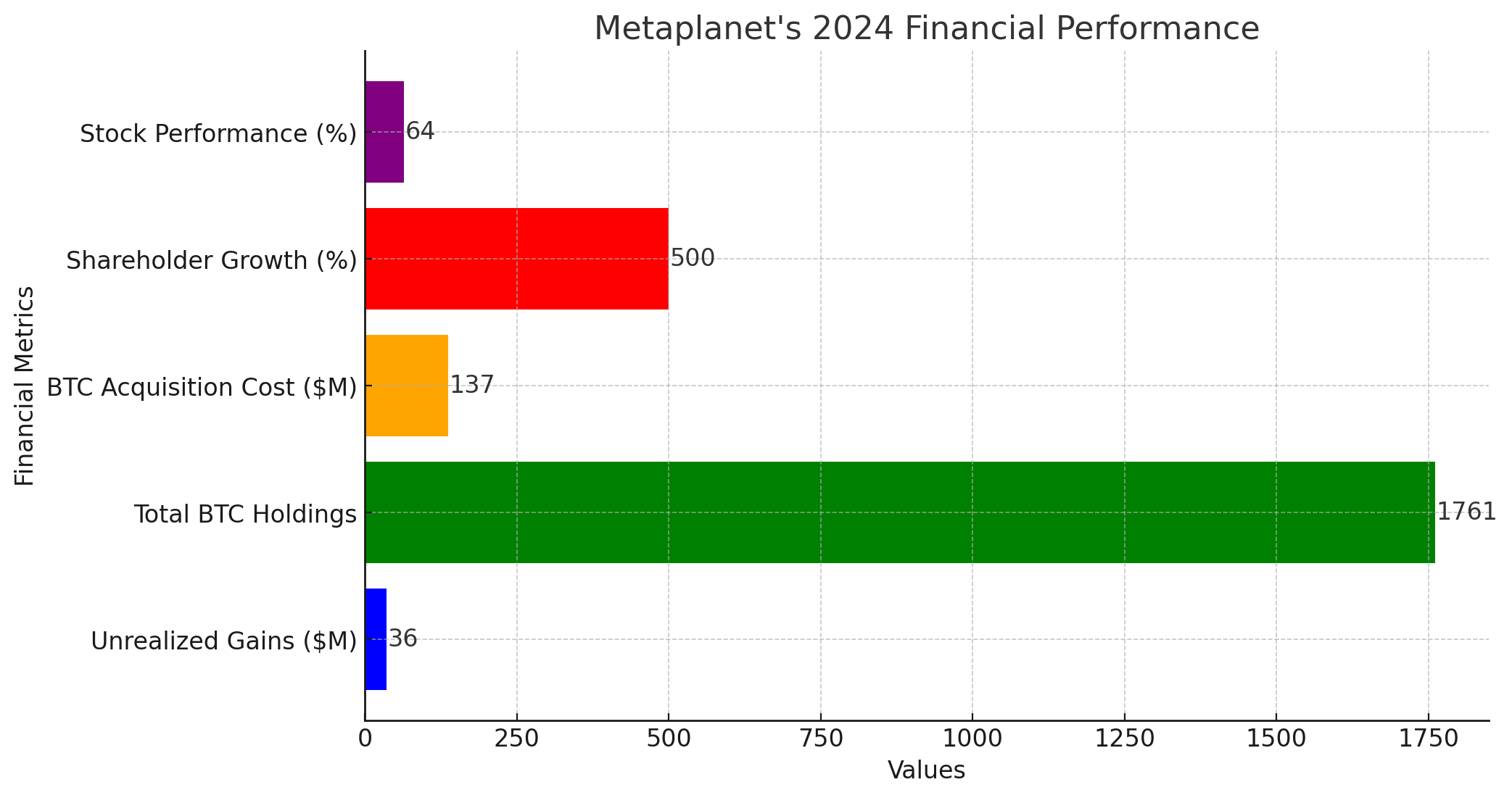

According to news reports, Japanese investment firm Metaplanet (3350) has announced itself as the best-performing equities in 2024 on the back of its hefty unrealized gain of $36M, or 5.46B yen, which was booked from its Bitcoin treasury. The Tokyo-listed company, which has been aggressively accumulating BTC, released its full-year financial results for 2024, sending the stock 8% higher on Monday and up 64% YTD.

Metaplanet positions itself as Japan’s answer to MicroStrategy’s BTC-focused corporate strategy, with Bitcoin at the core of its treasury strategy. With plans to increase its BTC holdings to 21,000 by the end of 2026, the company wants to deepen the integration of Bitcoin into its financial operations via debt issuance and equity offerings.

“Bitcoin is a superior store of value, and we remain committed to expanding our holdings as part of a long-term treasury strategy.” – Metaplanet Investor Presentation

The firm has also reportedly increased its shareholder base by 500% in 2024, reaching a record 50,000 investors as BTC’s mainstream adoption accelerates.

Metaplanet’s 2024 Financial Performance: A Bitcoin-Driven Growth Story

The company’s financial success in 2024 highlights the growing impact of institutional firms’ adoption of Bitcoin. The company leveraged its Bitcoin-first treasury approach to achieve significant gains, making it one of the top-performing publicly traded equities globally. As Bitcoin prices surged throughout the year, the firm saw an increase in shareholder value, stock price growth, and a major expansion in its investor base.

The firm’s financial performance in 2024 underlines the rising importance of Bitcoin adoption by institutional companies. The company utilized its Bitcoin-first treasury approach to substantial gains, positioning it as one of the best-performing publicly traded equities worldwide. As Bitcoin prices rose during the year, so did shareholder value, stock price appreciation, and a major increase in investor base.

