According to the report, Japan-based investment firm Metaplanet has significantly expanded its Bitcoin holdings. The company recently acquired an additional 269.43 BTC—an investment worth approximately $25.9 million—bringing its total reserves to 2,031.41 BTC. This aggressive accumulation has fueled a meteoric rise in its stock price, positioning Metaplanet as Japan’s top-performing stock with an astonishing 4,000% surge over the past year.

The firm’s Bitcoin purchases, executed at an average price of ¥14,846,322 per BTC (~$97,985), underline its long-term confidence in the cryptocurrency market. But what’s behind Metaplanet’s Bitcoin-first strategy, and what does it mean for investors?

Inside Metaplanet’s Bitcoin-First Strategy

Metaplanet’s pivot towards Bitcoin isn’t just about holding the cryptocurrency—it’s a radical financial shift aimed at redefining corporate treasury management. By mirroring MicroStrategy’s Bitcoin accumulation strategy, the company is betting big on BTC as a hedge against inflation, currency devaluation, and traditional market fluctuations.

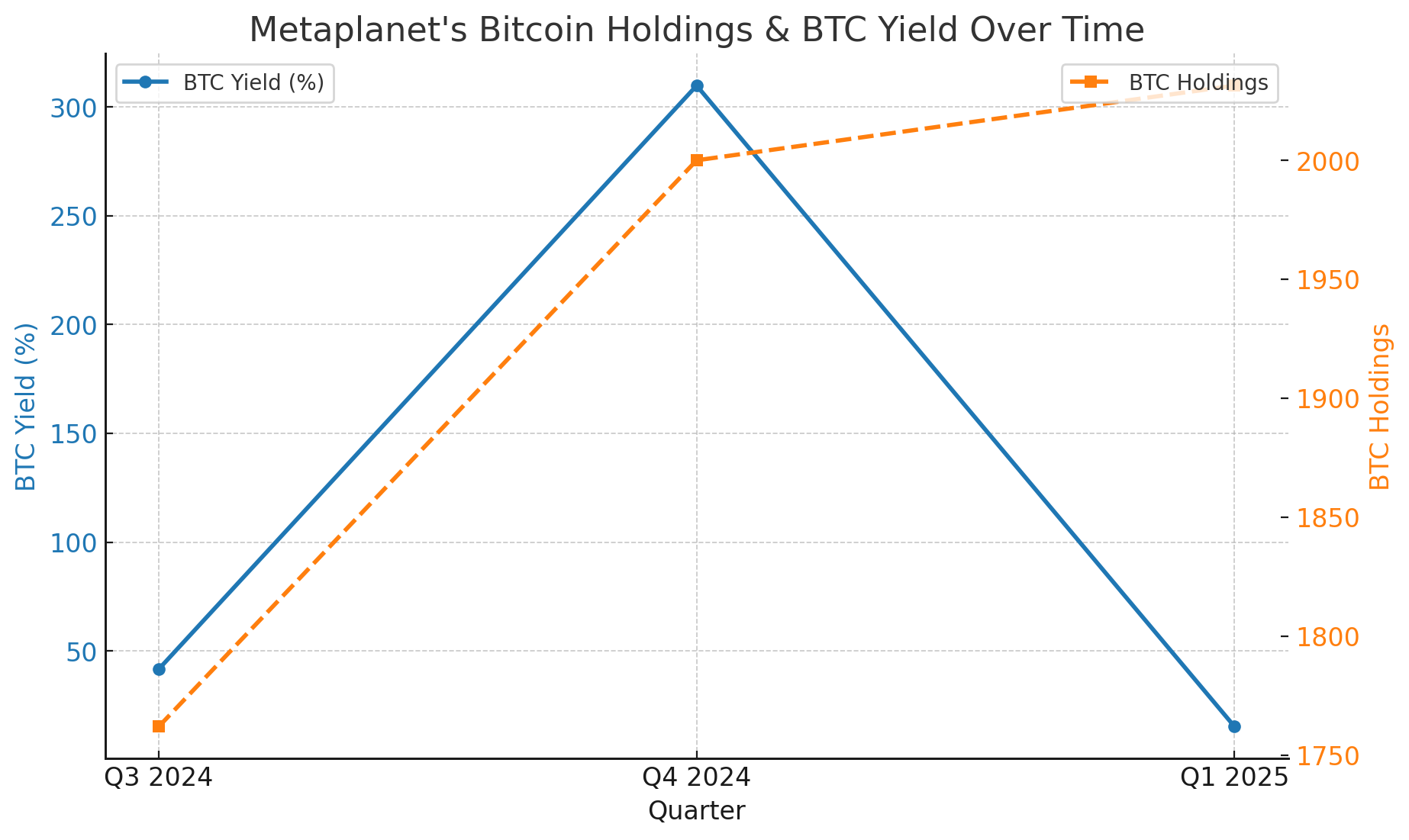

The firm closely tracks its BTC Yield, which measures the ratio of its Bitcoin holdings to the company’s total share value. The fluctuations in this metric—from 41.7% (Q3 2024) to 309.8% (Q4 2024) and 15.3% (early 2025)—highlight the dynamic nature of its Bitcoin-centric financial approach.

