Metaplanet intensifies its Bitcoin holding step, solidifying its position as Asia’s largest corporate holder — Is Japan’s MicroStrategy emerging on the global stage?

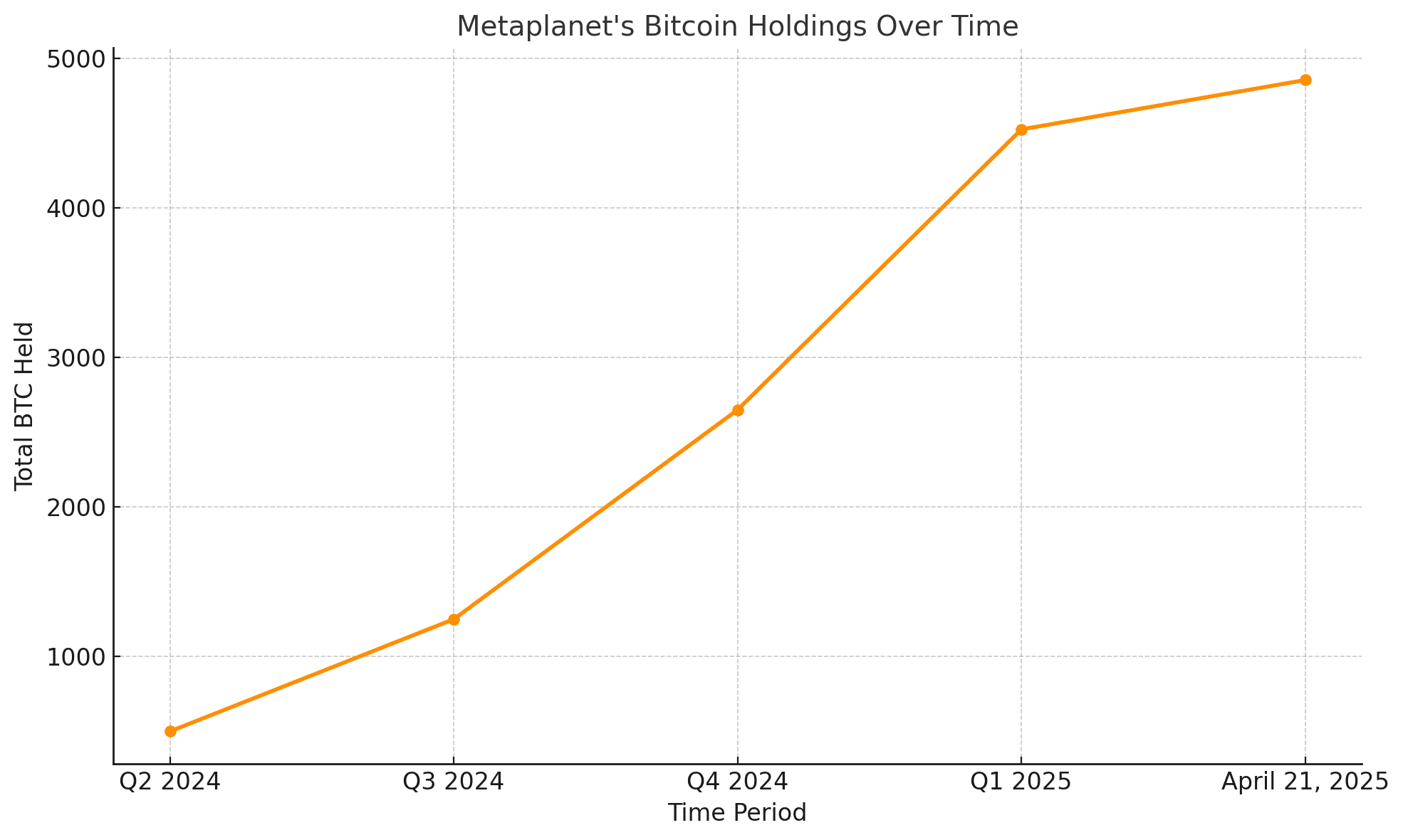

Tokyo-based investment firm Metaplanet has made another bold move in the crypto space, acquiring an additional 330 Bitcoin (BTC) for a total of $28.2 million, according to an official disclosure on April 21, 2025. This latest purchase pushes the firm’s total Bitcoin holdings to 4,855 BTC, valued at approximately $414 million.

