The crypto market is experiencing another sharp decline as Bitcoin plummets to $91,000. With total liquidations reaching $914 million, the altcoin market is facing a liquidity crisis similar to past downturns.

Bitcoin Drops Below Critical Levels

Over the past 24 hours, more than $150 billion has been wiped out from the crypto market, dragging the total market cap below $3 trillion. Bitcoin has fallen 4%, dropping under key support levels and hitting $91,000. According to Coinglass, Bitcoin’s 24-hour liquidation volume has soared to $274 million, with $258 million coming from long positions. Meanwhile, daily trading volume has surged by 150%, reaching $51 billion.

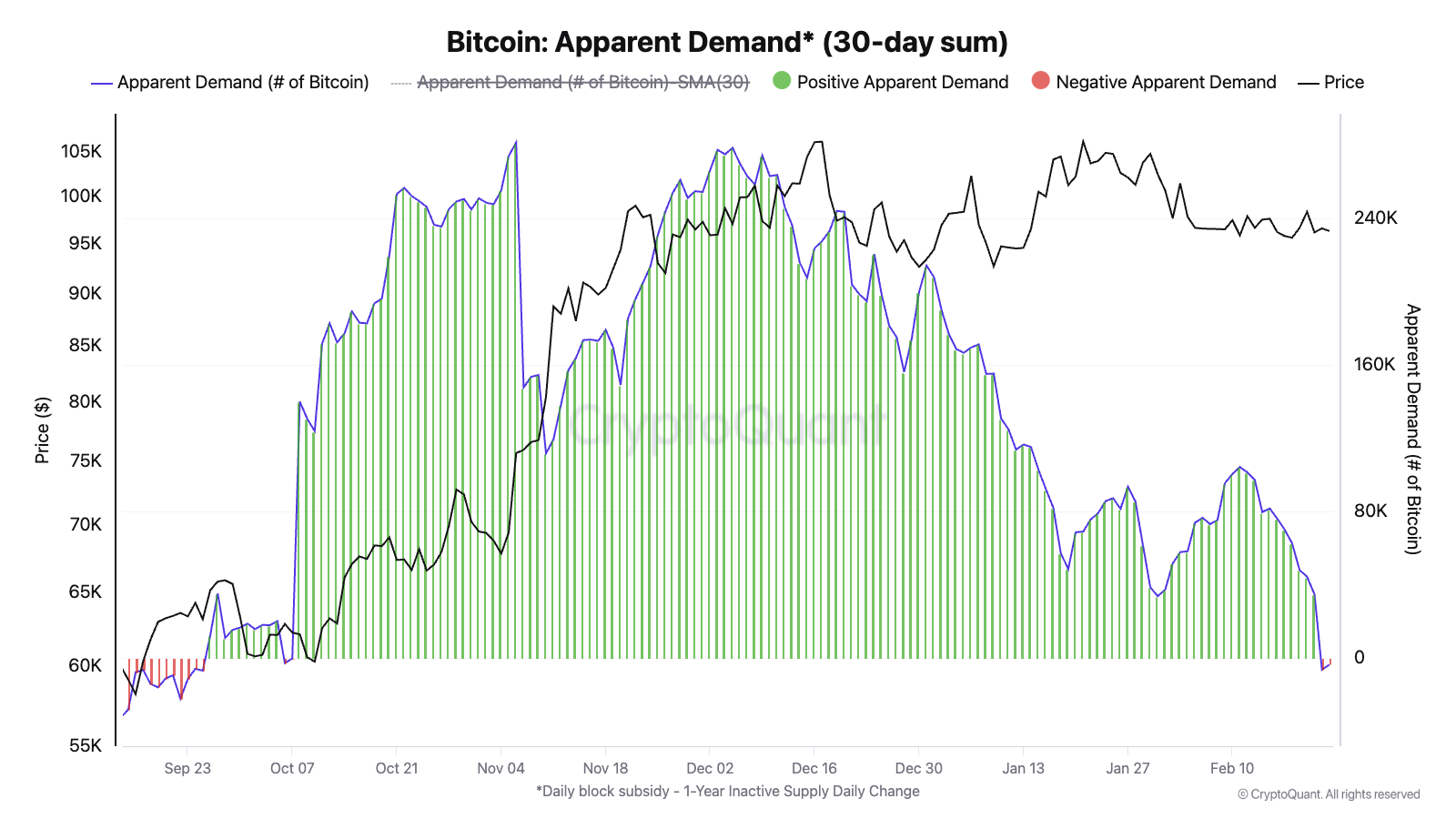

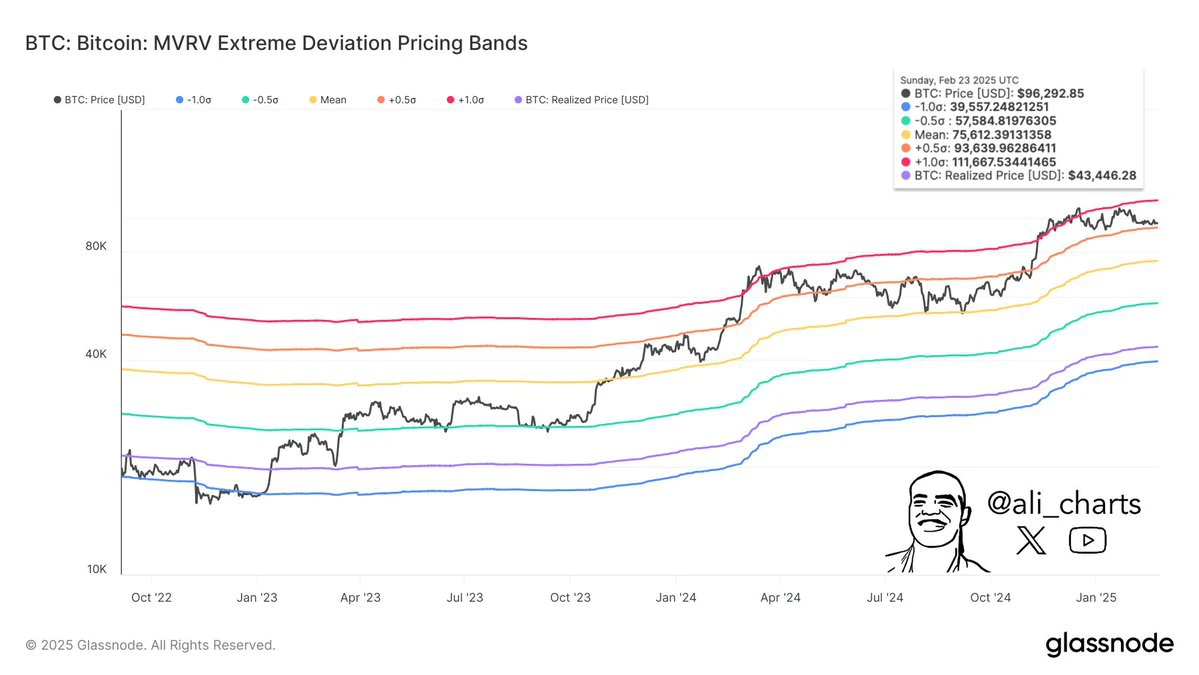

Market analysts warn that the current downward momentum could lead to further losses. CryptoQuant’s Head of Research, Julio Moreno, highlights that Bitcoin demand has turned negative for the first time since September 2024, making price recovery more difficult. Crypto analyst Ali Martinez has also cautioned that if Bitcoin fails to hold $93,700, prices could plunge to $75,600. With Bitcoin’s volatility and ongoing macroeconomic uncertainties, investors remain on edge. As of press time, Bitcoin is trading at $91,910, marking a 3.6% daily loss.

Bitcoin ETF Outflows Intensify

Bitcoin ETF outflows reached $571 million last week, with $516 million leaving spot Bitcoin ETFs. Fidelity’s FBTC fund recorded a $247 million outflow, while BlackRock’s IBIT saw $159 million exiting.

