The Sui token unlock scheduled for 1 July releases 58.35 million SUI, about 1.72 % of the project’s market capitalization, into public float. The $164 million cliff event represents the largest supply surge since main-net launch and rekindles fears that excess tokens could overwhelm demand just as broader altcoin sentiment cools.

SUI Token Unlock Mechanics and Tokenomics

Unlike linear vesting schedules that drip coins daily, this Sui token unlock arrives as a single lump: ecosystem grants, early contributor allocations and investor tranches that have been locked for 12 months. According to CryptoRank and Blockcast data, Sui will face three more meaningful cliffs before 2026, but July’s tranche is among the top three in size, making it a pivotal stress test for the network’s token-economic design.

Market Sentiment: Caution, Not Capitulation

Derivatives desks report $16.66 million in short positions near the $2.848 resistance zone, indicating traders are bracing for downside. Concurrently, exchange spot outflows worth $16.4 million suggest long-term holders are accumulating the dip, highlighting a split between fast-money futures traders and conviction-based buyers.

Brave New Coin research frames the unlock as a “volatile but survivable” event, noting that comparable cliffs for Aptos and Avalanche in 2024 produced double-digit drawdowns that reversed within a month once new supply was absorbed by DeFi incentives.

SUI Price Analysis

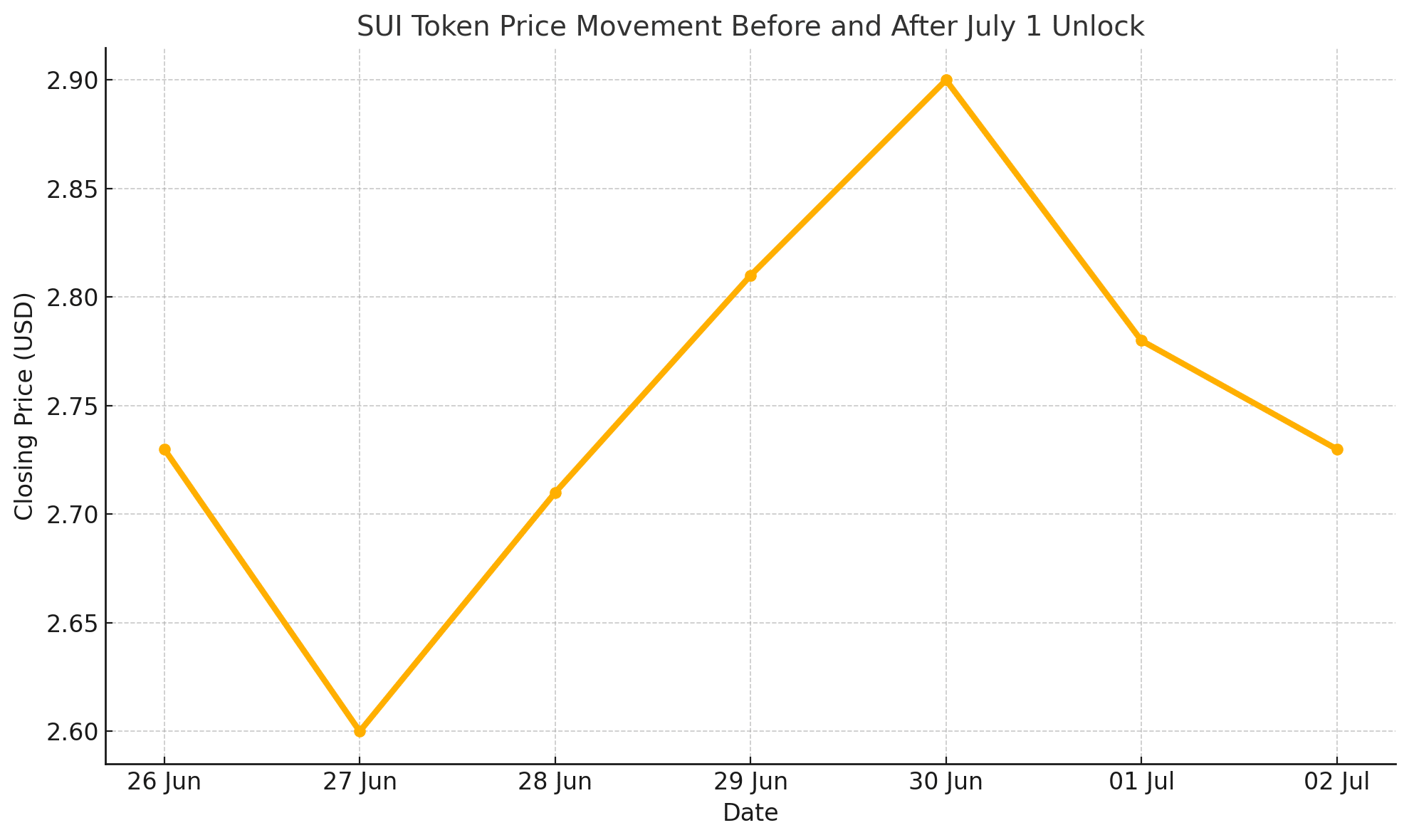

Recent Daily Performance of SUI

| Date (2025) | Closing Price ($) | 24 h Δ |

|---|---|---|

| 26 Jun | 2.73 | −2.4 % |

| 27 Jun | 2.60 | −4.6 % |

| 28 Jun | 2.71 | +4.2 % |

| 29 Jun | 2.81 | +3.5 % |

| 30 Jun | 2.90 | +3.4 % |

| 01 Jul | 2.78 | −4.4 % |

| 02 Jul | 2.73 | −2.5 % |

Source: CoinGecko

Momentum softened during the lead-up to the Sui token unlock, with a seven-day swing from $2.60 to $2.90 fading back toward $2.70. Technical analysts point to the 50-day exponential moving average at $2.84 as near-term resistance; a sustained break below $2.60 could open a path to $2.40 support cited by AMBCrypto’s chart review.

Expert Views

“Unlock events are rarely binary. If new supply finds productive use in grants and liquidity pools, price damage can be limited,”

— Katie Talati, Head of Research, Arca

FXStreet analysts echo that view but warn that declining open interest could amplify any knee-jerk sell-off if liquidity thins during U.S. holiday trade.

