CoinShares reports a $528 million outflow amid recession fears, reflecting heightened market uncertainty. Despite significant Bitcoin, Ether, and Solana withdrawals, CoinShares remains committed to its long-term strategy. Analysts offer mixed predictions on the market’s future.

The significant withdrawal highlights growing market fears and investor caution due to looming recession concerns and geopolitical issues. This marks the first outflow in four weeks, according to CoinShares’ latest report from August 5. Despite these challenges, CoinShares remains committed to its long-term strategy, expanding operations in the U.S. and boosting European distribution.

CoinShares’ Q2 2024 financial results still showcase strong performance, demonstrating resilience amid market volatility. However, the current situation emphasizes a cautious investor approach due to potential economic downturns.

Bitcoin Suffers Significant Losses

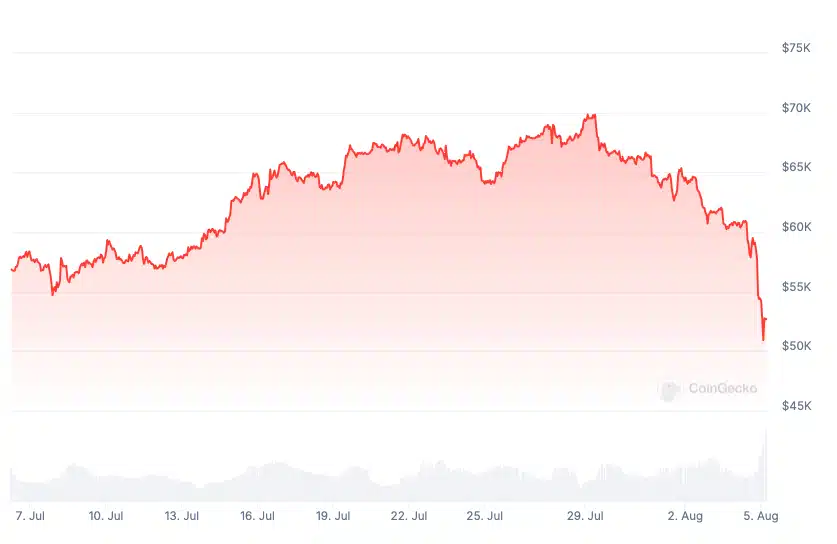

Bitcoin, the largest cryptocurrency by market value, led last week’s outflows, with $400 million withdrawn. This marked the first outflow after five consecutive weeks of inflows. The sell-off is attributed to recession fears in the U.S., geopolitical uncertainties, and broader market liquidations across various assets. Bitcoin’s fall below $50,000 has intensified concerns, with analysts predicting further outflows that could drive prices down to $42,000. The CoinShares report covered the period from July 28 to August 3, excluding the latest sharp declines on August 4 and 5.

Following a loss of support at $69,000 on July 29, Bitcoin has continued its decline, reaching its lowest price since February 2024. Currently, Bitcoin is trading at $51,301, down 15.6% over the past 24 hours, according to CoinGecko. This decline led to the liquidation of 290,000 traders in the past 24 hours, totaling $1.1 billion in liquidations, as per CoinGlass data.

Other Cryptos Also Hit Hard

Ether, the second-largest cryptocurrency by market cap, saw substantial outflows of $146.3 million last week. Solana (SOL) experienced $2.8 million in outflows. On the contrary, multi-asset crypto investment products recorded $18.1 million in inflows, with short-Bitcoin products seeing $1.8 million in inflows last week.

CoinShares noted continued outflows from blockchain equities, with $18 million in line with outflows from broader tech-related exchange-traded funds. This trend suggests a wider market apprehension extending beyond cryptocurrencies.

Analysts’ Diverse Reactions and Market Predictions

The market decline has prompted varied reactions from analysts and industry experts. Some foresee further downturns, while others anticipate recovery. Joseph Young, an industry advocate, suggested that the “bottom is nearing.” However, not all share this optimism.

Markus Thielen, CEO of 10x Research, stated in the latest market update on August 5, “Although Bitcoin has been in a gradual downtrend, marked by three tops and two bottoms, we anticipate the support line at $55,000 will break, potentially driving prices down to $42,000.” He added, “While this may seem extreme to some, economic weakness, as indicated by our ISM report, ongoing weak market structure, on-chain data, and our cycle analysis suggest further stress ahead.”

Conclusion

The latest developments in the cryptocurrency market, highlighted by CoinShares’ report of a massive $528 million outflow, underline the inherent volatility and unpredictability of digital assets. Economic uncertainties, recession fears, and geopolitical tensions are significantly influencing investor behavior, leading to substantial withdrawals. Bitcoin, the largest cryptocurrency, experienced the most significant hit, with a $400 million outflow, marking its first outflow in five weeks. Ether and Solana also saw substantial withdrawals, further reflecting the market’s cautious sentiment.

Despite these challenges, CoinShares remains committed to its long-term strategy, continuing to expand its operations in the U.S. and enhance its European distribution. The firm’s Q2 2024 financial results demonstrate resilience amidst market volatility, providing a beacon of stability for concerned investors. Analysts offer diverse perspectives on the market’s future, with some predicting further declines and others seeing potential recovery opportunities.

This period of heightened market anxiety underscores the importance of a balanced approach to crypto investment. While the significant outflows and price drops may cause concern, the steadfast strategies of firms like CoinShares and the varied analyst predictions provide a more nuanced understanding of the market’s current state and future prospects. Stay tuned to The Bit Journal.