jumped 30%, Solana rose 20%, and Cardano skyrocketed over 50%.

Strategic Objectives of the Crypto Reserve

The establishment of the Crypto Strategic Reserve serves multiple strategic objectives:

Economic Leadership: By integrating cryptocurrencies into its financial system, the U.S. aims to assert its dominance in the rapidly evolving digital economy.

Financial Innovation: The reserve is expected to foster innovation in financial technologies, encouraging the development of new financial products and services.

Regulatory Clarity: The initiative seeks to provide a clear regulatory framework for digital assets, balancing the need for oversight with the promotion of innovation.

The Upcoming White House Crypto Summit

To further solidify this initiative, the White House is hosting its first-ever Crypto Summit on March 7, 2025. The summit will bring together prominent founders, CEOs, and investors from the crypto industry, as well as members of the President’s Working Group on Digital Assets. The event aims to foster dialogue between the government and industry stakeholders, addressing topics such as regulatory policies, stablecoin oversight, and the integration of cryptocurrencies into the U.S. financial system.

Key Figures in the Administration’s Crypto Strategy

Several key figures have been appointed to spearhead the administration’s cryptocurrency strategy:

David Sacks: Appointed as the White House AI and Crypto Czar, Sacks is tasked with developing a legal framework to provide the clarity the crypto industry has been seeking. He will chair the upcoming summit and play a pivotal role in shaping U.S. crypto policy.

Bo Hines: Serving as the Executive Director of the Presidential Council of Advisers for Digital Assets, Hines, a former college football player with a background in law, is responsible for advancing the administration’s crypto agenda on Capitol Hill.

Market and Industry Reactions

The crypto industry has largely welcomed these developments, viewing them as a validation of digital assets and a commitment to integrating cryptocurrencies into the mainstream financial system. The market’s positive response underscores the anticipation of a more supportive regulatory environment under the current administration.

However, some analysts caution that the integration of cryptocurrencies into national reserves requires robust regulatory frameworks to mitigate risks associated with volatility and security. The administration’s challenge lies in balancing innovation with investor protection and financial stability.

Conclusion

The establishment of the U.S. Crypto Strategic Reserve marks a pivotal moment in the nation’s approach to digital assets. By embracing cryptocurrencies, the United States aims to lead in the global digital economy, fostering innovation while navigating the complexities of regulation and market dynamics. The forthcoming White House Crypto Summit is poised to further define the nation’s crypto strategy, setting the stage for the future of digital assets in the U.S. financial landscape.

Stay tuned to The BIT Journal and keep an eye on Crypto’s updates.

FAQs

1. What is the U.S. Crypto Strategic Reserve?

The U.S. Crypto Strategic Reserve is a newly announced federal initiative that will hold major cryptocurrencies like Bitcoin, Ethereum, XRP, Solana, and Cardano to establish the U.S. as a leader in digital assets.

2. Why did Trump launch the Crypto Reserve?

Trump launched the Crypto Reserve to support the cryptocurrency industry, counter previous regulatory crackdowns, and position the U.S. as a global hub for blockchain innovation.

3. What impact did the announcement have on crypto prices?

Following the announcement, Bitcoin surged by 10%, Ethereum by 12%, and other listed cryptocurrencies saw even larger gains, with Cardano rising over 50%.

4. Who is leading Trump’s crypto strategy?

David Sacks, appointed as the White House AI and Crypto Czar, is leading the initiative, alongside Bo Hines, who is managing policy discussions on Capitol Hill.

5. What is the significance of the White House Crypto Summit?

The Crypto Summit will bring together government officials, industry leaders, and investors to discuss regulations, stablecoins, and the integration of crypto into the financial system.

Glossary of Key Terms

Cryptocurrency – A digital or virtual currency that uses cryptography for security and operates on decentralized networks, usually blockchain-based.

Strategic Reserve – A government-held asset pool designed to stabilize markets or support national interests, now being applied to cryptocurrencies.

Bitcoin (BTC) – The first and largest cryptocurrency by market cap, often referred to as digital gold.

Ethereum (ETH) – A leading blockchain platform known for its smart contracts and decentralized applications (DApps).

Ripple (XRP) – A digital asset focused on fast and low-cost cross-border payments.

Solana (SOL) – A high-speed blockchain designed for scalable decentralized applications and finance.

Cardano (ADA) – A blockchain platform known for its strong research-driven development and focus on sustainability.

Stablecoin – A type of cryptocurrency pegged to a stable asset (e.g., the U.S. dollar) to reduce volatility.

Regulatory Clarity – Clear and defined rules governing cryptocurrencies to support legal compliance and industry growth.

White House Crypto Summit – A high-profile meeting between government officials and crypto industry leaders to discuss regulations and strategies.

Sources