Ethereum (ETH) is currently navigating a tight trading range, leaving investors optimistic about a potential breakout. Recent data indicates a significant volume of ETH has been withdrawn from exchanges, sparking speculation about an upcoming bullish move. Despite a consolidating crypto market, this development has caught the attention of many. Will Ethereum rally soon? What are the price targets? Here’s what you need to know.

Major Ethereum Withdrawals Signal Bullish Potential

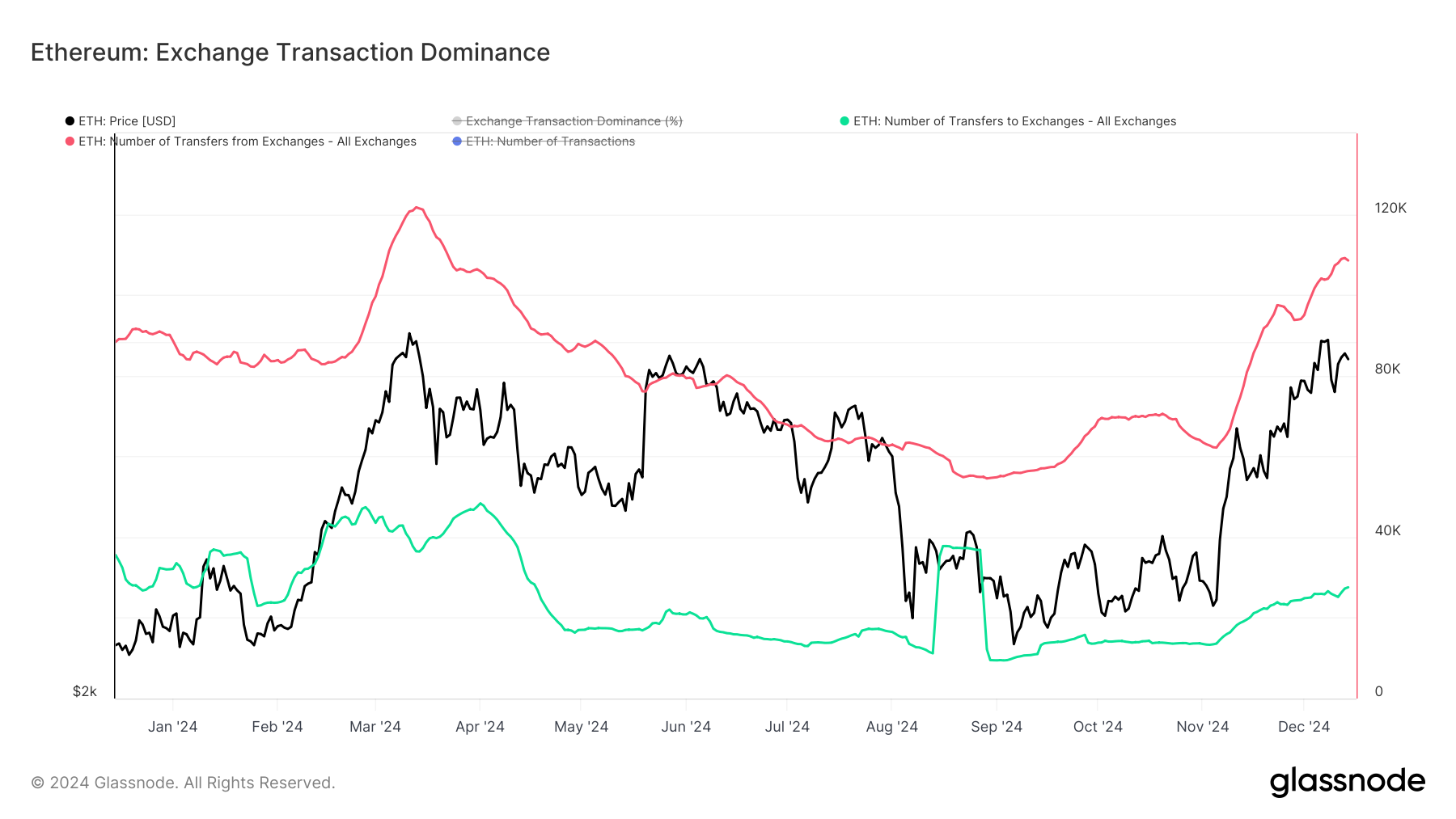

On December 14, a staggering 108,521 ETH was withdrawn from crypto exchanges, representing over $418 million at current prices. According to Glassnode, this marks the highest level of Ethereum withdrawals since March. By moving their ETH off exchanges, investors are reducing potential sell pressure.

This decline in sell pressure increases the likelihood of an upward price movement. Large-scale withdrawals reflect growing investor confidence and positive sentiment toward Ethereum’s future. With less ETH available for trading on exchanges, the conditions appear favorable for a price breakout.

