On Thursday, the crypto market was rocked by the news that blockchain-based gaming company Animoca Brands initiated a massive sale of its PIXEL token. On-chain data revealed a significant spike in whale activity surrounding the token, raising serious concerns among investors about its price movement, especially with an upcoming major token unlock event for the project.

Animoca Brands Sends 20 Million PIXEL to Binance

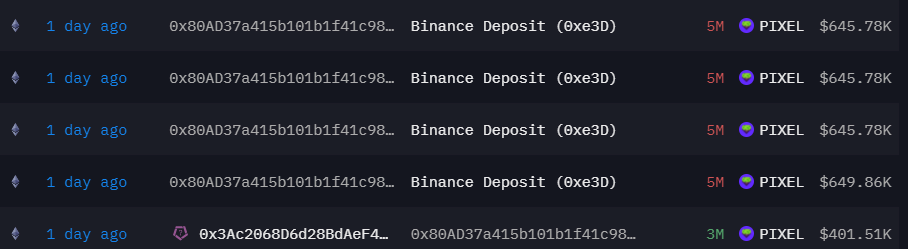

According to Arkham Intelligence, a wallet linked to Animoca Brands transferred 20 million PIXEL tokens (valued at $2.44 million) to Binance on September 19. The average entry price for these tokens was calculated to be $0.1356. Notably, only a small amount of PIXEL remained in the wallet after the transfer. Furthermore, Santiment data showed a staggering 750% increase in whale transactions involving the PIXEL token in the past 24 hours. This surge suggests that large investors may be offloading their holdings ahead of the upcoming token unlock event.

According to TokenUnlocks, 54.38 million PIXEL tokens are set to be released into the market, representing 7.05% of the token’s circulating supply. This massive unlock, scheduled for September 19, could put significant downward pressure on the token’s price, as an increase in circulating supply with stable demand typically leads to a price decline. With Animoca Brands’ large token sales and the spike in whale activity, PIXEL’s price faces a significant risk of decline.

Will PIXEL’s Price Fall?

As of today, PIXEL’s price has risen by approximately 3% in the last 24 hours, trading at $0.1445. The token’s 24-hour low and high were recorded at $0.1275 and $0.1483, respectively. Today’s price increase reflects broader market optimism following the Fed’s rate cut. However, Animoca Brands’ large token sale and the impending token unlock have caused growing concern among market participants about the token’s future price movements.

Token unlock events typically trigger bearish sentiment as the increased supply puts pressure on the asset’s price. Additionally, Coinglass data showed that open interest in PIXEL’s futures contracts dropped by 3.5%, down to $14.91 million, further reflecting investor pessimism about the token’s future.

Other Major Crypto Movements: Bitcoin and Ethereum Transfers

While PIXEL token movements remain in focus, other notable crypto transactions have caught attention in the market. On September 19, Ember reported that a wallet that withdrew 801 BTC from Huobi in 2019 at a price of $10,103 per Bitcoin transferred 301 BTC to Binance just two hours ago. Bitcoin’s price has since surged 510%, reaching $61,668, resulting in a 5.1x profit for the investor over five years.

一个在 2019 年 8 月以 $10,103 的价格从 Huobi 提出 801 枚 BTC ($8.09M) 的地址,在美联储降息市场上涨后出售 301 枚 BTC:

2 小时前将 301 枚 BTC ($18.56M) 以 $61,668 的价格转入 Binance。

时隔 5 年,BTC 价格由他从 Huobi 提出时的 $10,103 上涨到了现在的 $61,668。收获 5.1 倍的收益。… pic.twitter.com/XY6T7rNsvn

— 余烬 (@EmberCN) September 19, 2024

Additionally, on the Ethereum side, Lookonchain tracked a wallet involved in the Ethereum Initial Coin Offering (ICO). This wallet, which had been inactive for two years, transferred 10,000 ETH (worth approximately $24.37 million) to Kraken. These significant movements suggest that investors should pay close attention to similar large-scale transactions in the market.

An #Ethereum ICO participant deposited 10,000 $ETH($24.37M) into #Kraken 15 minutes ago after being dormant for 2 years!

The participant received 50,000 $ETH(ICO cost was $15.5K, now worth $121.85M) at #GENESIS.https://t.co/cuEosgIONq pic.twitter.com/PK4KePNFvu

— Lookonchain (@lookonchain) September 19, 2024

The combination of Animoca Brands’ significant token sale, the upcoming PIXEL token unlock event, and large transfers involving Bitcoin and Ethereum highlights the volatility and risk in the current market. As the PIXEL token faces increased sell pressure and whale activity, investors should remain cautious and keep a close eye on developments in both the altcoin and broader crypto markets.