By focusing on hoarding BTC, the company became Japan’s largest corporate holder of Bitcoin, the likes of MicroStrategy in the U.S. The performance of the firm’s stock demonstrates investors’ confidence in its long-term strategy regarding BTC, which has grown 64% year-to-date. The firm also saw a 500% increase in the number of its shareholders-50,000 investors-investors who believe in its Bitcoin-centered strategy.

Metaplanet, on a broader aspect, indicated strong financial results for 2024, credited to BTC price appreciation and Bitcoin treasury strategy:

| Metric | 2024 Performance |

| Unrealized Gains | $36 million (5.46B yen) |

| Total BTC Holdings | 1,761 BTC |

| BTC Acquisition Cost | $137 million |

| Shareholder Base Growth | 500% increase (50,000 total) |

| Stock Performance YTD | +64% |

The firm’s Bitcoin-first approach has helped position it as one of the best-performing equities in 2024, outperforming 55,000 publicly traded companies globally.

How Metaplanet Plans to Expand its Bitcoin Holdings and Strengthen Its BTC Strategy

While implementing the long-term strategy of Bitcoin accumulation, Metaplanet has been working out a structured way to increase its BTC reserves, striking a balance between financial stability and increased reserves. It shall use all available financing options, including debt issuance, equity offerings, and operational cash flow, for sustainable acquisition of BTC. By focusing on innovative capital-raising mechanisms, Metaplanet aims to be among the leading corporations in Bitcoin adoption while limiting its exposure to financial risk.

Fundraising via debt issuance and equity selling, Metaplanet has a multiway avenue toward expanding its Bitcoin inventory:

- Debt Issuance:

- Secured bonds

- Convertible bonds

- Bitcoin-backed loans

- Equity Issuance:

- Private placements

- Preference shares

- Convertible bonds & warrants

- Cash flow from business operations

By these methods, the corporation intends to procure 10,000 BTC at the end of 2025 and 21,000 by the end of 2026. To carry out this business, Metaplanet issues 21 million shares in the form of moving strike warrants against Bitcoin accumulation through the capital it raises.

“Our financing strategies ensure we can continue acquiring BTC at scale while optimizing risk management.” – Metaplanet Report

Expert Analysis: Evaluating Metaplanet’s Bitcoin Investment Strategy

Meanwhile, while Metaplanet keeps expanding its Bitcoin treasury, financial and crypto analysts are making sense of such an aggressive strategy for BTC accumulation and what that will mean in terms of possible benefits, risks, and long-term implications. While the move has boosted shareholder confidence, debates by experts over the stock performance indicate non-viability in volatile market conditions.

Industry analysts have weighed in on the Bitcoin-centric financial strategy of Metaplanet, assessing opportunities and risks associated with its approach.

Dr. Naomi Takahashi, Financial Analyst at Nomura Holdings:

“Metaplanet’s Bitcoin-first strategy mirrors MicroStrategy’s playbook but tailored for Japan’s market. While it has boosted shareholder value, volatility remains a key risk.”

James Reynolds, Senior Crypto Market Strategist at Messari:

“The company’s plan to issue 21 million shares in warrants to fund BTC purchases is an aggressive move. If BTC prices rise, this could be a game-changing strategy for corporate treasury management.”

Lisa Chang, Institutional Crypto Investment Expert:

“Metaplanet is capitalizing on Bitcoin’s store-of-value narrative. If successful, this approach could inspire other Japanese firms to adopt BTC as a treasury reserve asset.”

Conclusion: The Future of Metaplanet’s Bitcoin Strategy

Experts believe that aggressive Bitcoin accumulation made Metaplanet one of the best-performing equities in Japan in 2024, leveraging both debt and equity markets to buy BTC in much the same manner as MicroStrategy’s focused approach to BTC. With a target of 21,000 BTC in 2026, the Japanese firm is doubling down on Bitcoin’s long-term potential to be the core global store of value, though its success is pegged to the stability of BTC’s price, investor psychology and risk management.

The crypto and financial industries will closely watch whether the BTC treasury model inspires other firms to follow suit, thereby reshaping corporate finance in Japan and beyond.

The BIT Journal is available around the clock, providing you with updated information about the state of the crypto world. Follow us on Twitter and LinkedIn, and join our Telegram channel.

Frequently Asked Questions (FAQ) About Metaplanet’s BTC Strategy

How much Bitcoin does Metaplanet currently hold?

As of 2024, Metaplanet holds 1,761 BTC, valued at $137 million at the time of purchase.

What is Metaplanet’s goal for BTC accumulation?

The firm aims to acquire 10,000 BTC by 2025 and 21,000 BTC by 2026, funded through debt and equity issuance.

How has Metaplanet’s stock performed in 2024?

Metaplanet’s stock is up 8% this week and 64% year-to-date, making it one of the best-performing equities globally.

Why is Metaplanet compared to MicroStrategy?

Like MicroStrategy, Metaplanet leverages BTC as a corporate treasury asset, betting on long-term appreciation and hedging against fiat devaluation.

What financing methods does Metaplanet use to acquire BTC?

The company uses secured bonds, Bitcoin-backed loans, private placements, preference shares, and warrants to fund BTC acquisitions.

Glossary

Bitcoin Treasury Strategy: A corporate approach of using BTC as a reserve asset to hedge against inflation and fiat currency devaluation.

Moving Strike Warrants: A financial instrument that allows the holder to purchase shares at a variable price, often linked to BTC performance.

Convertible Bonds: A type of debt that can be converted into shares, used to raise capital without immediate stock dilution.

Secured Bonds: Bonds backed by collateral assets, such as BTC, to reduce lender risk.

Private Placement: A fundraising method where shares are sold to institutional or high-net-worth investors instead of the public market.