A new investigation by blockchain analytics firm Bubblemaps has revealed that the team behind Melania Trump’s meme coin (MELANIA) has allegedly moved and begun selling $30 million worth of tokens from the project’s community funds, all without public acknowledgment or explanation. The revelations have disrupted the crypto community, further eroding investor confidence in politically linked meme assets.

According to Bubblemaps’ April 7 post on X (formerly Twitter), 50 million MELANIA tokens valued at roughly $30 million, were transferred from the project’s community fund to a single wallet, then distributed across multiple addresses. From these wallets, at least $3 million worth of tokens were deposited into centralized exchanges. Additionally, two separate $6 million positions were opened, and approximately $500,000 worth of MELANIA has already been sold.

“No one from the MELANIA team has addressed this. Not the movements. Not the selling,”

Bubblemaps said in the post. The firm added that 92% of the token’s supply is currently held by team wallets, raising red flags about the project’s decentralization and intentions.

MELANIA Price Tanks Over 96% Since January High

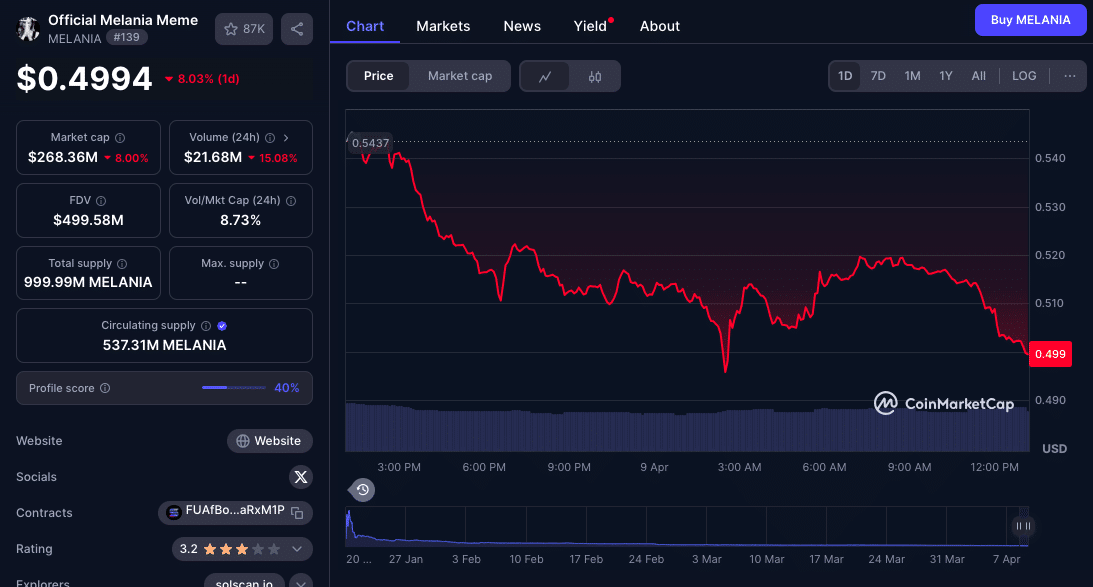

Launched on January 19, a day after Donald Trump’s own meme coin made headlines, the MELANIA token has suffered a catastrophic collapse in value. After peaking above $13 shortly after launch, MELANIA is now trading at $0.49, representing a 96% drawdown. CoinMarketcap data shows the token has lost over 8% in the last 24 hours alone.

The timing of the dump is particularly damaging. It comes on the heels of Bubblemaps’ March report, which first identified questionable activity linked to Hayden Davis, who previously claimed involvement in MELANIA’s creation. The firm said Davis used single-sided liquidity strategies to covertly offload tokens, both in MELANIA and LIBRA, a politically charged token allegedly linked to Argentine President Javier Milei.

Bubblemaps stated:

“The damage isn’t done yet. With 92% of the supply held in team wallets, there’s a looming risk of further dumps.”

Broader Memecoin Market Faces Declining Enthusiasm

The controversy surrounding MELANIA comes as the meme coin sector experiences a notable slowdown. According to Dune Analytics, the number of tokens graduating from the Solana-based meme coin launchpad Pump.fun has dropped over 70% since January, from 5,400 tokens per week to 1,500 by March.

Similarly, SolScan data shows that only 31,651 new tokens were launched on Solana as of April 5, a stark decline from the 95,578 tokens created at the January 26 peak of the memecoin mania.

This trend suggests that retail and speculative interest in memecoins is tapering off in the face of wider market corrections, a tightening U.S. monetary policy stance, and increasing scrutiny over rug pulls and liquidity fraud.

Institutional Fallout and Regulatory Implications

While meme coins remain largely unregulated, that could soon change. Reports say the U.S. Securities and Exchange Commission (SEC) has already taken enforcement actions against projects that misrepresent token utility or engage in insider enrichment. The opaque handling of MELANIA’s community funds, combined with the team’s silence, may invite further attention.

Regulatory clarity on meme coins and celebrity-backed tokens remains limited, but according to legal experts, that won’t shield projects from liability if proven to defraud investors.

“Lack of disclosure and asset misappropriation are clear red flags in any financial product,” said fintech attorney Daniel Wilson of CryptoLegal Advisors.

Conclusion: A Harsh Lesson in Token Trust and Transparency

The MELANIA memecoin case underscores the critical need for transparency, governance, and investor safeguards in the increasingly volatile world of cryptocurrency. The silent token dump, if proven true, serves as a cautionary tale for traders drawn to hype-driven projects with no formal accountability.

With MELANIA’s price in freefall and 92% of supply controlled by insiders, the damage, both financial and reputational, appears far from over. As regulators circle and investor sentiment deteriorates, the fate of politically branded memecoins hangs in the balance.

FAQs

How much did the MELANIA team allegedly sell?

Blockchain analytics firm Bubblemaps reported that $30 million worth of MELANIA tokens were moved from community funds, with a portion already sold.

Who is Hayden Davis, and what is his role in MELANIA?

Hayden Davis claimed to have co-created MELANIA. Bubblemaps previously accused him of covertly selling tokens using single-sided liquidity strategies.

What’s the current price of MELANIA?

As of April 9, MELANIA is trading around $0.51 — down over 96% from its all-time high in January.

Are memecoins still popular?

Interest in memecoins is declining. Token launches on platforms like Pump.fun and Solana have significantly dropped since the January peak.

Could MELANIA face regulatory action?

If proven that the token team misappropriated funds or failed to disclose insider sales, MELANIA could attract regulatory scrutiny, especially from the SEC.

Glossary

Memecoin – A cryptocurrency often inspired by internet memes or pop culture, usually with little intrinsic value or utility.

Single-Sided Liquidity – A strategy where only one asset is added to a liquidity pool, often used to sell large amounts of a token covertly.

Community Funds – Tokens or capital set aside to support a project’s growth, development, or marketing, expected to be used in the community’s interest.

Token Dump – Rapid selling of large amounts of a cryptocurrency, often by insiders, which can crash the asset’s price.

Decentralization – The distribution of control and decision-making in a blockchain network or crypto project, ideally reducing the influence of a central authority.

References

Disclaimer

This article is for informational purposes only and should not be construed as financial advice. Cryptocurrency investments are highly volatile and carry risk. Always conduct independent research and consult with a licensed financial advisor before making investment decisions.