As Bitcoin trades above $87,000, Metaplanet’s aggressive accumulation strategy has positioned it not only as Asia’s largest corporate Bitcoin holder but also as the tenth-largest globally, according to rankings by BitcoinTreasuries.net.

Metaplanet’s Strategic Shift: Bitcoin as a Balance Sheet Staple

Since pivoting to a Bitcoin-centric strategy in 2024, Metaplanet has been methodically increasing its Bitcoin holdings, modeling its approach after MicroStrategy’s playbook. The firm employs a unique internal metric called “BTC Yield,” which calculates Bitcoin held per fully diluted share, to measure its performance.

“For the current quarter ending April 21, 2025, BTC Yield stands at 12.1%, building on a trend of strong performance from previous quarters,” the company noted.

In Q1 2025, Metaplanet had already posted a BTC Yield of 41.7%, following figures of 309.8% and 95.6% in the previous two quarters, reflecting explosive growth in crypto-backed value per share.

Financing the Bitcoin Holdings: Bonds, Equity, and Innovation

To finance its aggressive accumulation strategy, Metaplanet has leveraged Japan’s capital markets through innovative instruments, including:

Zero-coupon bonds

Stock acquisition rights

The firm’s ambitious ¥210 billion ($1.36 billion) capital raising campaign, known as the “210 Million Plan”, is already 40% complete, with over ¥35 billion ($226 million) raised.

Notably, on April 16, 2025, Metaplanet raised an additional $10 million through a zero-interest bond, adding liquidity just days before the latest Bitcoin purchase.

Metaplanet’s Stock Soars Over 1,000%

This Bitcoin-heavy strategy has resonated with investors. Shares of Metaplanet, listed on the Tokyo Stock Exchange, have surged over 1,080% since the company adopted its Bitcoin-first corporate approach.

“Metaplanet is fast becoming Japan’s answer to MicroStrategy,” said a Tokyo-based analyst. “Their bold commitment to BTC is turning heads not just in Asia, but globally.”

Bitcoin Price Rally Provides Tailwind

Metaplanet’s latest acquisition comes at a time when Bitcoin is hovering around $87,000, reaching its highest level since March 28, 2025. The timing appears calculated, taking advantage of market optimism following positive macro signals and ongoing global interest in BTC as a hedge against fiat devaluation.

Bitcoin Price Snapshot (April 21, 2025)

| Metric | Value |

|---|---|

| Current BTC Price | $87,279 |

| BTC Bought by Metaplanet | 330 BTC |

| Value of Purchase | $28.2 million |

| Total Bitcoin Holdings | 4,855 BTC |

| Estimated Holdings Value | $414 million |

Source: CryptoTimes, CoinMarketCap

Conclusion

Metaplanet’s latest $28M Bitcoin purchase is more than just a balance sheet move — it’s a strategic signal. As the firm races toward its ¥210 billion fundraising goal and continues building crypto-native value, its approach underscores a broader shift in how Asian corporates may begin integrating Bitcoin as a long-term treasury asset.

“This is not a fad; it’s a macro hedge and a new corporate currency strategy,” said a Metaplanet spokesperson in an earlier statement.

As regulatory clarity improves and institutional sentiment shifts, Metaplanet may be just the beginning of Asia’s corporate Bitcoin wave.

FAQs

What is Metaplanet?

Metaplanet is a publicly listed investment firm based in Japan, now known for aggressively acquiring Bitcoin as part of its treasury strategy.

How much Bitcoin does Metaplanet currently hold?

As of April 21, 2025, Metaplanet holds 4,855 BTC, valued at over $414 million.

How is Metaplanet funding its Bitcoin purchases?

Through capital market instruments such as zero-coupon bonds and stock acquisition rights under its ¥210 billion “210 Million Plan.”

Why is Metaplanet being compared to MicroStrategy?

Like MicroStrategy, Metaplanet has adopted Bitcoin as its primary treasury asset and has seen its stock soar as a result.

Glossary of Key Terms

BTC Yield: A metric used by Metaplanet to calculate Bitcoin held per fully diluted share.

Zero-Coupon Bond: A debt security that doesn’t pay interest but trades at a discount, providing profit at maturity.

Bitcoin Holdings Strategy: A corporate investment strategy involving the Bitcoin holdings as a reserve asset.

Fully Diluted Shares: Total number of shares that would be outstanding if all convertible securities were exercised.