Well-known crypto investor Arthur Hayes warns of increasing market instability, noting that hedge funds are taking long positions in ETFs while shorting CME Bitcoin futures. However, with Bitcoin prices sliding, this strategy may face challenges, potentially forcing funds to close positions during U.S. trading hours.

Altcoins Face Heavier Losses

The altcoin market has been hit harder than Bitcoin, with Ethereum (ETH) dropping 8%, sinking below $2,500. Ethereum’s 24-hour trading volume has climbed to $31.6 billion, with liquidations reaching $195 million. Meanwhile, Solana (SOL) has suffered a 22% loss since Friday, making it one of the hardest-hit assets.

Adding to the turmoil, the Bybit hack on February 21 has shaken investor confidence. Arkham Intelligence called it one of the largest financial hacks in history, but Bybit surprisingly recovered all stolen Ethereum within 48 hours. In a surprising twist, Citadel Securities, a financial giant with $65 billion in assets, is reportedly exploring market-making activities in crypto, including Bitcoin. However, investors remain skeptical, reacting with a cautious “buy the rumor, sell the news” approach.

For more updates on the crypto market, stay tuned to The Bit Journal.

- https://twitter.com/Thebitjournal_

- https://www.linkedin.com/company/the-bit-journal/

- https://t.me/thebitjournal

Follow us on Twitter and LinkedIn and join our Telegram channel to get instant updates on breaking news!