“We believe Bitcoin is the most robust and secure form of money ever created,” Metaplanet stated in a recent investor update. “Our strategy is focused on maximizing long-term value by leveraging Bitcoin’s appreciation potential.”

Metaplanet’s Bitcoin play is not just about holding BTC—it is actively monetizing its holdings. One of its revenue-generation strategies includes selling Bitcoin put options, a move that allows the firm to earn substantial premiums while maintaining exposure to the asset’s price movement.

From Tokyo to the Global Stage: Metaplanet’s Vision for 10,000 BTC

Looking beyond its current holdings, Metaplanet has set an ambitious target of 10,000 BTC by the end of 2025. To achieve this, the company plans to leverage strategic partnerships to boost Bitcoin adoption both in Japan and globally.

In January 2025, Metaplanet’s board approved a plan to issue 21 million new shares through a third-party allotment to EVO FUND, with proceeds directed toward further Bitcoin acquisitions. This bold move aims to secure liquidity while reinforcing the firm’s commitment to long-term Bitcoin accumulation.

A key part of Metaplanet’s vision involves integrating Bitcoin into everyday business operations. The firm’s hospitality subsidiary, Wen Tokyo Co., operates the Royal Oak Hotel in Tokyo’s Gotanda district. Industry insiders speculate that the company may rebrand it as “The Bitcoin Hotel”, a hub for crypto enthusiasts and global investors.

Metaplanet’s Rise to Japan’s Top Stock—What’s Driving the Surge?

Over the past year, Metaplanet’s stock has skyrocketed over 4,000%, making it Japan’s best-performing stock. This is largely fueled by the company’s Bitcoin-first approach, which attracts investors looking for exposure to the booming digital asset market.

“Metaplanet’s rise is reminiscent of MicroStrategy’s transformation when it pivoted to a Bitcoin-focused strategy,” said a Tokyo-based financial analyst. “The market is rewarding companies that take decisive action in the digital asset space.”

With Bitcoin’s price trending upward, many analysts believe Metaplanet’s stock has further room for growth, especially as its BTC holdings increase.

Final Thoughts: Is Metaplanet Japan’s MicroStrategy?

Metaplanet’s bold Bitcoin strategy signals a fundamental shift in Japan’s corporate sector, where firms increasingly view BTC as a store of value. By aggressively accumulating Bitcoin and integrating it into its financial strategy, Metaplanet is carving out a new path that could inspire other Japanese corporations to follow suit.

With a 10,000 BTC target on the horizon, investors will be closely watching how Metaplanet navigates market volatility and regulatory landscapes. If its strategy continues to pay off, we might just be witnessing the rise of Japan’s version of MicroStrategy.

Stay tuned to The BIT Journal and keep an eye on Crypto’s updates.

FAQs

1. Why is Metaplanet investing so heavily in Bitcoin?

Metaplanet sees Bitcoin as a hedge against inflation and currency depreciation, aiming to strengthen its financial position through BTC accumulation.

2. How much Bitcoin does Metaplanet currently hold?

As of February 2025, Metaplanet holds 2,031.41 BTC, with a target of reaching 10,000 BTC by year-end.

3. What is Metaplanet’s long-term Bitcoin strategy?

The company aims to continue accumulating BTC while leveraging financial instruments like Bitcoin put options to generate additional revenue.

4. How has Metaplanet’s stock performed?

Metaplanet’s stock has surged over 4,000% in the past year, making it Japan’s best-performing stock.

Glossary of Key Terms

Bitcoin Yield – A metric that measures the ratio of Metaplanet’s BTC holdings to its share value.

Put Options – Financial contracts allowing investors to sell an asset at a predetermined price, often used for hedging.

MicroStrategy Comparison – Refers to Metaplanet’s Bitcoin accumulation strategy being similar to that of MicroStrategy, a U.S. firm that pioneered BTC treasury management.

Sources

Metaplanet to Acquire 21,000 Bitcoins Worth $2 Billion Amid Today’s Stock Surge

Metaplanet Inc. Reports Strong 2024 Results Fueled by Bitcoin Strategy