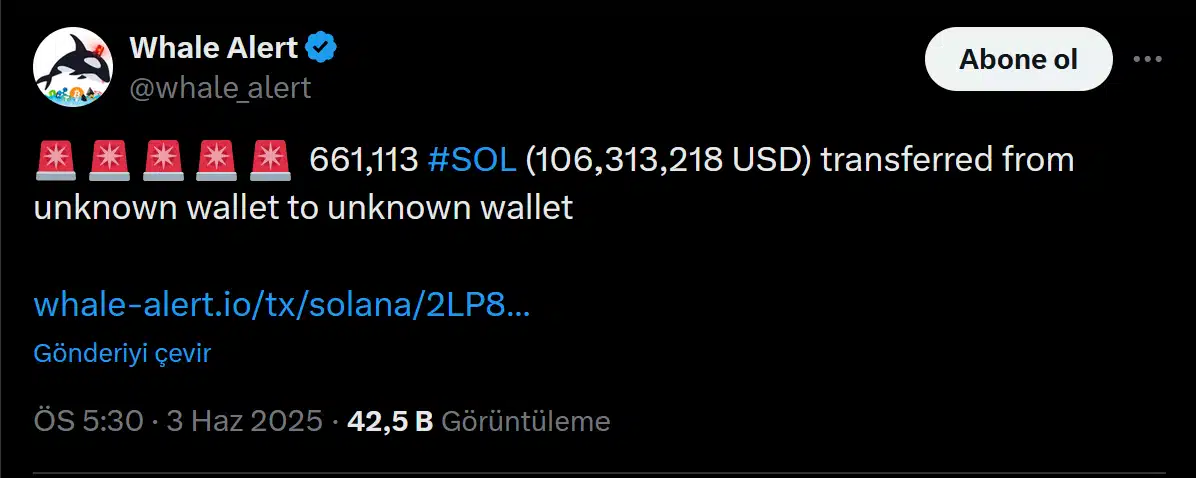

A significant whale transaction on the Solana network has caught the attention of the crypto market. On June 3, 2025, blockchain tracking service Whale Alert reported that 661,113 SOL—valued at approximately $106 million—was transferred between two anonymous wallets. The move, despite not being linked directly to an exchange deposit, triggered concerns of a potential sell-off among investors and analysts.

Price Pressure Builds Amid Technical Weakness

Shortly after the large-scale transfer, Solana’s price dipped over 3%, signaling a growing bearish sentiment. According to Coingecko data, SOL was trading at $155.69 at the time of reporting, with a 24-hour range fluctuating between $154.80 and $162.57. Trading volume hovered around $3.4 billion, while Solana’s market capitalization settled at $81.3 billion.

Over the last 7 days, SOL has lost more than 10% of its value, although it still holds a 7.7% gain over the past month. This divergence indicates short-term volatility despite broader uptrend resilience. However, technical indicators are skewing negative. TradingView’s data reveals that the SOL/USD pair is now flashing a “Strong Sell” signal based on moving averages. Although some oscillators still show “Buy,” these are providing minimal support against the prevailing downward momentum.

Key Support Levels in Focus

Analysts warn that if the selling pressure continues, SOL may retest the $150 psychological support zone, especially considering its struggle to hold above the $160–$165 range during May. The weakening chart structure and bearish formations on daily timeframes amplify the concern.

What the Whale Transfer Could Mean

While the transaction hasn’t been traced to any major crypto exchange, market participants often view such significant wallet movements as strategic positioning before a sale. These transfers typically trigger alarm bells due to their potential impact on liquidity and sentiment. The Bit Journal notes that institutional or large-scale investors tend to manage their holdings in ways that can indirectly influence price trends—even when no immediate selling occurs.

Given the timing and subsequent market reaction, it’s plausible the recent price drop is tied to a fear-driven response rather than confirmed liquidation. Still, with SOL facing multiple technical and psychological barriers, market participants remain cautious.

Investor Takeaway

For short-term traders, the focus will be on whether Solana can defend the $150 level. For long-term holders, this dip might present a buying opportunity—but only if broader on-chain and sentiment indicators begin to stabilize. As always, monitoring wallet flows and technical trends remains essential in such a fast-moving environment.

- https://twitter.com/Thebitjournal_

- https://www.linkedin.com/company/the-bit-journal/

- https://t.me/thebitjournal

Follow us on Twitter and LinkedIn and join our Telegram channel to get instant updates on breaking news!

References:

Whale Alert. (2025). @whale_alert on X (formerly Twitter)

CoinGecko. (2025). Solana Price Data

TradingView. (2025). SOL/USD Technical Chart