RSI Indicates Room for Growth

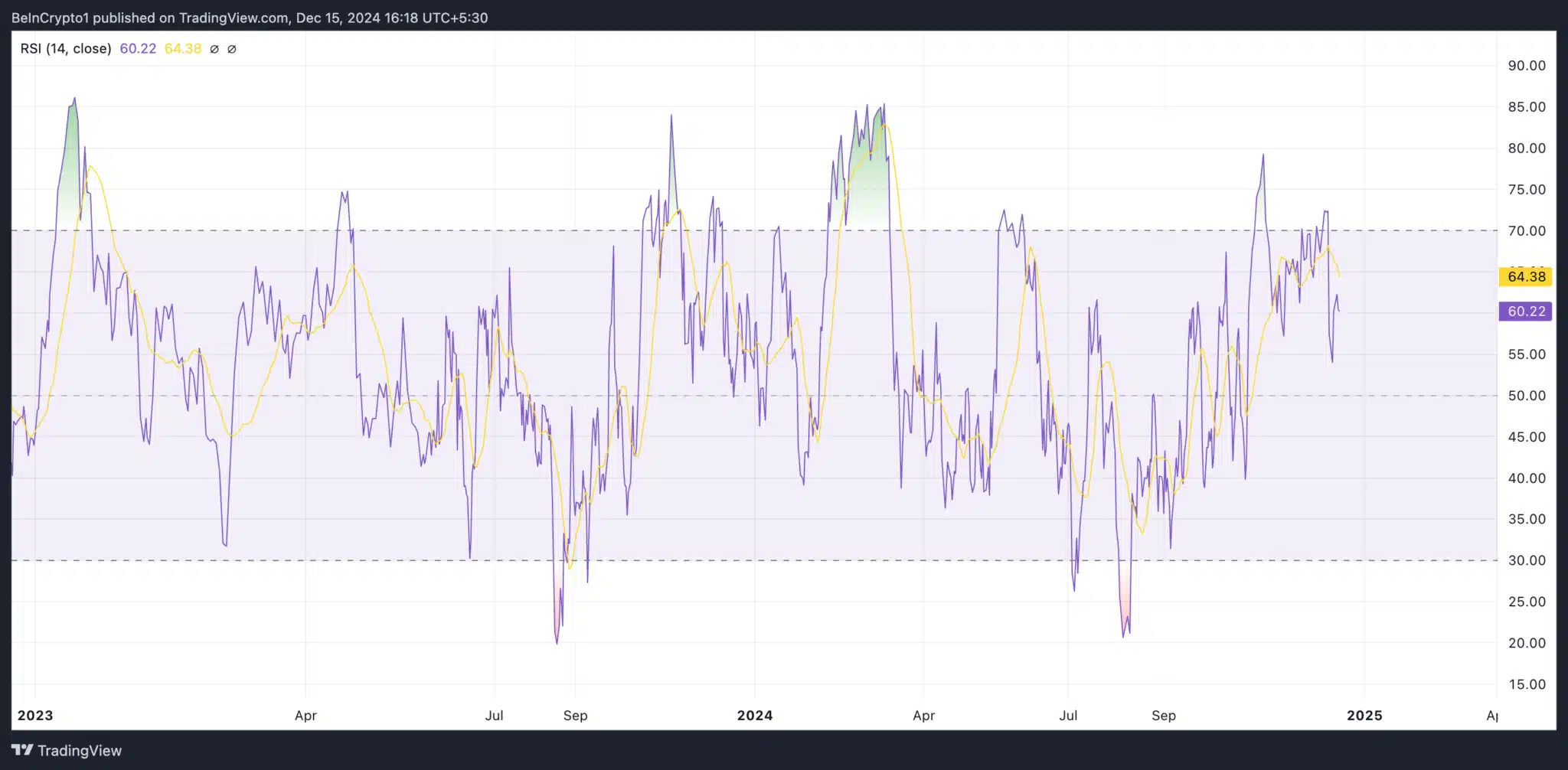

Ethereum’s Relative Strength Index (RSI) currently stands at 60.22, signaling further upside potential. The RSI helps identify overbought or oversold conditions, guiding investor decisions.

At its current level, Ethereum’s RSI shows that it has not yet entered the overbought zone, suggesting more room for growth. Analysts believe ETH could test the critical $4,000 mark, a level closely monitored by investors as a key milestone. Breaking this barrier would confirm a bullish continuation, paving the way for higher price targets.

Ethereum Price Outlook: Bulls Eye $4,000

Ethereum is trading at $3,866, hovering just below the $4,069 resistance level. Should the reduced sell pressure persist, ETH could break this resistance and aim for its all-time high of $4,936. However, if profit-taking occurs, the price could retrace to $3,388. Despite this risk, strong demand and supportive market conditions continue to bolster Ethereum’s outlook.

What’s Next for Ethereum?

With substantial withdrawals from exchanges and encouraging RSI readings, Ethereum appears poised for a potential rally. If sell pressure continues to diminish, ETH could surpass the $4,000 level and sustain its upward momentum.

As market dynamics evolve, The Bit Journal highlights that Ethereum’s strong fundamentals and growing investor confidence are key drivers of its performance. However, it’s crucial for investors to conduct their research and be mindful of market risks before making decisions.

- https://twitter.com/Thebitjournal_

- https://www.linkedin.com/company/the-bit-journal/

- https://t.me/thebitjournal

Follow us on Twitter and LinkedIn and join our Telegram channel to get instant updates on breaking news!