Comparative Lens

Token unlocks now dominate early-stage layer-1 narratives. In the first week of July alone, more than $484 million in unlocks, spanning Sui, Solana, Optimism and Dogecoin, are set to test market depth. Sui’s share is the largest single-asset component, making it the bellwether for how aggressively traders punish supply shocks in the current cycle.

Strategic Outlook

Liquidity Recycling: Market-makers may redirect part of the unlocked allocation into on-chain liquidity mining, cushioning spot order-books.

Staking Safety Net: Sui’s ~7 % staking yield offers holders an alternative to immediate selling, potentially absorbing float.

Volatility Window: Deribit options price a ±12 % weekly move around the Sui token unlock, implying event-driven turbulence rather than structural capitulation.

If developer activity—up 27 % quarter-on-quarter—continues to push total value locked past $2 billion, new supply could transition from overhang to growth capital within weeks.

Conclusion

July’s Sui token unlock transforms a token-supply milestone into a market-psychology crucible. While traders brace for a near-term wobble, structural factors—robust staking yields, expanding DeFi activity and transparent vesting, offer buffers against a disorderly crash. History shows that unlock-driven dips can morph into accumulation phases when network fundamentals outshine dilution fears. For now, vigilance and disciplined risk management remain the watchwords as Sui confronts its biggest test of market maturity to date.

FAQs

Q1 | How many SUI unlocks remain in 2025?

Three smaller cliffs totalling ~130 million tokens are scheduled after July.

Q2 | Do unlocks always depress price?

Effect varies; liquidity conditions, staking incentives and market sentiment dictate impact.

Q3 | Can governance delay the July unlock?

No. Unlock dates are hard-coded in vesting contracts and require a super-majority upgrade to modify.

Q4 | What signals show imminent selling?

Rising exchange inflows and sharply negative funding rates often precede dump events.

Glossary of Key Terms

Sui token unlock: Scheduled cliff release of previously locked SUI.

Cliff event: One-time large token issuance after a vesting pause.

Total Value Locked (TVL): Assets deposited in Sui’s DeFi protocols.

Open Interest: Total outstanding derivatives contracts.

EMA (50-day): Technical average tracking medium-term trend.